Newsletters give up

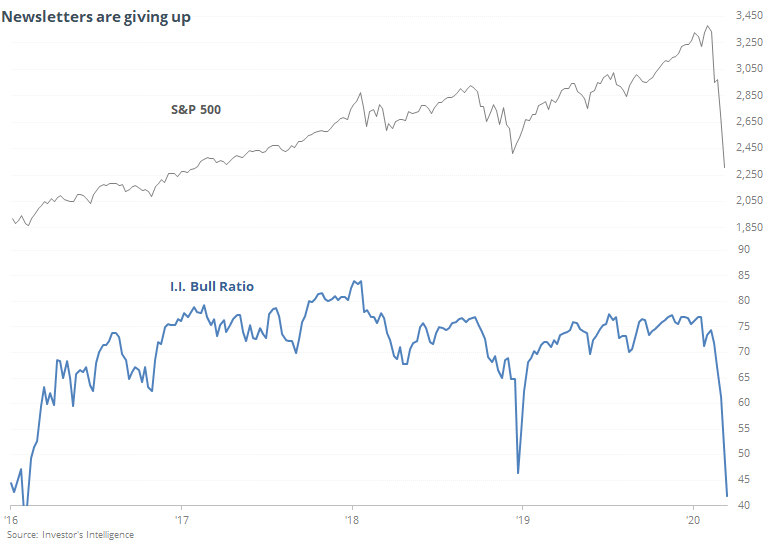

There are a few go-to indicators that casual observers tend to gravitate to when discussing "sentiment." One of those is the survey of newsletter writers by Investor's Intelligence.

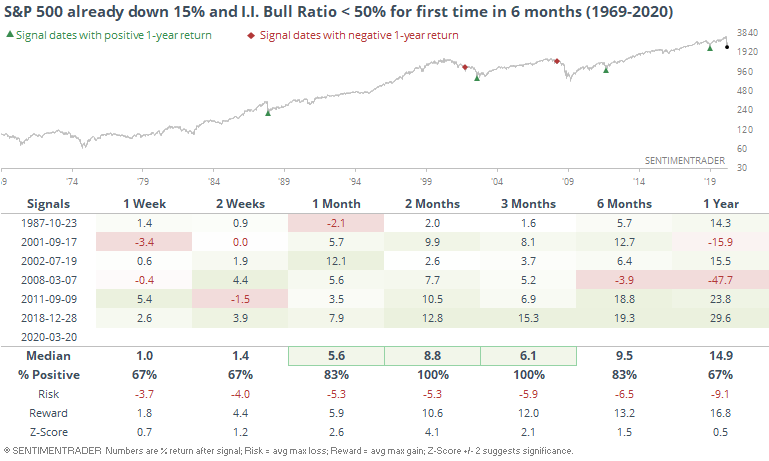

Despite the tumult in markets in recent weeks, the survey hadn't shown much give-up, which changed this past week. For the first time in well over a year, the Bull Ratio (Bulls / (Bulls + Bears)) dropped below 50%. This means that more of them expect stocks to decline than rally in the months ahead.

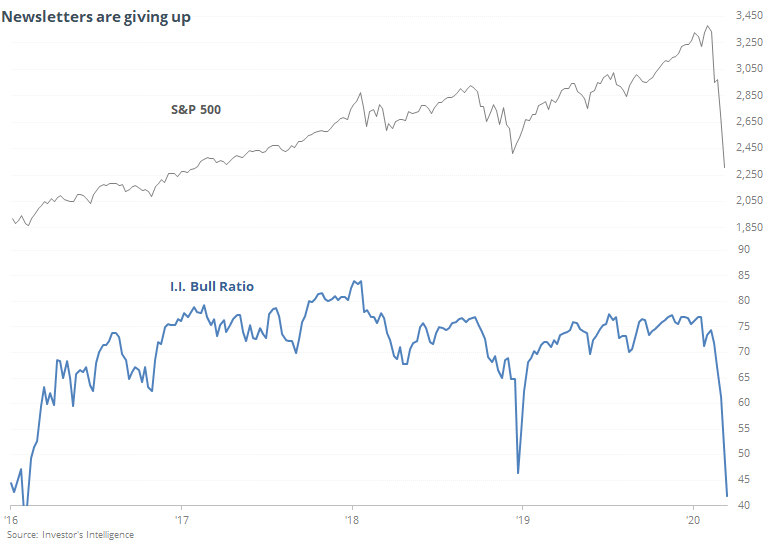

This ends one of the longer streaks of bullishness in the survey's history.

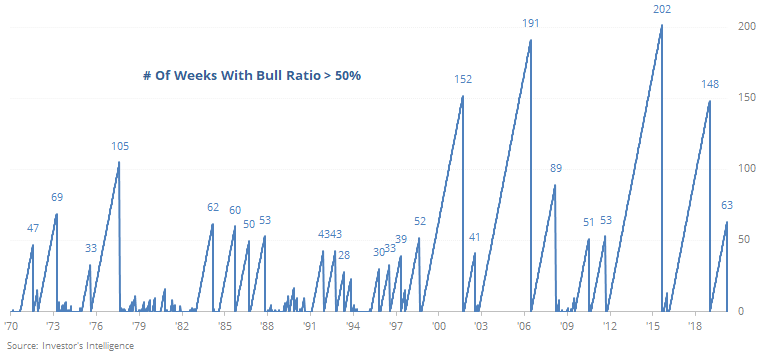

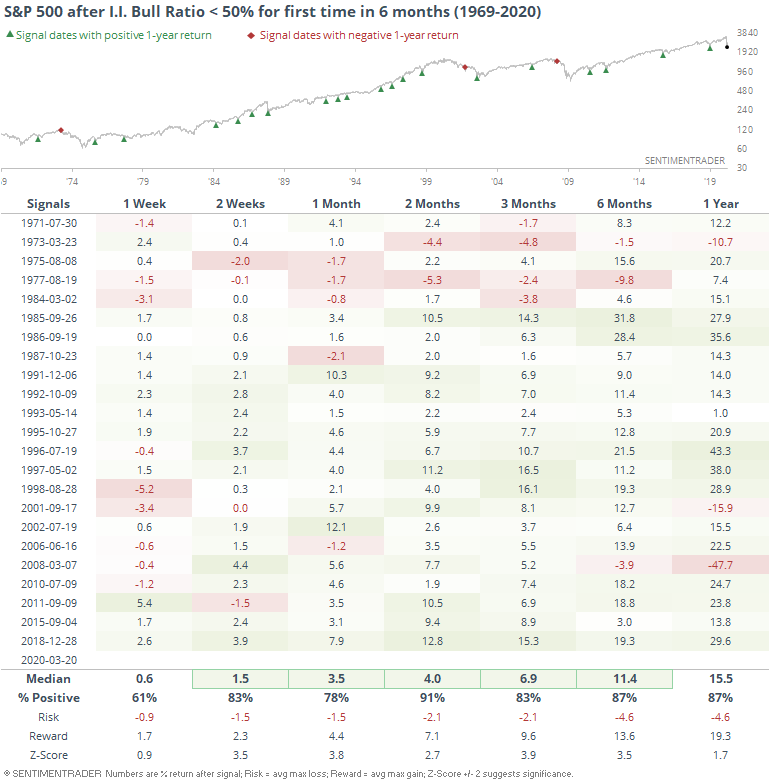

When newsletter writers first change their aggregate bias from positive to negative, it has occurred relatively early in a few declines, but the vast majority of cases saw this happen at the tail end of major declines.

Most of these signals triggered when stocks hadn't declined very much. As returns started to wobble, newsletters became less sure of themselves and flipped to bearishness. The current decline has been the quickest in history, but they still showed a little stubbornness before becoming bearish.

If we look only at those times when it took at least a 15% drop to get these folks to become bearish, then we get the following.

This occurred relatively early in the 2001-02 and 2008 bear markets. Even so, the S&P rallied over the next 2-3 months each time.

As the Bull Ratio drops, future returns in the S&P 500 tend to rise. There has been a negative correlation between the two over the years. It's not especially strong, but it's been rare to see negative forward returns after a Bull Ratio this low.

This data doesn't say much about short-term prospects, but it should bode well for the medium- to long-term.