New Low Decline As An "All-Clear"; Junk Bond Surge

This is an abridged version of our Daily Report.

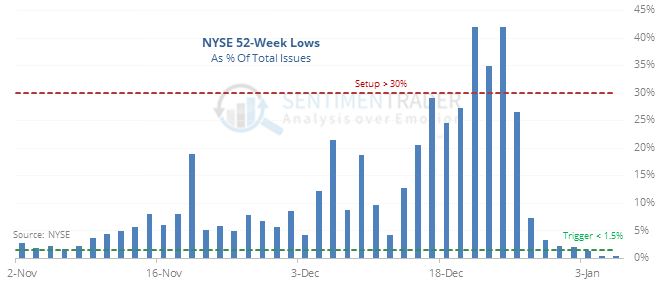

All is not clear

In December, more than 40% of securities hit a 52-week low. That has since collapsed to fewer than 0.4% of issues, the 2nd fastest and most dramatic reversal in history.

If we relax the thresholds, using more than 30% new lows as the setup and fewer than 1.5% with a month as the trigger, then we see that other big declines in the percentage of issues at new lows were an inconsistent “all-clear” signal for stocks, with too many failures.

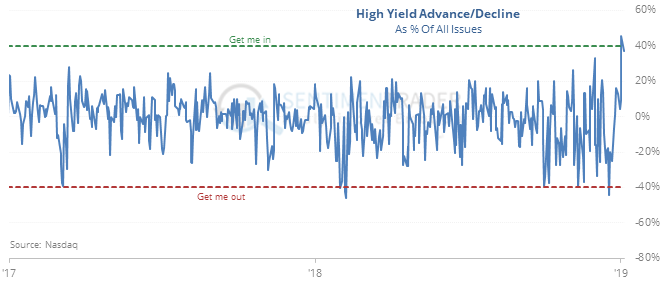

High and higher yield

Sentiment on high-yield (junk) bonds reached an extreme in late December, and since they’ve rallied strongly.

For one of only a handful of times, investors have went from “get me out” to “get me in”, showing intense buying interest that has persisted in the months ahead. It was a good sign for the broader stock market, as well. Six months later, the S&P 500 was higher by a minimum of 8.8%.

Retracement

The S&P 500 has retraced more than 38.2% of its decline, one of the best-ever retracements this soon after a decline of more than 15%. Rallies that retrace more of a decline this quickly have tended to show more weakness in the shorter-term (markets get overbought) but outperform over the next six months.

Sudden shift

According to the heatmap, Mexico is the most-loved country over the past 10 days as its Optimism Index climbs above 70. The Backtest Engine shows that over the past 3 years, a 10-day average this high led to an average 3-month return of -1.5% and 29% win rate.