Nasdaq's Bad Breadth, Too

This morning, respected technician Helene Meisler made an observation on breadth that was notable:

https://twitter.com/hmeisler/status/817737481663709184

That reinforces what we discussed in the report on Friday about the weak breadth not necessarily being isolated to ravages in the bond market.

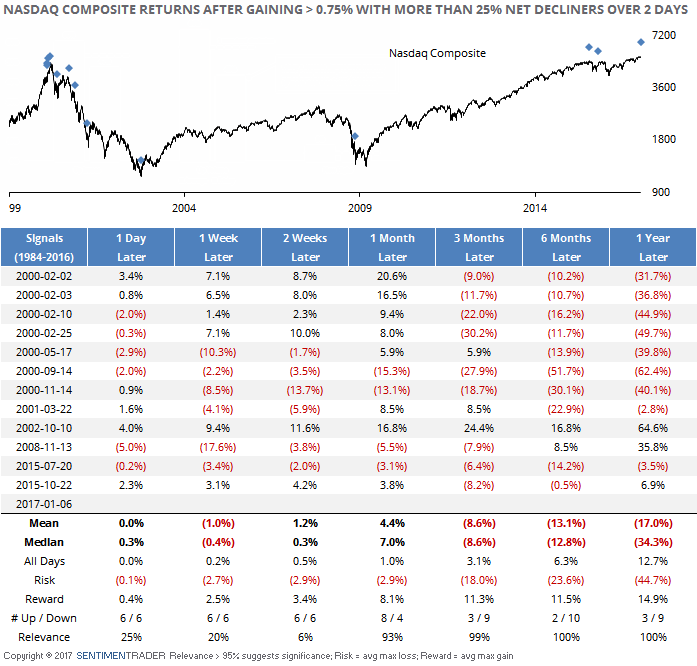

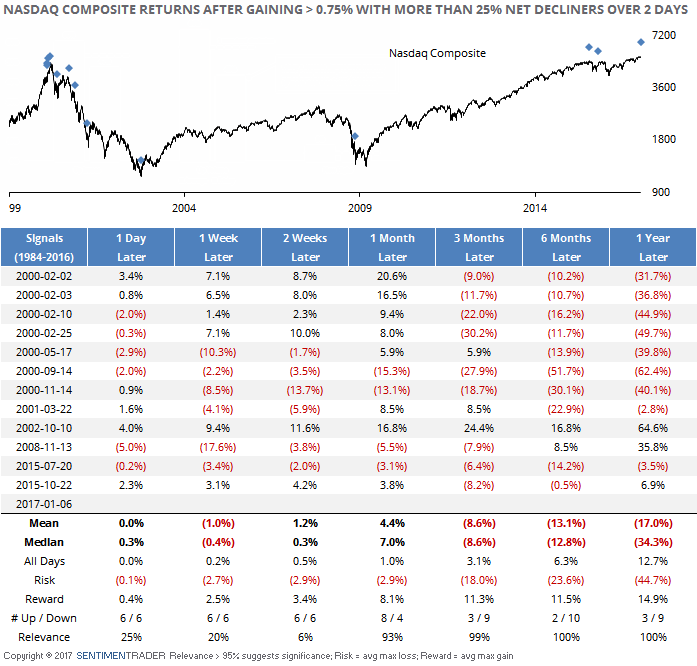

Let's go back to 1984 and look for other times the Nasdaq Composite gained 0.75% or more over the past two days, yet more than 750 issues (or 25% of the total on the Nasdaq exchange) lost ground during those two days.

Most of them occurred in 2000, which isn't that surprising. It has occurred only twice during our current bull market, in July and October 2015, both ultimately leading to the large declines.

Overall, there were only two other times it occurred when the Nasdaq was trading at a new 52-week high - February 10, 2000 and July 20, 2015. We can't read much of anything into a sample size of two, but still...not encouraging.

Just more evidence that the lack of participation on the thrust to all-time highs on Friday is a troubling sign, and trouble in the bond market is not an excuse for the readings.

Helene also pointed out that the small-cap Russell 2000 has lost 1.5% over the past couple of sessions, despite the push to multi-year highs in the S&P. The only other times that has happened are March 21, 2000 (right before the peak of the bubble) and April 2, 2013 (no negative connotations there).