Overseas fund exodus nears 2008 crisis low

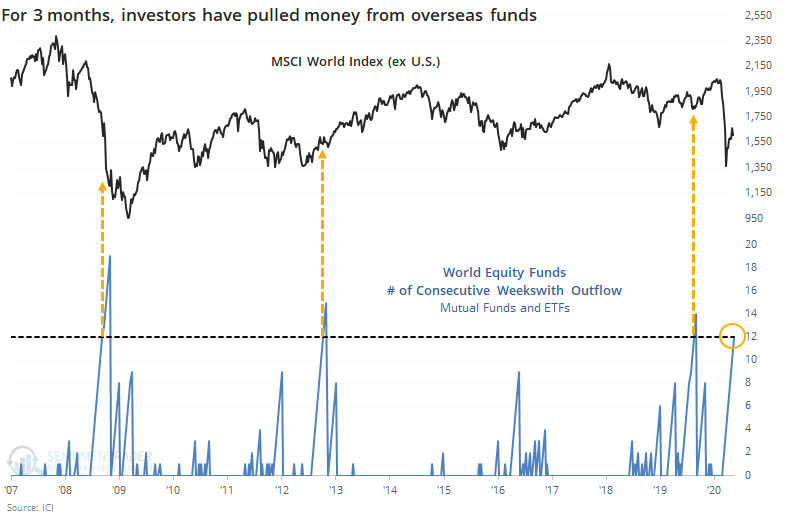

The latest weekly data from the Investment Company Institute shows that investors continue to shun equity funds that are focused outside of the U.S., with overseas funds suffering their 12th consecutive week of outflows. That's among the longest streaks since 2007.

The streak went quite a bit longer in 2008 as the global financial crisis tumbled into its final phase. The other two times the streak lasted this long resulted in higher prices, though the one in August 2019 ultimately led to the current decline after 6 months of gains in the MSCI World Index (excluding the United States).

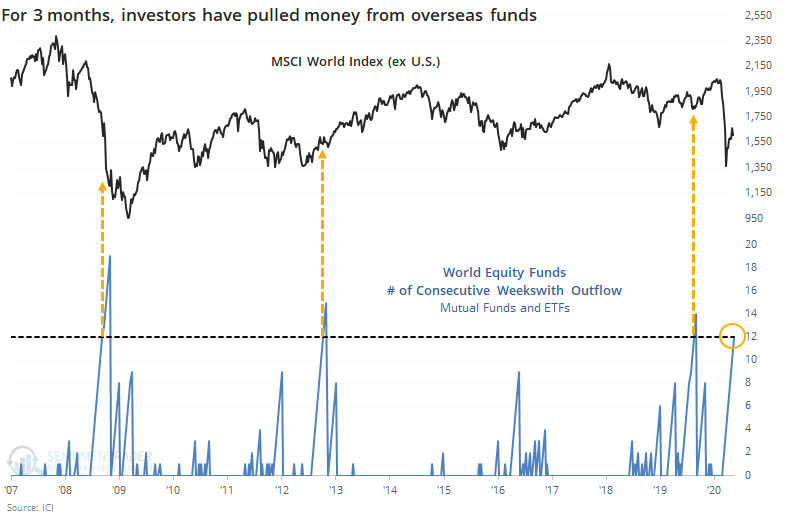

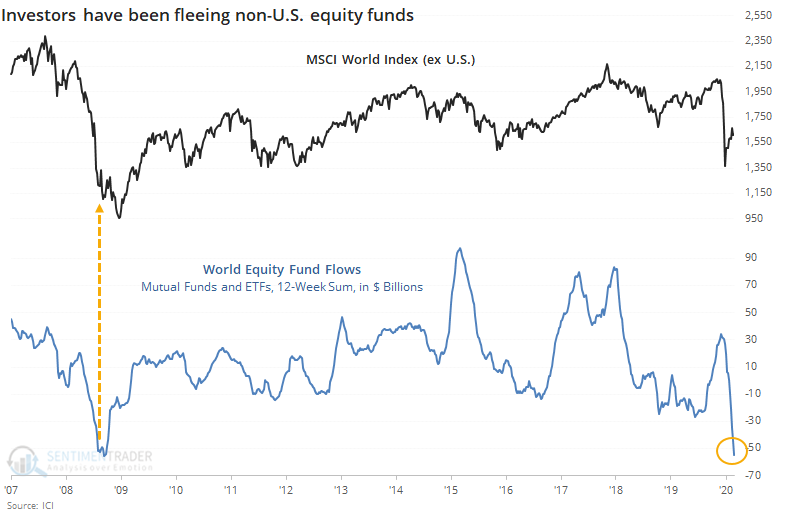

Over those 12 weeks, investors have fled more than $54 billion worth of world funds, on par with the worst of the selling in 2008. No other time period comes close.

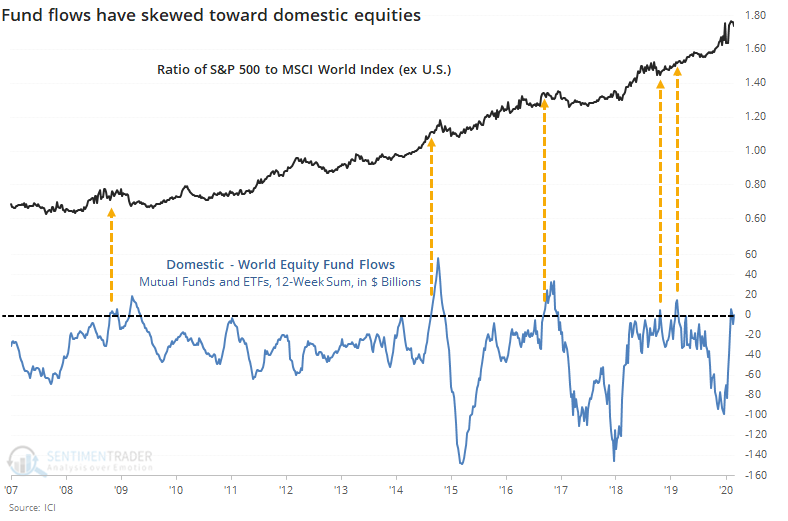

They've also been selling domestic funds since the tumult began in March but not to the same degree as non-domestic funds. The spread between them is now among the narrowest in 13 years.

Other times when investors favored domestic versus non-domestic funds over this long of a stretch, the ratio between the S&P 500 and MSCI World Index soon peaked several times, but the last two did not.

The sample size is unfortunately limited, but from what we can see, this kind of outflow may not be enough to suggest other markets are likely to outperform the U.S. It is extreme enough to suggest a longer-term give-up among investors, and a generally positive environment outside the U.S. over the medium- to long-term.