Options traders just won't quit

The "stocks only go up" mentality that caught fire in July turned into a raging inferno by the end of August, especially in names like Amazon and Tesla. That triggered warnings about what might happen once some of those options expired.

That preceded a nearly 12% drop in the Nasdaq 100 at its low point in September. While that served to wipe out some of the speculative fervor, it didn't completely destroy it. And now some of those traders are back for more.

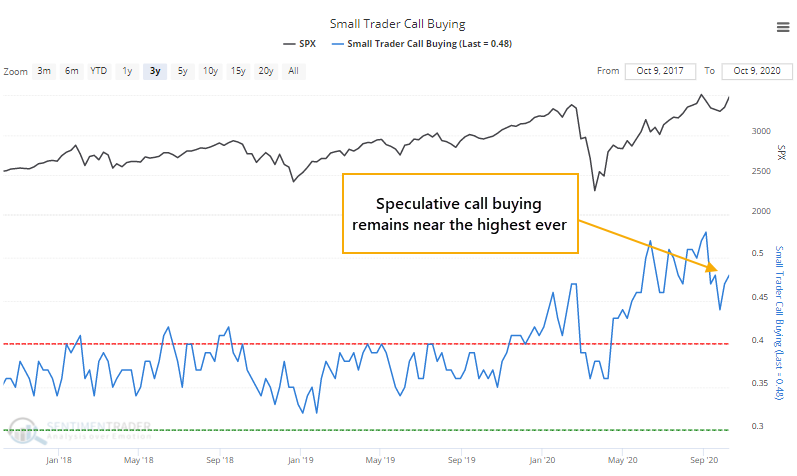

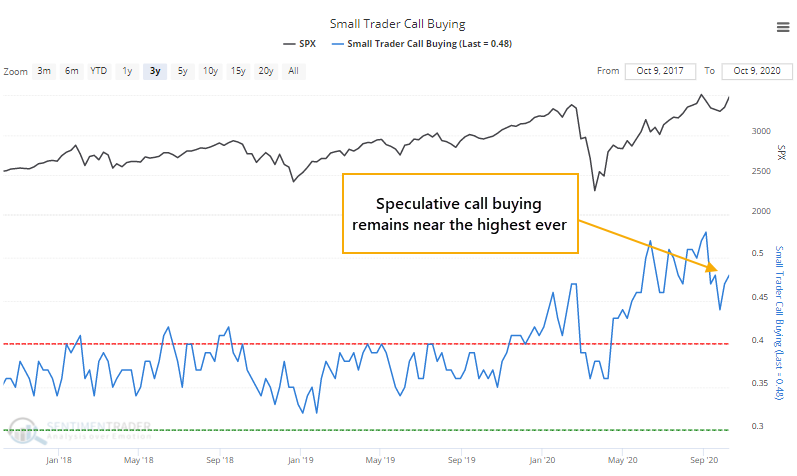

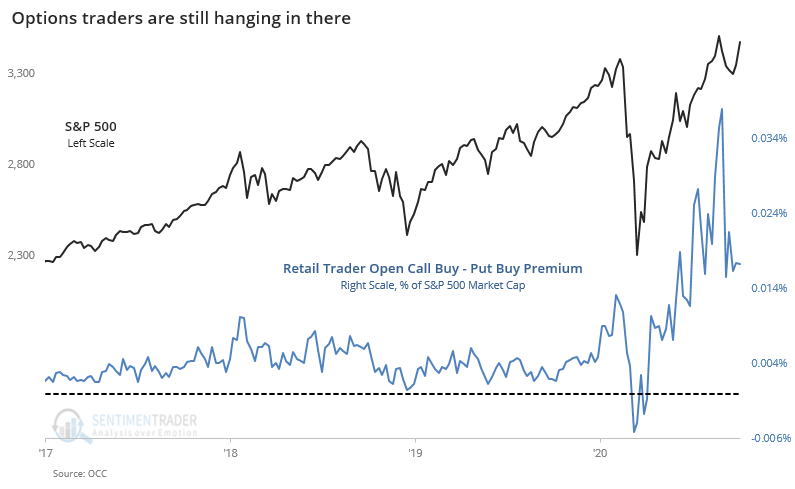

Last week, the smallest of options traders spent 48% of their volume on buying to open speculative call options. That's higher than 98% of all other weeks since the year 2000 though still below the peak from late August / early September.

