No Negative Surprises As Indexes Hit Highs

This is an abridged version of our Daily Report.

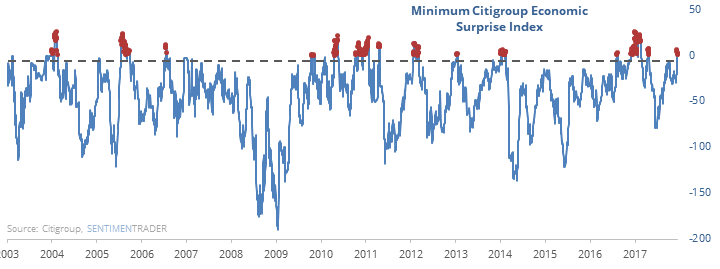

No negative surprises

Every major Economic Surprise Index across the world is now positive. From the U.S. to China, Europe to Emerging Markets, all regions have had economic reports that have exceeded economists’ expectations.

When we’ve had such coordinated economic goodies in the past, defensive sectors did best going forward. The dollar and commodities suffered, the yield curve declined, and emerging markets did best of all.

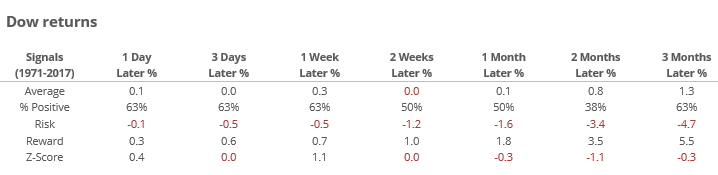

New highs in December

The S&P, DJIA, and Nasdaq all closed at 52-week highs as we head into the last weeks of the year. That seems like it should help boost the positive seasonality, but it hasn’t in the past, with several years showing exhaustion.

The latest Commitments of Traders report was released, covering positions through Tuesday

There were some notable moves from “smart money” hedgers. They’ve greatly increased their shorts against 30-year Treasury bonds, moving from net long at the end of October to a near-record short this week.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.