Nasdaq Hugs Its Average As Volatility Recede Despite Recession Risk

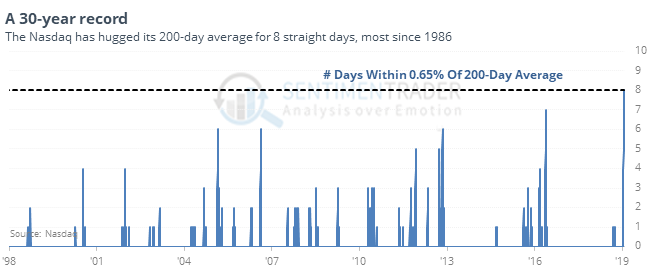

A tight hug

The Nasdaq Composite has hugged its 200-day average for more than a week.

Bulls and bears could both make an argument for what that might mean, but since 1971 the Nasdaq has powered higher in the longer-term when it showed this kind of indecision around the widely-watched metric, though it’s always iffy to extrapolate short-term behavior (like hugging the 200-day average for a week) to potential returns a year forward.

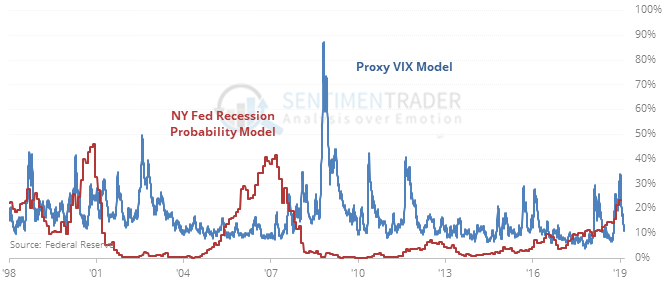

Ignoring the warnings

Recession risk continues to rise according to a Federal Reserve model, recently hitting a multi-year high. At the same time, volatility expectations continue to collapse and just hit a 90-day low.

That has preceded some rocky markets since 1962 but was not a consistent warning of investors ignoring potential trouble.

9 in a row

The Dow has gained for 9 straight weeks, its longest stretch in nearly 25 years. Since 1900, it has managed to do this a dozen times, most leading to weak short-term returns, but strong long-term ones. Only one other followed a 52-week low like this streak has.

The Commitments of Traders report was released covering positions through February 5

As noted in prior weeks, “smart money” hedgers just keep on buying stock index futures. By Feb 5, they were holding more than $20 billion of S&P, Nasdaq, and Dow futures.

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.