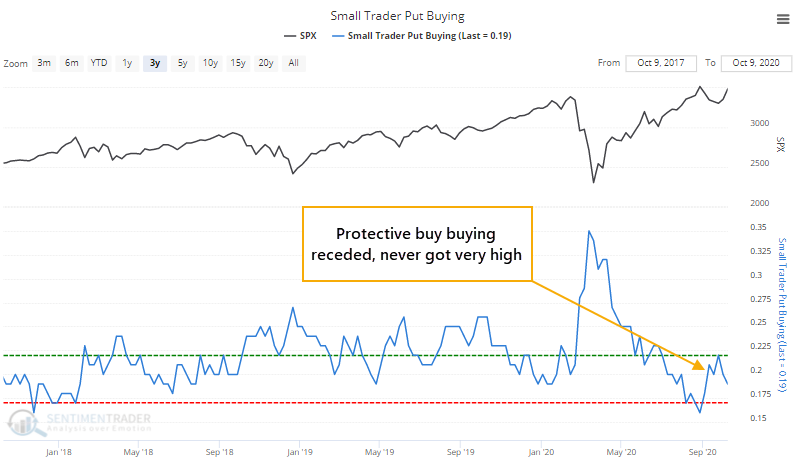

They also reduced the number of hedges, with protective put buying dropping to 19% of total volume. Again, not quite as extreme as before.

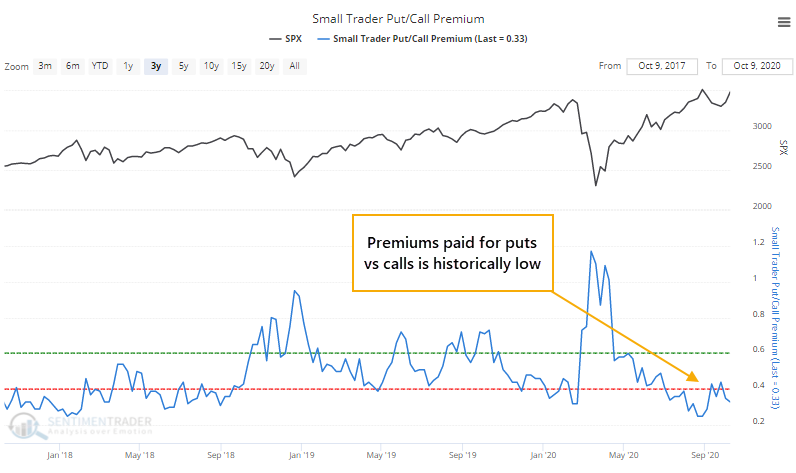

One of the oddities from a month ago was that implied volatility was rising along with stock prices. That hasn't happened this time around. Because the options contain less pumped up premiums, the ratio of premiums spent on puts versus calls also isn't as extreme as it was before. But it's still historically low.

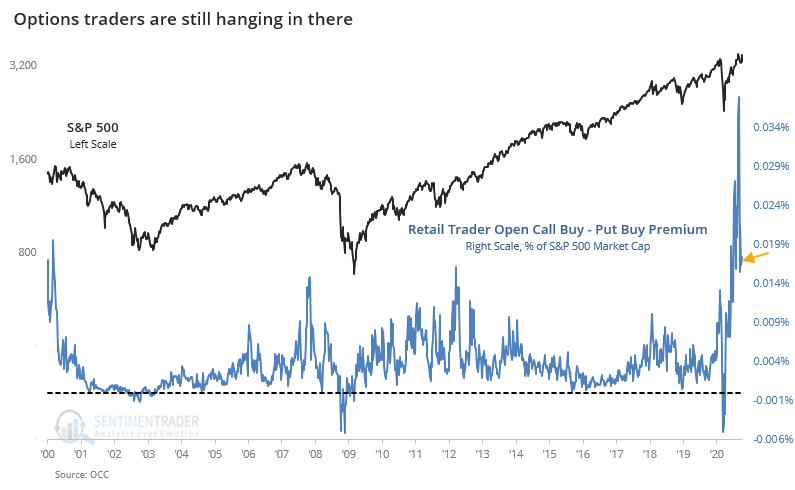

If we look at a broader view, it's clear that speculative activity has subsided but remains disturbingly high. Among retail traders, buying fewer than 50 contracts at a time, the premiums spent on calls vs. puts as a percentage of the S&P 500's market capitalization has dropped quite a bit from its earlier peak.

But that hardly matters when looking at the past 20 years. It's still higher than almost all other peaks in speculative fervor.

