Options Traders Have Never Done This Before

More record speculation

Two weeks ago, options traders pressed their bets, pushing speculative activity to a record high.

And they just keep pressing.

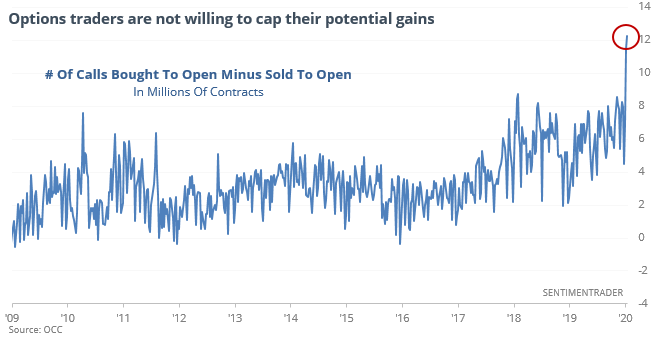

Last week, call buying to open as a percentage of all NYSE volume hit a record that had been set just the prior week. Even more telling, traders are not willing to cap their potential gain by selling calls to open, either. The number of contracts being bought to open versus sold to open is skyrocketing,

All of this is not being offset by hedging activity, as our Option Speculation Index continues to climb as well. This kind of behavior has rarely ended well for the speculators.

Small-cap breakout

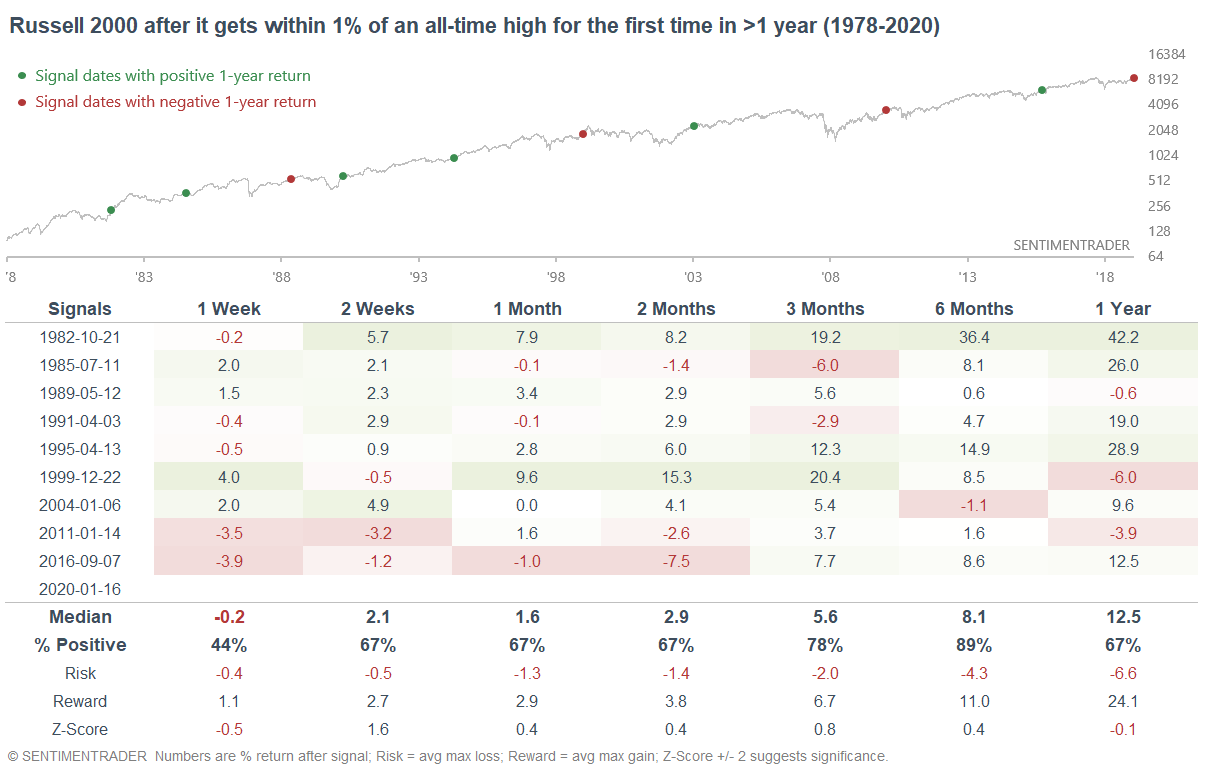

The S&P 500, Dow, and NASDAQ all made new all-time highs in 2019 after crashing in Q4 2018. The one outlier is the Russell 2000 (small caps), which has yet to make a new all-time high.

This may be about to change. The Russell 2000 (total return, including dividends reinvested) is less than 1% below its all-time high. When the Russell 2000 (total return) came close to an all-time high for the first time in more than a year, it usually trended higher over the next 6 months.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- New highs on the NYSE and Nasdaq are the most in two years

- A lot of stocks in XLU and QQQ are overbought