Momentum Shift As Bonds Have Big Move

This is an abridged version of our Daily Report.

Momentum shift

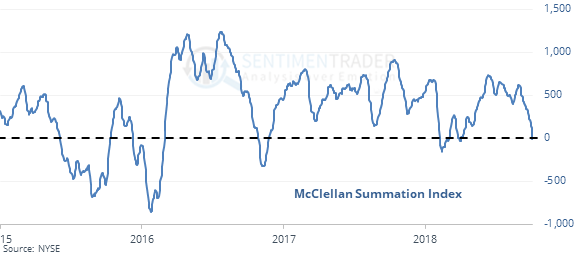

The McClellan Summation Index is below zero for the first time in a half-year.

It’s also turning negative while stocks are still relatively close to their recent highs, and that has been more of a negative shorter-term.

Bonds’ biggest move since January

The yield on 10-year Treasuries had the biggest move in more than nine months by hitting a multi-year high with a Relative Strength Index above 75. Other times this happened, watching short-term moves was a clue for longer-term.

Start of a panic

On Thursday, more than 1.5 million put options were traded on 10-year and 30-year Treasuries.

Change in trend

The Nasdaq 100 closed below its 50-day average for the first time since May.

The latest Commitments of Traders report was released, covering positions through Tuesday

The 3-Year Min/Max Screen shows that “smart money” hedgers moved to yet another multi-year long position in gold and long-term Treasuries while adding to massive short exposure to unleaded gas.