Monday Gap

Markets are on edge after several bouts of political gamesmanship leading into the new week.

The latest round, with China retaliating in the trade escalation, has furthered pressured U.S. equities.

Most markets aren't open yet, but we can see the largest movers here.

I'm not sure how much to read into historical behaviors, since markets are clearly being dominated by headlines right now. A single Tweet could easily erase or exacerbate any move, regardless of how traders typically react in "normal" markets.

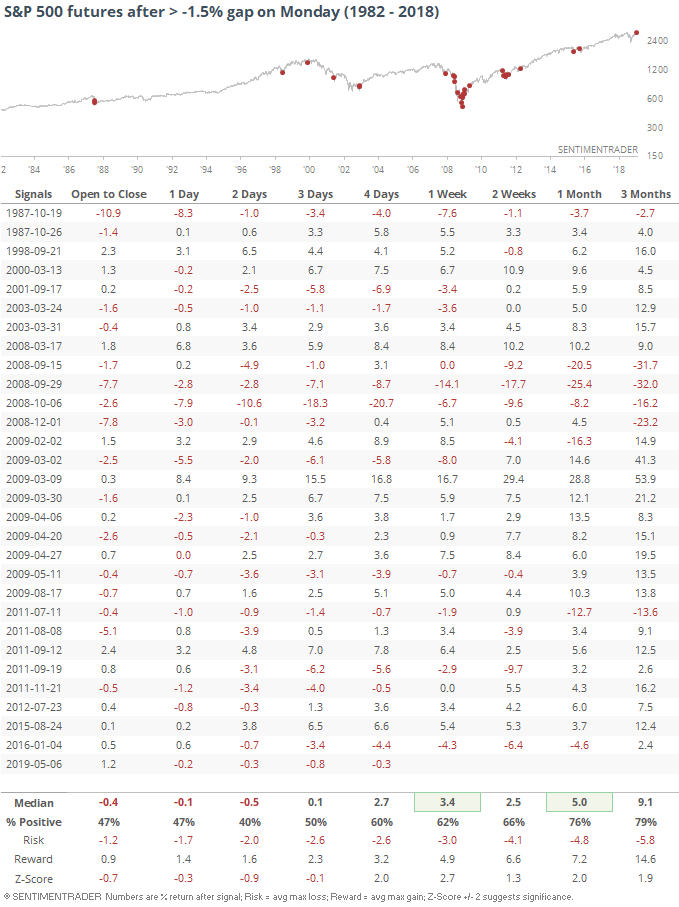

So taking this with a grain of sand, we can see below that when traders face a large gap down on a Monday, there is typically some follow-through weakness in the days ahead. I do think that Monday is an important filter, as markets have historically shown very different reactions depending on when in the week certain extremes like gaps occur.

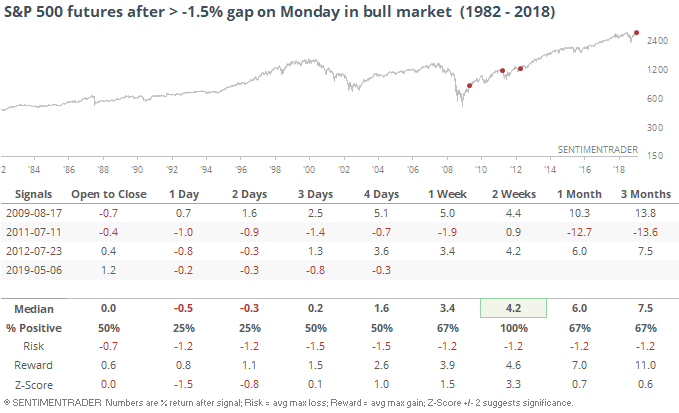

If the S&P was in a bull market at the time (simply defined at being above the 200-day average), it wasn't much of a different outcome, though the sample size is an obvious limiter.

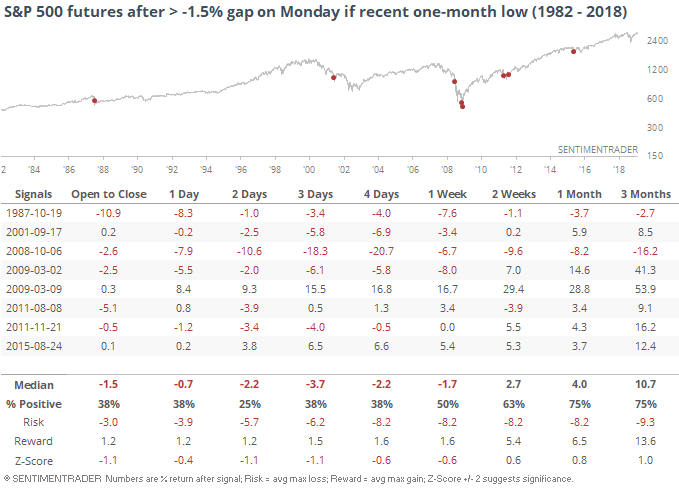

If the S&P had dropped to at least a one-month low in the prior few days, during bull or bear markets, then returns were also weak in the short-term.

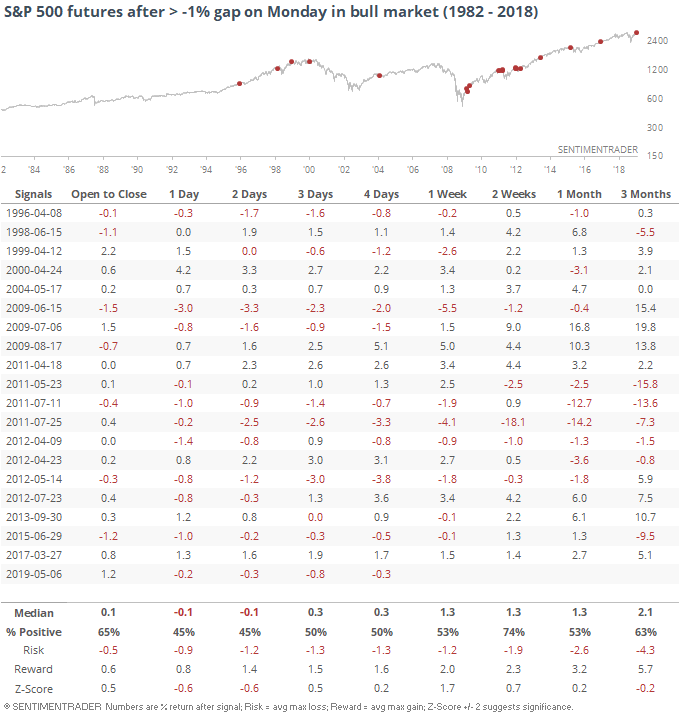

If we relax the parameters and look for -1% gaps down on bull market Mondays, the sample size jumps quite a bit but the overall pattern remains the same - weak in the very short-term, with a tendency to see a bounce over the next two weeks.

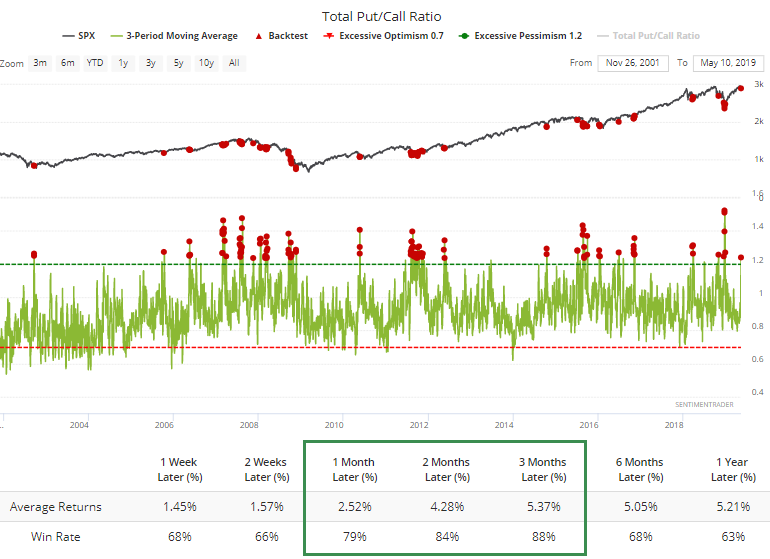

If the weakness follows through over the next 1-3 days, we'll likely see quite a few shorter-term extremes. Already, the put/call ratios are spiking to a level that has preceded good medium-term returns.

The confidence expressed by the smallest of options traders is still a major red flag, and that didn't ease up much last week, which is worrying. That gives me less confidence in the total p/c ratio stats.

The sentiment extremes we hit in April are unwinding but still have a long way to go. It seems premature to expect selling pressure to dry up immediately as a result. But on a shorter-term 1-2 week time frame, based on the gap behavior above, it seems likely that if sellers persist through Tuesday-Wednesday, then the probability of a snapback (over the next 1-2 weeks) rises significantly. I'm not relying on much more than that given the prior extremes we've discussed and the headline-driven nature of markets right now.