NASDAQ's "weak" breadth

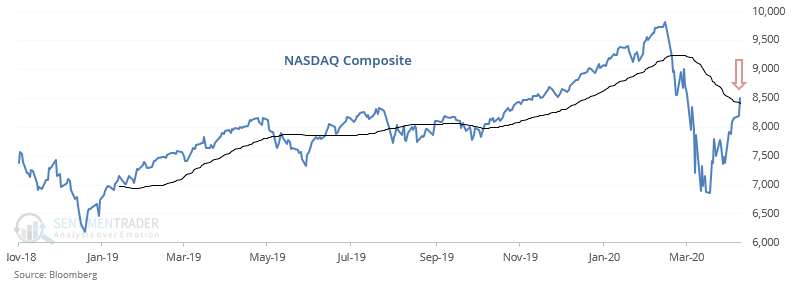

While the S&P 500 is close to its 50 dma, the NASDAQ Composite has already crossed above its 50 dma.

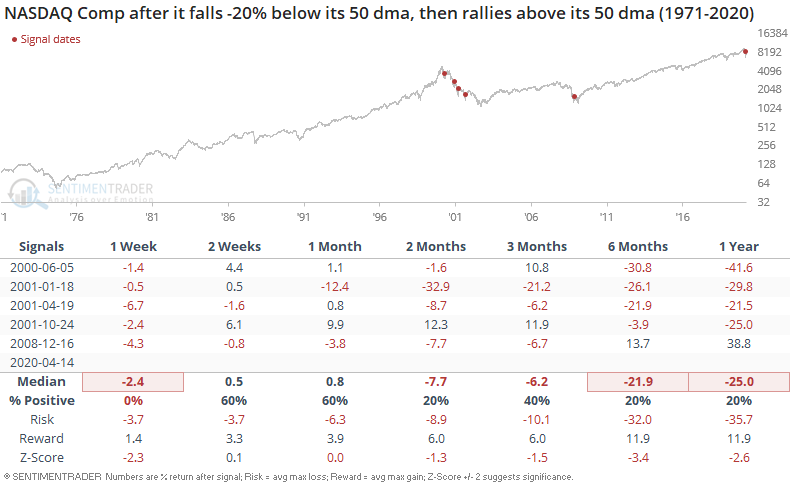

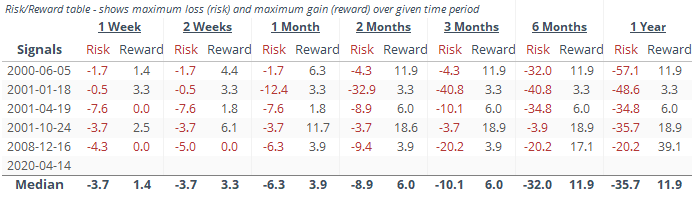

When the NASDAQ Composite regained its medium term moving average after a market crash, its short term forward returns were poor. The NASDAQ Composite often struggled around the 50 dma over the next week. The long term forward returns were mostly bearish since most of these historical cases happened during the 2000-2002 bear market:

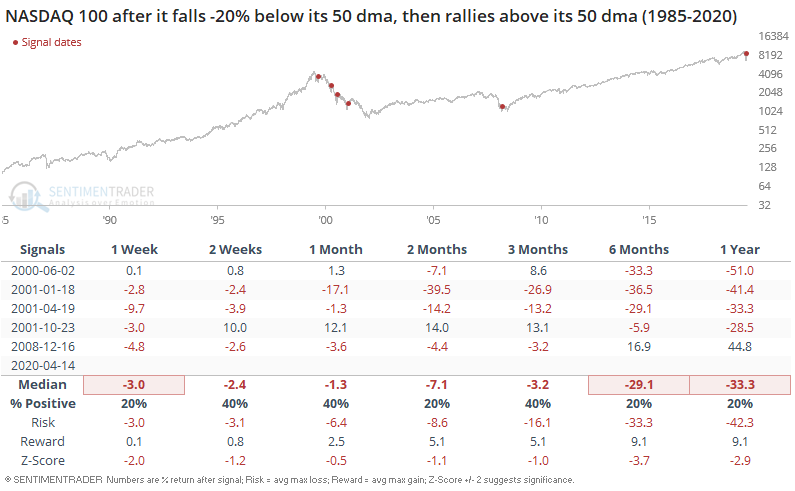

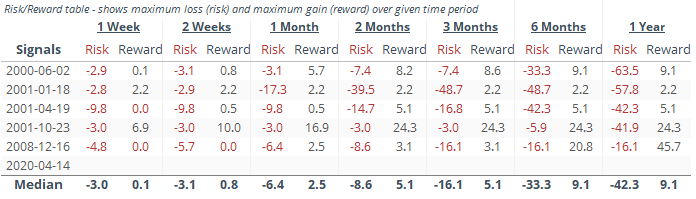

This was also short term bearish for the NASDAQ 100:

