One Good Reason to Avoid DIS for Awhile

Based on the headline, you might expect me to launch into some COVID-19 related rant about why one should still avoid big crowds - like those typically found at Disney.

But no, my interest here is strictly financial in nature. And my concerns have everything to do with "when" and a lot less to do with "what."

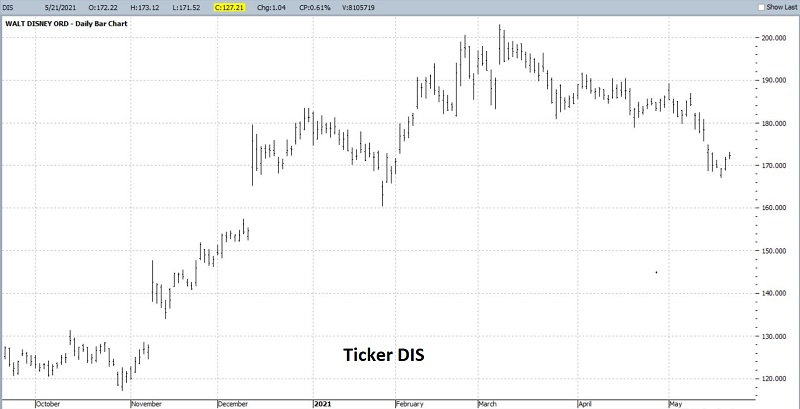

As you can see in the chart below (courtesy of ProfitSource by HUBB), DIS has weakened since the early part of March. That's the Bad News. The Good News is that since the end of September 2020, the stock is still up roughly +39%.

DISNEY: THE MAGICAL MONTHS

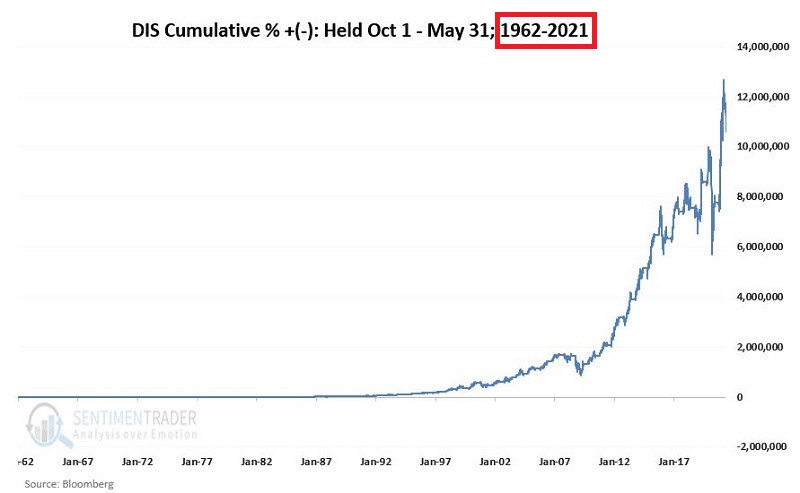

As it turns out, this should not be surprising. The chart below displays the cumulative % gain for DIS stock held ONLY from October 1st each year through the end of May the following year, every year since 1962.

Because of the magnitude of the gains, the left-hand side of the chart above gets "scrunched" down to the point where it looks like nothing happened. So the chart below "zooms in" on the period from 1962 through 1984 to better highlight DIS performance during the "Magical Months" on the left-hand side of the graph above.

An initial $1,000 investment in DIS stock held only October through May starting in 1962 is worth $108,204,694 as of 5/21/2021, or a gain of + 10,820,369%.

DISNEY: THE NOT-SO MAGICAL MONTHS

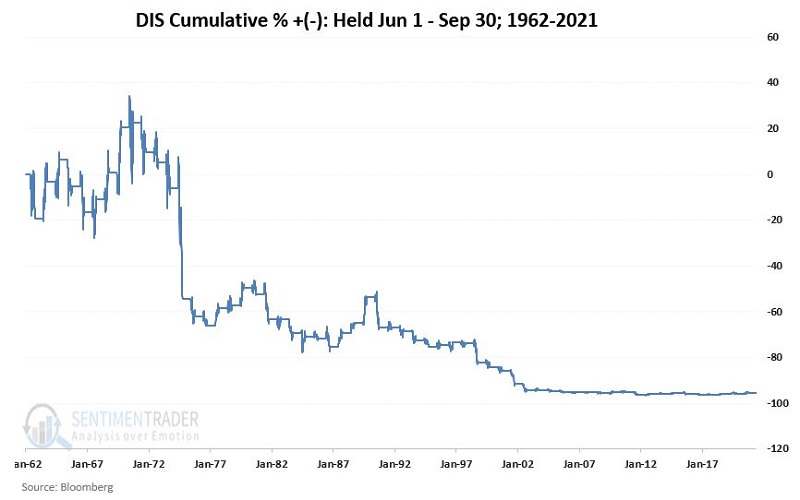

Now for the more relevant - and not so "magical" news. Figure 3 displays the cumulative % gain for DIS stock held ONLY from June 1st each year through the end of September that same year, every year since 1962.

An initial $1,000 investment in DIS stock held only June through September starting in 1962 is worth $44.86 as of 5/21/2021, or a loss of -95.5%.

BY THE NUMBERS

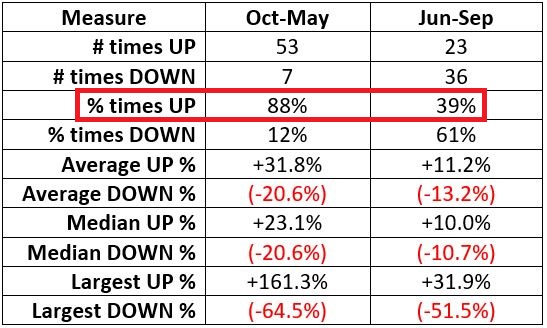

The table below displays a summary of DIS performance during Oct-May versus Jun-Sep.

THE UPSHOT

Many investors will ask the obvious question of "Why does this work?" And the most succinct answer I can proffer is, "It beats me." Obviously, many investors will not be satisfied with that answer. And that is perfectly OK by me. As a proud graduate of "The School of Whatever Works," I tend to focus much more closely on "how often" and "how much" than I do "how come."

Not everyone is wired that way, and that's OK.

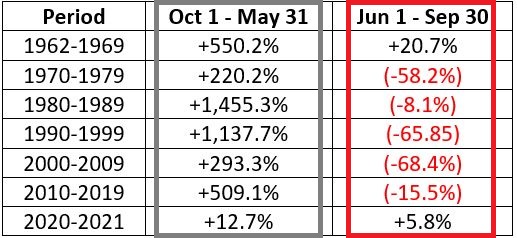

Speaking of consistency, the table below displays decade-by-decade DIS results for the Oct-May period versus the Jun-Sep period.

The key things to note are that:

*The Oct-May period showed a pretty substantial gain during each of the 6 previous decades.

*The Jun-Sep period showed a gain during the '60s but lost money in every subsequent decade

(Note 2020-2021 results are through 5/21/2021).

SUMMARY

The results displayed above in no way "guarantee" that DIS will perform poorly in the months ahead. Still, with June 1st just around the corner, it is worth noting that the June-September period has been pretty rough on DIS stock investors for a long time. Will this continue to be the case in the future? Ah, there's the rub. And once again, I must repeat my standard answer of "It beat's me."

But the real point is that in the long run, investment success has a lot to do with finding an "edge" and exploiting it repeatedly. Or as I like to say:

"Opportunity is where you find it."