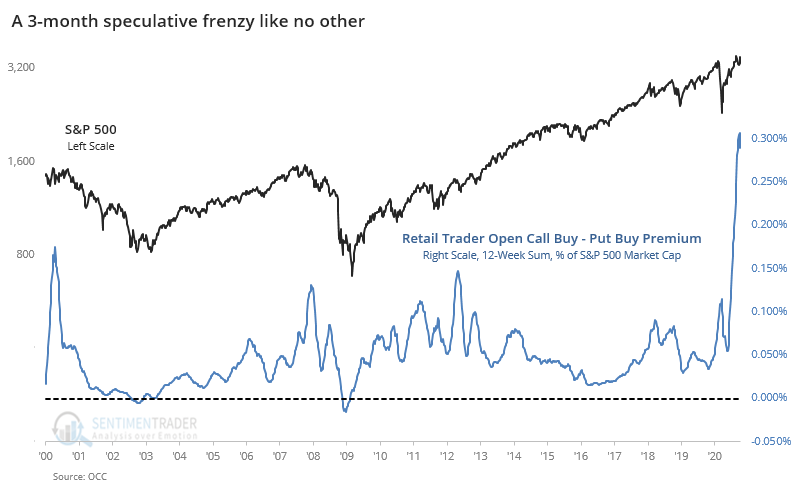

If we sum up this activity over the past 12 weeks, we can better see just how proracted and extreme their behavior has been.

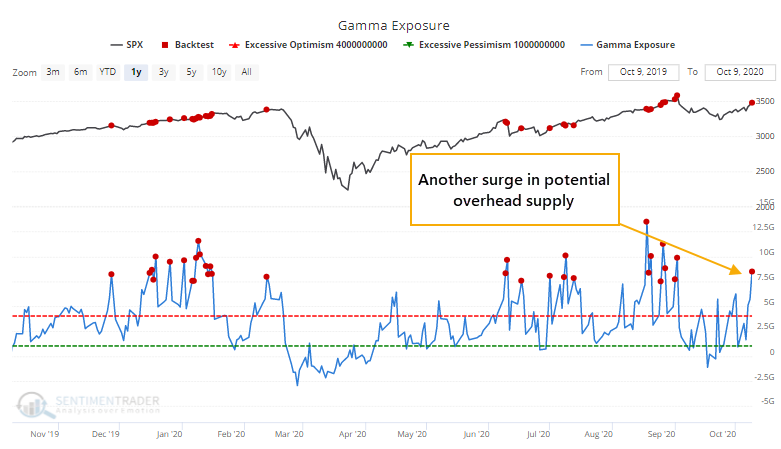

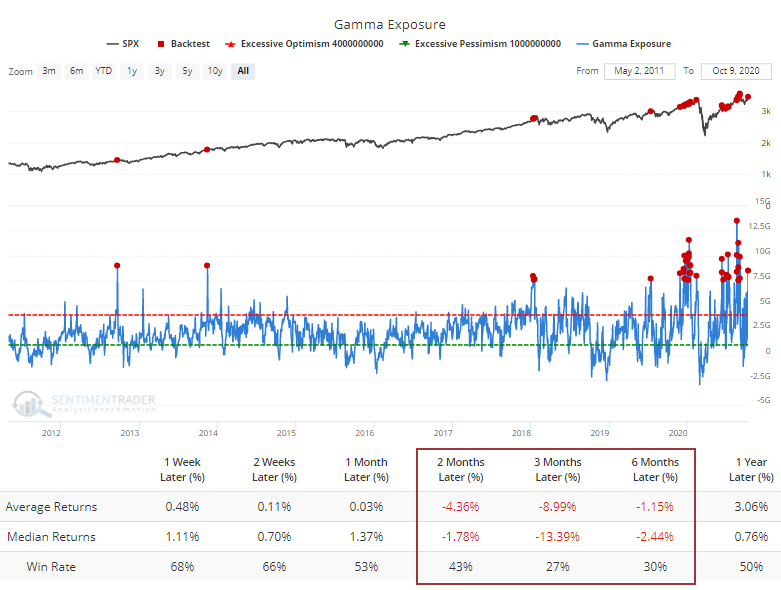

Another worry is that late last week, estimated Gamma Exposure spiked according to SqueezeMetrics. This is a rough estimate for how much dealers may sell for every 1% rise in the S&P 500.

The index has not done well when Gamma Exposure was high according to the Backtest Engine.

When we saw this behavior in August, it was especially worrying because there were consistent signs of trouble underlying the indexes. On some days, the major indexes like S&P 500 or Nasdaq Composite would jump 1% or more while most of the stocks in those indexes were declining.

We're most assuredly not seeing that now, as last week witnessed some of the best internal dynamics in months. That takes quite a lot of the bite out of the newest resurgence in speculative juices. It's hard to see how this kind of behavior gets rewarded - markets simply aren't that accommodating. But given last week's impressive, and important, recovery in major breadth metrics, this options activity isn't as big of a worry as it was a month+ ago.