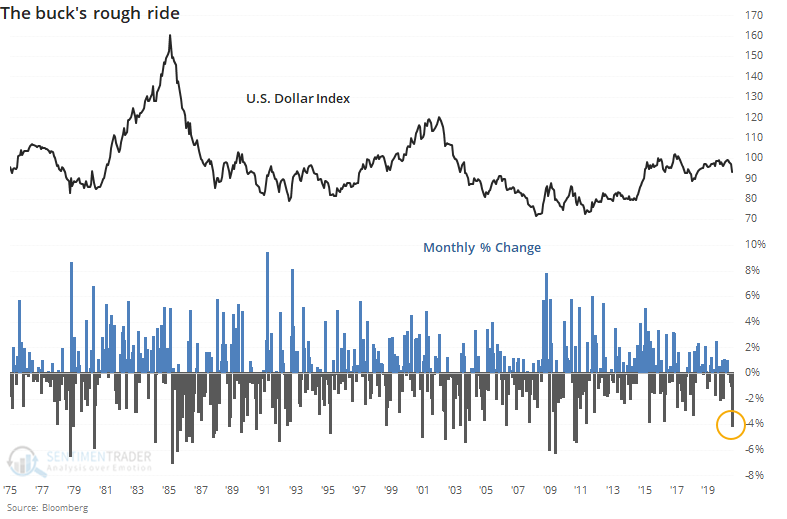

One of the dollar's worst months ever

The dollar has had a really, really bad month.

Unless it makes a stunning reversal on Friday (it didn't), the buck is on track for one of its largest monthly losses in a decade, amid a drop to at least a two-year low.

Downside momentum in the dollar hasn't necessarily had a tendency to lead to mean-reversion. Unlike what we often see in stocks, extreme moves in one direction aren't a great predictor for contrary moves in the other direction.

That's been the case for large monthly declines, as well. When it has suffered at least a 3% decline to at least a two-year low, the dollar showed a gain over the next six months only 40% of the time, and its median return across all time frames was below random. There are other measures showing sentiment on the buck is pessimistic enough to lead to a shorter-term snapback, but that now needs to fight historically bad momentum.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Returns in the dollar, gold, and stocks after big down months in the dollar

- Gold has uncoupled from one of its main drivers - real interest rates

- Individual investors are historically pessimistic during a historically massive rally in stocks

- The S&P has had a historic 4-month run

- The participation among stocks in the Nasdaq's rally has been unimpressive