While the NASDAQ Composite jumped above its 50 dma, very few of its members have done so (only 27%):

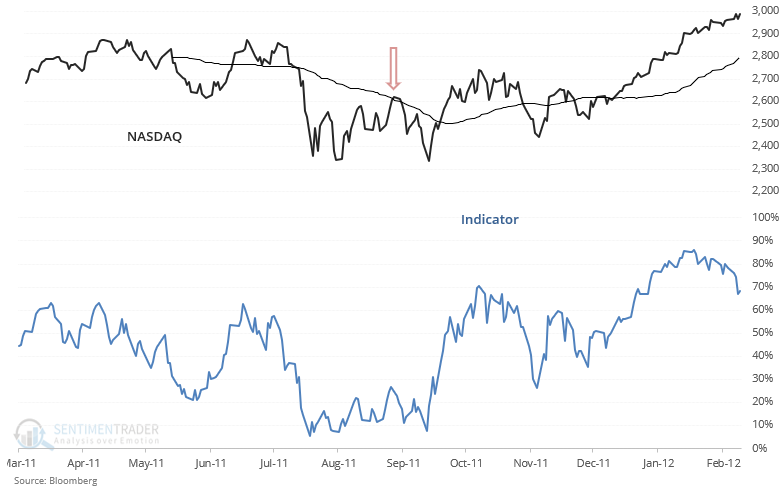

There's only one other historical case in which less than 30% of NASDAQ members were above the 50 dma's while the NASDAQ Composite was above its 50 dma: September 16, 2011

Back then, the NASDAQ fell -10.9% and retested its lows.

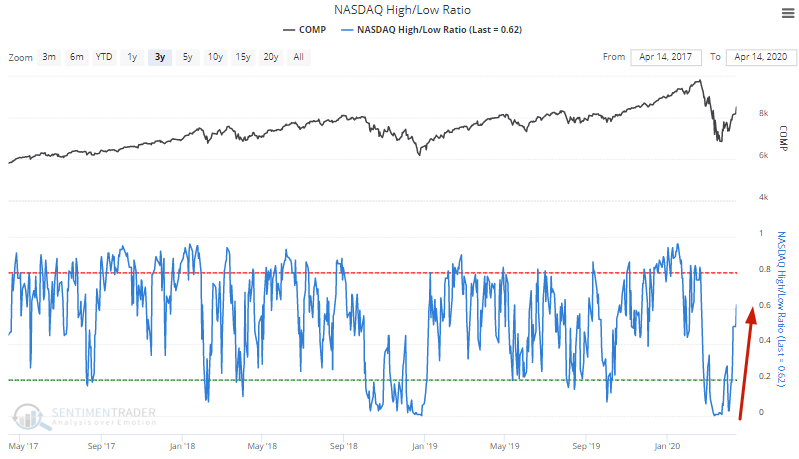

Although many NASDAQ members are not above their 50 dma's, very few of them are still at 52 week lows. Meanwhile, some stocks such as Amazon have reached new 52 week highs. This has caused the NASDAQ High/Low Ratio to surge above 50%.

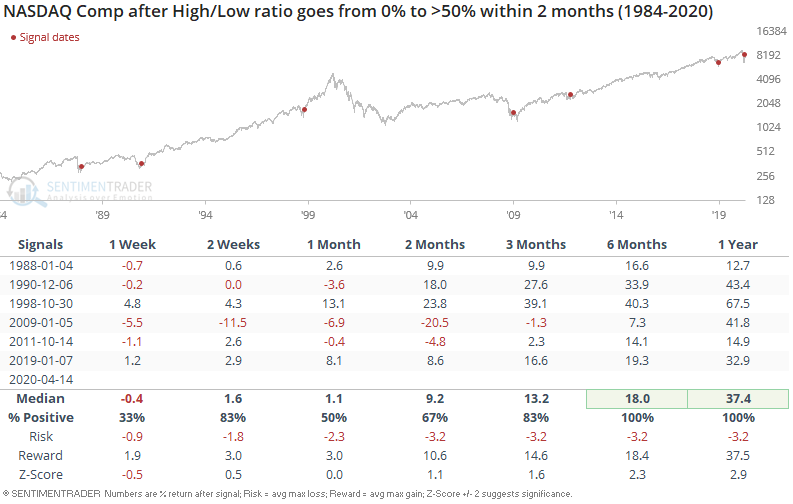

When the ratio went from 0% to >50% within 2 months, the NASDAQ Composite's short term returns were mixed/bearish. But this always led to a rally over the next 6-12 months.