Narrowing Smart-Dumb Spread; 4 Straight Up Weeks

This is an abridged version of our Daily Report.

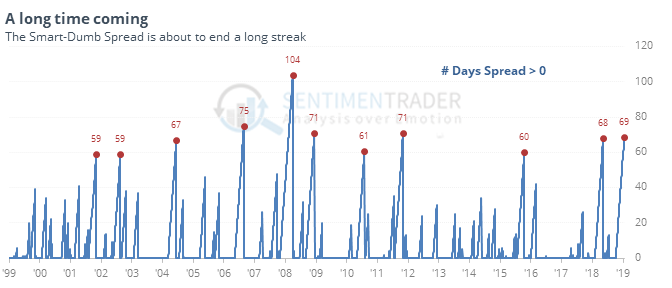

Narrowing spread

As stocks rally, Dumb Money has become more confident while Smart Money has increased their hedging activity. The spread between the two hit a multi-year extreme before Christmas and is now nearing zero for the first time in months.

By the time the spread has reached zero, the trend is usually well under way. And when stocks are in a longer-term downtrend at the time, that has been a bad sign. That contrasts to the times when the spread flipped and the S&P was above its 200-day average at the time.

Impressive momentum

The hard part is that the price and breadth thrust has been so remarkable. The S&P has gained more than 1% four weeks in a row following a low, which marked a major turning point the few times it’s happened. It was also bullish when gaining 1.5% for four straight weeks, even if not following a low.

Website note

We’re now posting more studies in the Active Studies section, with the ability for Premium members to subscribe to alerts if they wish to receive an email in real-time.

Not necessarily a negative

The S&P 500 fund, SPY, hit a one-month hit with larger than 1% gain on Friday, then completely reversed that on Tuesday, while still below its 200-day average. This looks bad on a chart, but has happened 5 times, and all 5 showed gains over the next 2-3 weeks, some of which then rolled over.