Markets (Usually) Don't Bottom On Friday

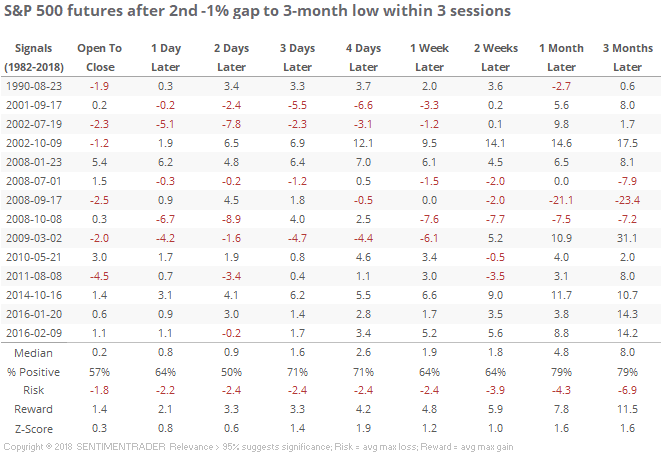

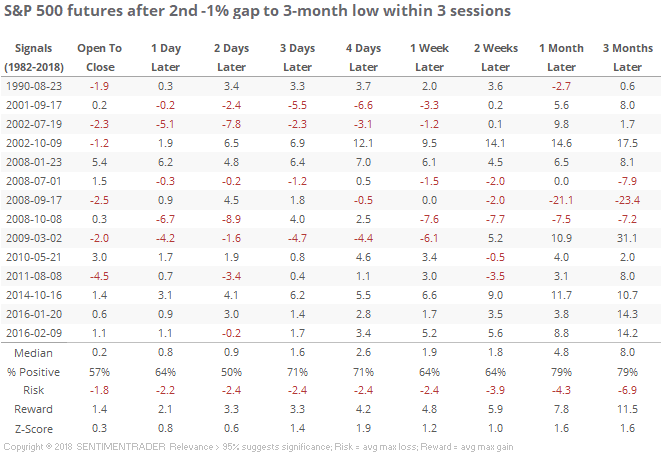

For the second time in only a few days, traders are looking at another large gap down to start the day, with S&P 500 futures indicated down by more than 1%.

It's easy to forget, but we've seen this kind of large losses at multi-month lows five other times since the bottom in 2009. Other that that, it was mostly restricted to the bear markets in 2001-02 and 2008ish.

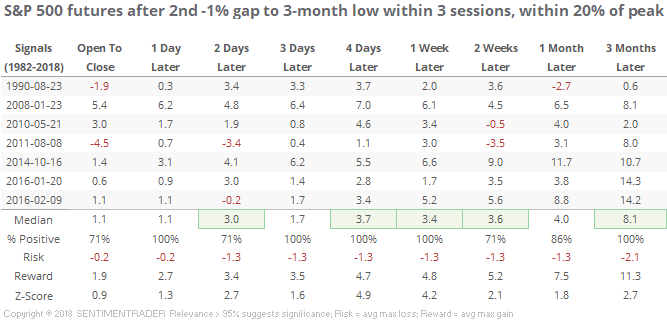

If we focus on bouts of similar opening gaps but only when the S&P was within 20% of its 52-week high at the time, then there was a good record of that second negative gap coinciding with a short-term exhaustion. It's a small sample, but each of the others preceded multi-day rebounds.

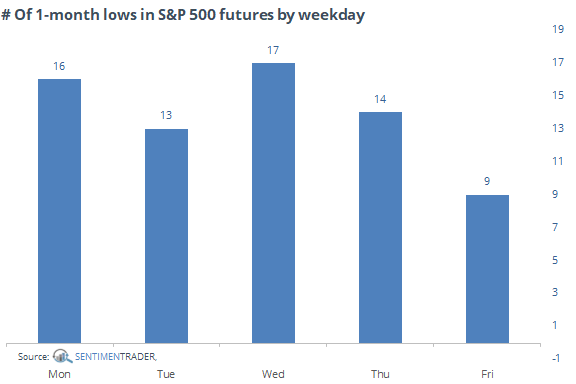

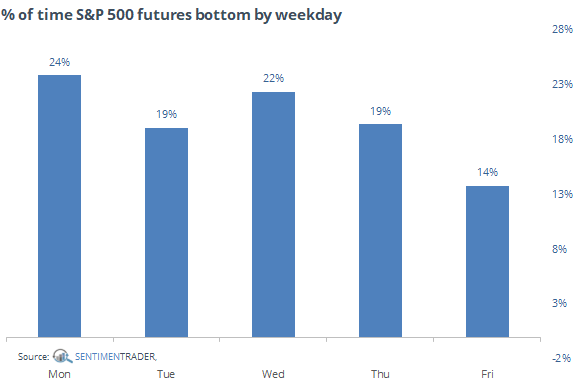

There's an old cliche that market's don't bottom on Friday. Like most of these things, there's a hint of truth, but heuristics only go so far. If we look at the 69 times in the history of the S&P 500 futures that they fell to at least a 3-month low and formed at least the lowest price over the next month, then we can see that the futures often did not, indeed, bottom on a Friday. It did 9 times, but that's about half as often as it bottomed on Wednesday.

This is a little misleading, though. Maybe we just don't often sink to a low on Friday, so it doesn't have a chance to bottom. If we instead look at the same figures, but adjust them for how often each day sinks to a low, we get this.

Didn't really change. Of the 65 times that the futures hit a 3-month low on a Friday, only 9 of them proved to be the low point for the next month, so that's a lowly 14% success rate. Nearly a quarter of the time when they fell to a low on a Monday, though, it marked the lowest point for the next month.

So, we're more likely to see further weakness into early next week and form a low then. It's not a law, it's just a simple look at probabilities and behavioral tendencies.

Quite a few other things we've been looking at would support that notion. What we've seen this week hasn't really been "melty" enough or on a par with what we've seen at other mini-panic bottoms in the past 9 years or beyond. It's getting close, but not quite there. Another few days of flushing out or whipsaws should get us there, and there are a whole factor of indications that the next 1-3 months should see higher prices, even if we're transitioning to a bear market.