Opening Enthusiasm As Wall Street Upgrades

This is an abridged version of our Daily Report.

Don’t sleep or you’ll miss it

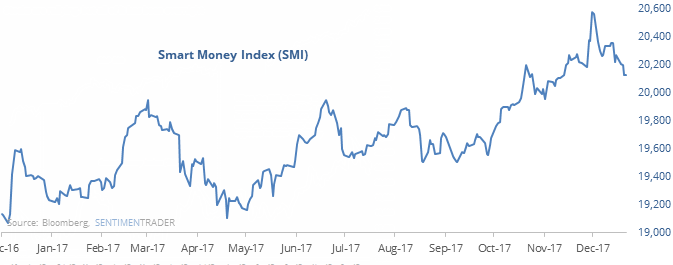

So far in December, the stock market’s gains have come overnight, with regular trading hours showing a net loss. That is unlike what we’ve seen for most of this year. The Smart Money Index looks at early-morning versus the rest of the day, and it is falling dramatically.

Divergences like this have led to weakness in the medium-term.

Upgrade mania

Wall Street analysts are having trouble keeping up with rising stock prices, so they’re upgrading price targets. In keeping with the trend, they’ve pulled back on the number of stocks they’re downgrading. The net number of upgrades is now among the highest of the bull market, which has led to mixed returns in the S&P, but poor ones in indexes like the New York Composite.

Saggy trading

The S&P 500 fund, SPY, has closed in the bottom 25% of its intraday range for the past 3 days.

Santa’s window

That 4-day positive bias happens to coincide with good seasonality. The period from the day before Christmas to three days after has been positive 51 out of 67 times since 1950.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today.