Momentum Worries As Emerging Stocks Start Uptrending

This is an abridged version of our Daily Report.

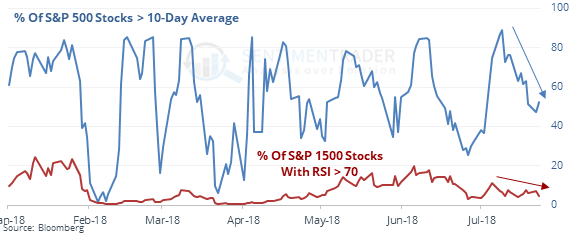

Momentum worries

As the S&P hit a 100-day high, a very low % of stocks are showing momentum. An almost record low % of stocks are above their 10-day avg or have an RSI > 70, which has preceded weak shorter-term returns or failed rallies.

Emerging uptrend

Emerging markets are above the 50-day average after being below for months. The index tends to trend and has a much better annualized return when above average than when below. A cross above average has been a good shorter-term signal, though several rallies ended up failing.

So close

The S&P 500 has climbed to within 1% of a new high after suffering at least a 10% decline in the past six months. Of the 36 other times it did this, it took a median of 3 trading days before it closed at a new high, with 69% of them reaching a new high within a week.

Debt contraction

Investors reduced their debt held against the value of their stocks by more than 3% in June, the 2nd-largest drop in margin debt in 5 years.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |