No Thrust As Big Money Pulls Back

This is an abridged version of our Daily Report.

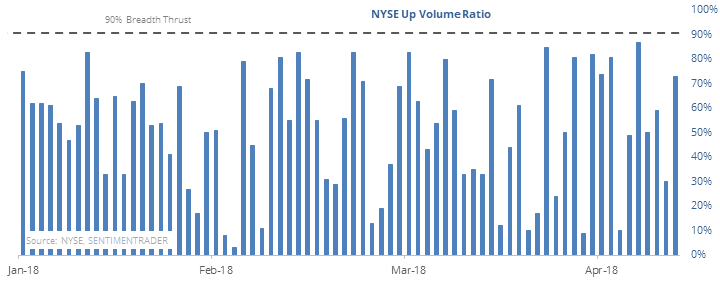

Two weeks and still no thrust

Stocks have been rallying for a couple of weeks, but there hasn’t yet been a 90% Up Volume day.

Forward returns when there has been a 90% day in the first two weeks were excellent, not so much when not. That is a minor negative for our current signal.

Big money is pulling back

The Barron’s poll of big money managers shows a pullback in optimism despite the (volatile) rally in stocks. The Bull Ratio is about average for the past 19 years. Among sectors, they favor Financials, and Energy while avoiding Utilities to a record degree.

Volatility drop

The Optimism Index on the VXX fund is now below 15 for only the 3rd time in the past year. For a fund that almost always declines, that’s a low reading.

Energy is sizzling

The Energy sector has the most 52-week highs of any other, nearing 20% of stocks in the S&P 500 Energy Sector.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |