Options traders won't be deterred

The smallest of options traders are not to be deterred.

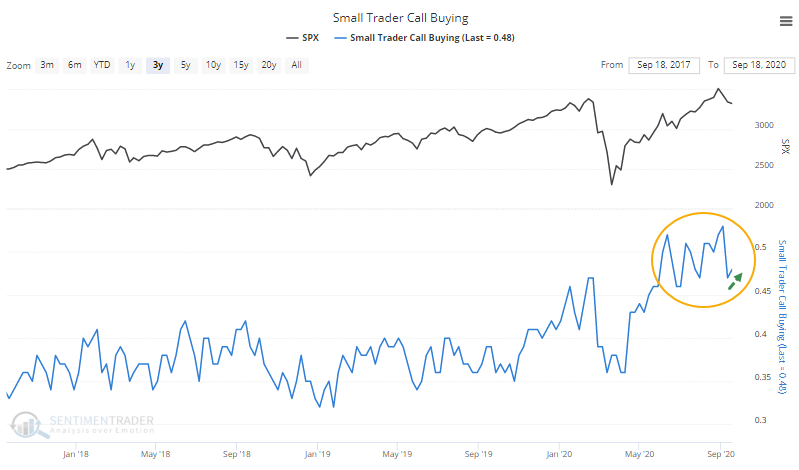

Even after what were likely catastrophic losses over the past two weeks, since most of the options activity was concentrated in the large tech stocks that have suffered large losses, retail volume for 10 contracts or fewer increased its speculative tilt last week. They spent nearly 50% of all their volume buying call options to open, a naked bet on rising prices.

The ratio of opening call premiums to put premiums declined, ranking among the lowest in 20 years. This is even after the S&P 500 slipped below its 10-week moving average. According to the Backtest Engine, that has not been a good combination.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- A more comprehensive look at last week's options trading behavior

- Gamma Exposure is coming down, but with a caveat

- What happens after QQQ suffers a $2 billion outflow in a single day

- For the first time in a while, more stocks are in downtrends than uptrends