Opening Gap Odds As Investor Optimism Doubles

Buyers are coming in hard this morning, ostensibly due to further measures announced by the ECB. Whatever the reason, futures are indicated to open more than 0.75% higher than Wednesday's close, which would be a two-month high.

Using the S&P 500 fund, SPY, there have been 64 times it has shown such a gap. From the open to close, the S&P added to its gains only 41% of the time, averaging -0.3%. When it was below the 200-day average, it gained 6 out of 14 times, averaging -0.4%.

When this occurred below the 200-day, the only times the S&P was able to maintain any substantial gains over the next several sessions were in October 1998 and April/May 2009, as stocks were emerging from steep sell-offs. As always, if stocks can continue to shrug off probabilities like this and power higher, it adds to the evidence of even higher prices in the medium-term. Futures are fading a bit as this gets published, but even if the opening gain is above 0.5%, the short-term stats were similar to the above.

The rally has taken hold among individual investors, with the latest survey from AAII showing that bullish sentiment has doubled from the lows. The Bull Ratio was at a lowly 28% a month ago compared to 61% as of today's release.

This isn't necessarily a bad thing. Increasing bullishness is good for markets, as long as it doesn't get too bullish.

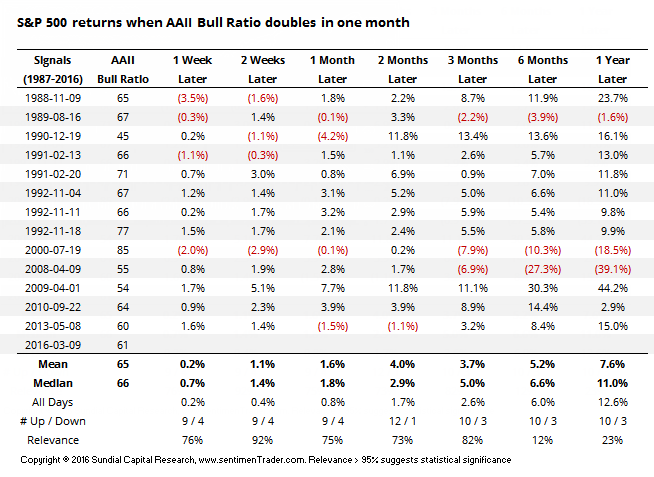

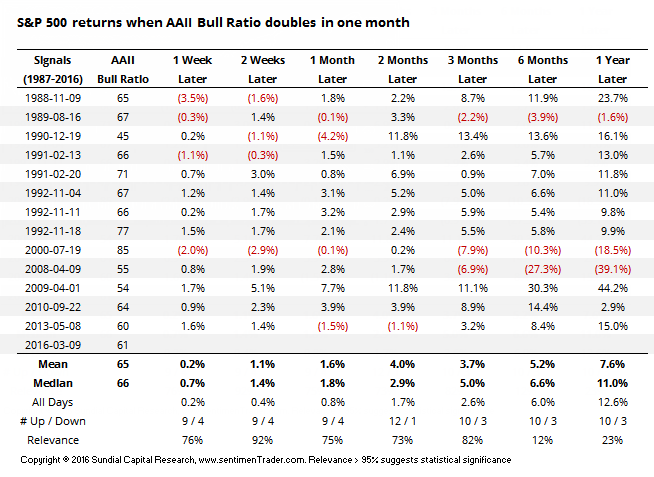

Going back to the survey's inception, here are the returns in the S&P when the AAII Bull Ratio doubled over a one-month period:

Two months later, the S&P was higher 12 out of 13 times, averaging a healthy gain of 2.9%. The sole loss was small and quickly reversed in the weeks following. This is also one of the smaller Bull Ratios in the table, adding a bit to the positive tone.

There were five other weeks (in 1988, 2000, 2008, 2009 and 2013) when ratio had been at its lowest level in a year before it doubled, not including our current instance. Returns going forward were in line with the others, showing no additional bullish inclination.

The gap open does not look promising for those looking to chase short-term strength, but again we're seeing the kind of activity that is associated with momentum markets, and those rarely just roll right over into medium-term declines.