Non-Confirmation From Cyclical Groups Signal

In a note last week, I shared a risk-off model that identifies when cyclical industries fail to confirm a new high in the S&P 500. The model has been flashing yellow for some time now. However, the algorithm's price momentum condition remained above the threshold level that would trigger an alert. On Friday, momentum for the S&P 500 index turned negative, and a new signal fired at the close of trading.

Let's review the risk-off signal and forward return outlook.

CYCLICAL COMPONENTS

- Automobiles & Auto Components Industry Group

- Transports Industry Group

- Homebuilding Sub-Industry

- Consumer Discretionary Sector Equal-Weight

- Financials Sector Equal-Weight

- Industrials Sector Equal-Weight

- Small Cap Index

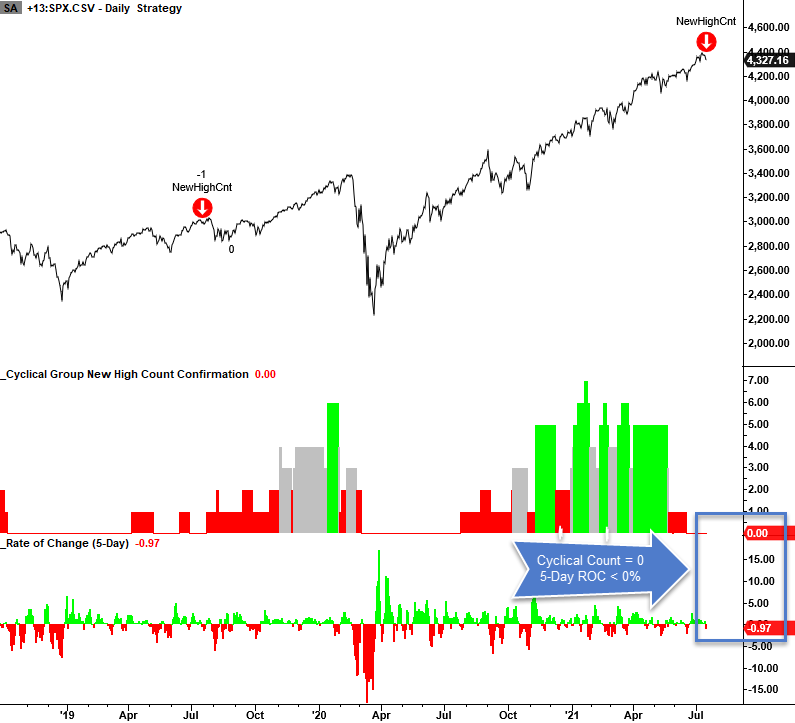

MODEL CONCEPT

The cyclical group new high count model identifies when economically sensitive groups are failing to confirm new highs in the broad market as measured by the S&P 500. The model will issue an alert based upon the following conditions.

SIGNAL CRITERIA

- If the cyclical group new high count = 0

- If the S&P 500 records a 252-day high

- If Condition 1 and 2, start days since true count.

- If days since true count <= 5 and the 5-day rate of change for the S&P 500 < 0, then signal risk-off.

- If the cyclical group new high count crosses above the reset threshold then Firtscross = true. i.e. a reset to screen out duplicate signals

CURRENT DAY CHART

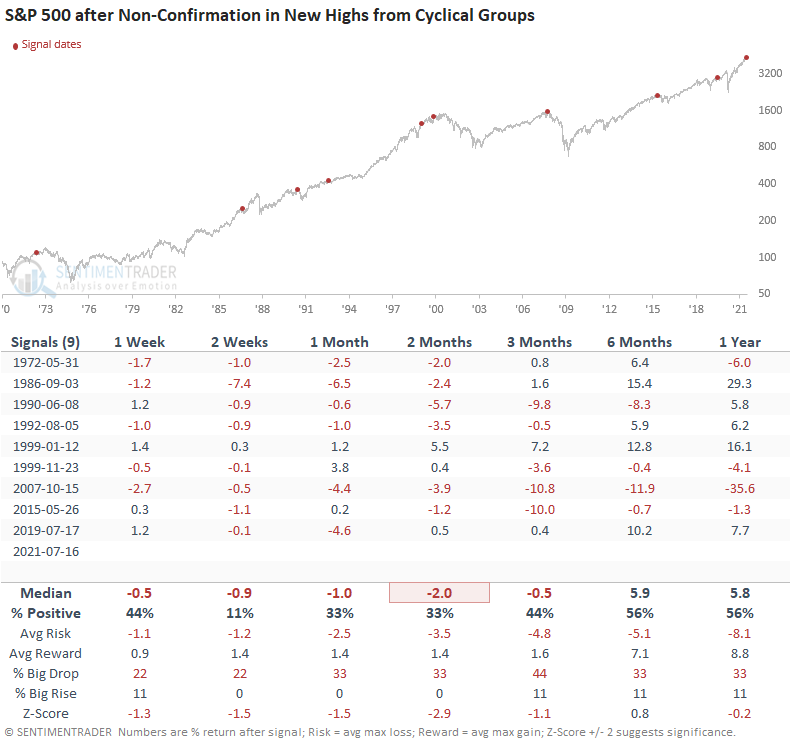

HOW THE SIGNALS PERFORMED

While the sample size is small, the results are weak across almost all timeframes.

The cyclical group new high count non-confirmation risk-off model is not a component in the TCTM Risk Warning Model or the Risk-Off Composite Model. While I like the concept and the message, I have an alternative model that uses the cyclical components. That model is a voting member in the TCTM Risk Warning Model.