Most Active ETF Performance During Santa Rally

We all know that stocks, in general, tend to rise during the last week(s) of a year through the first few sessions of the New Year. But what about other markets?

Seasonality is a tricky thing. It's easy to see past performance, but there is some game theory involved as well. If everyone knows something, then the time frames can shift as traders try to front-run the masses.

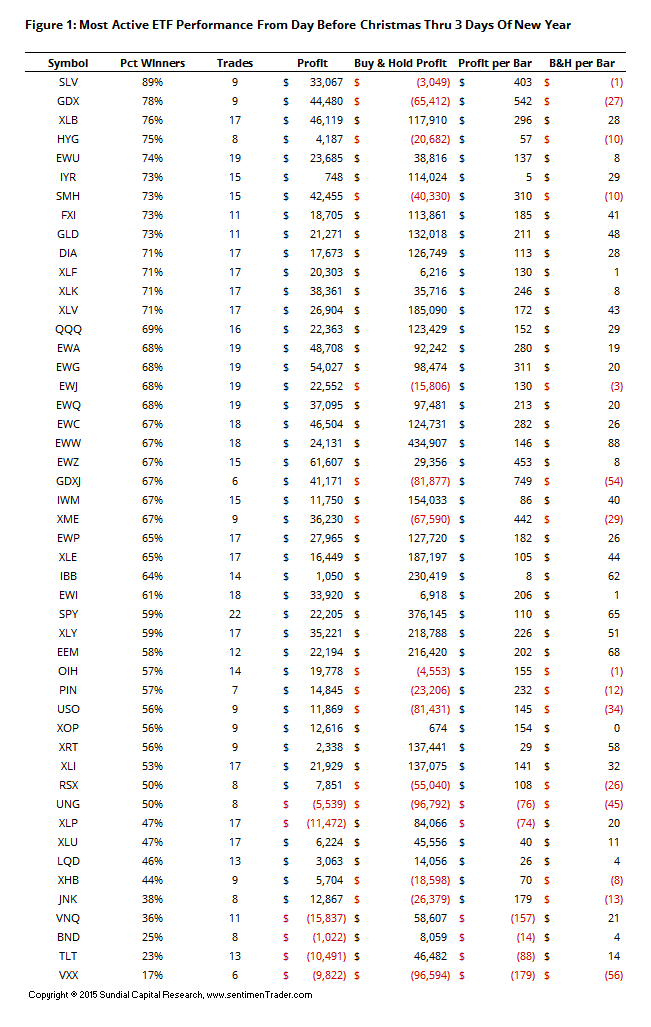

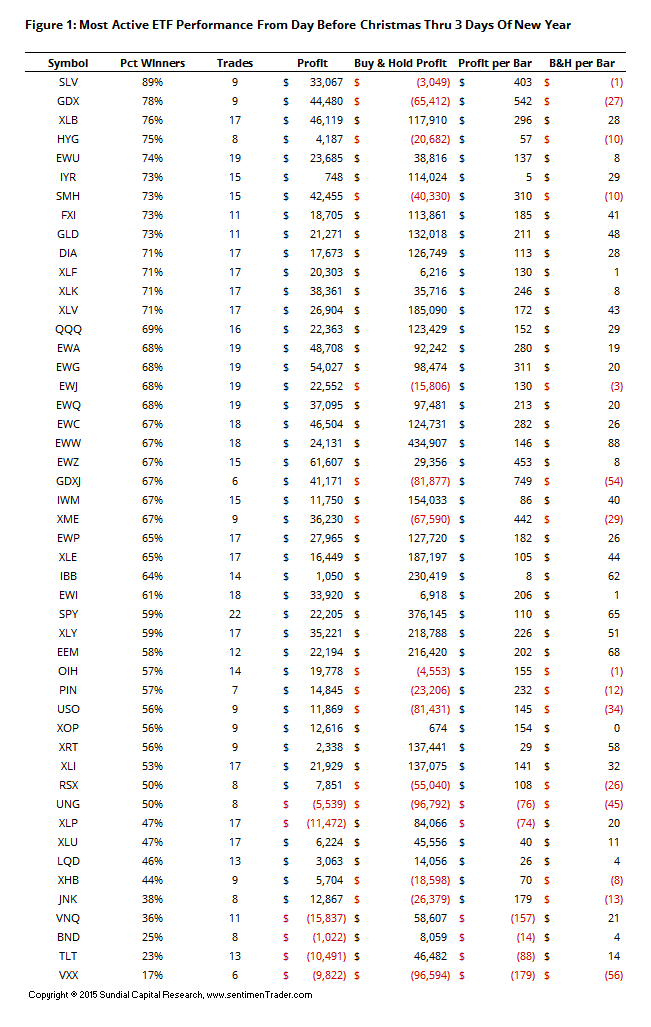

Instead of looking at the broad market, let's check the Most Active ETF list and see how they have held up during this part of the year. The table below lists them from best- to worst-performing, assuming we invested $100,000 in each trade.

Surprisingly, commodity and basic material ETFs were at the top of the list of most consistent winners. In the silver ETF, we would have generated a profit of over $33,000 despite being in the market for only 82 trading days.

The most consistent losers were volatility (no surprise there), along with the most interest-rate sensitive funds like TLT, VNQ (REITs) and XLU (Utilities).

Stocks have already rallied heartily heading into the season, perhaps evidence of the anticipation effect noted earlier. Assuming the pattern holds up, though, we should see rate-sensitive issues under-perform to the benefit of what had been some of the most beaten-down funds of the past year.