Overseas markets show near term improvement

Key points:

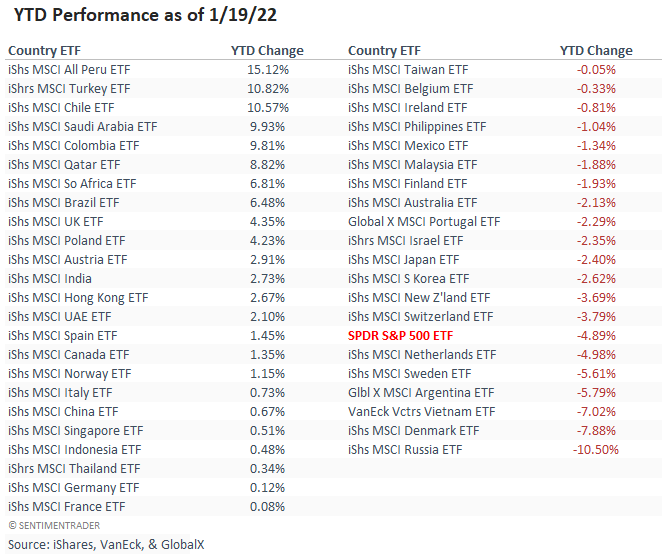

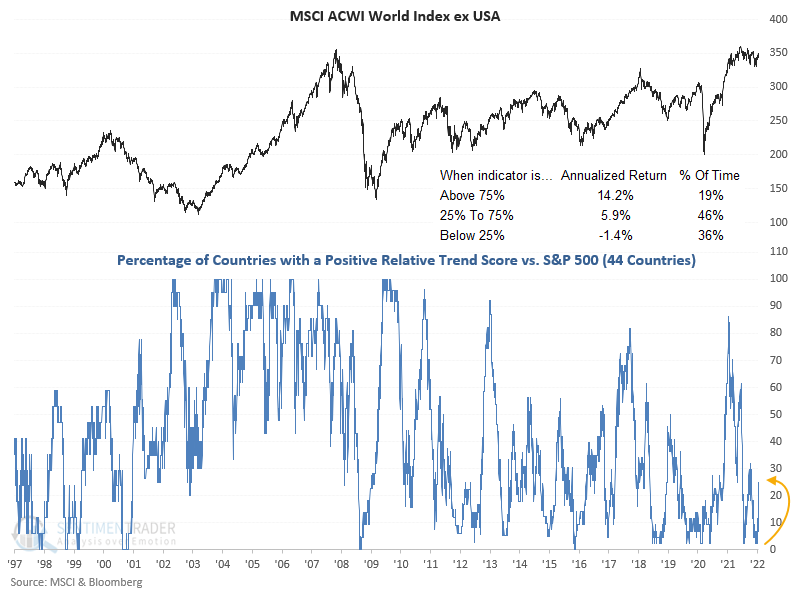

- On a YTD basis, an overwhelming number of foreign markets are outperforming the S&P 500

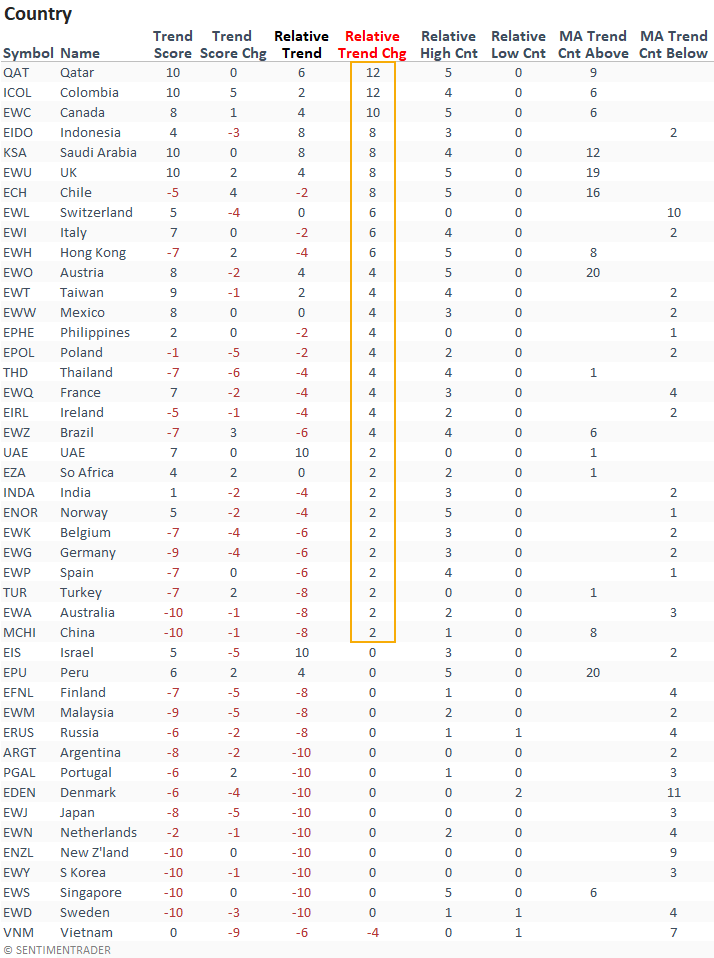

- A trend indicator that compares overseas markets to the S&P 500 is now improving

- Foreign index relative highs are outpacing relative lows by a significant amount

Foreign markets are outperforming the S&P 500 in the near term

In 2021, most foreign markets underperformed the most widely followed domestic benchmark. The underperformance is now reversing, with 86% of the country ETFs that I track outperforming the S&P 500 on a YTD basis. Brazil and South Africa show

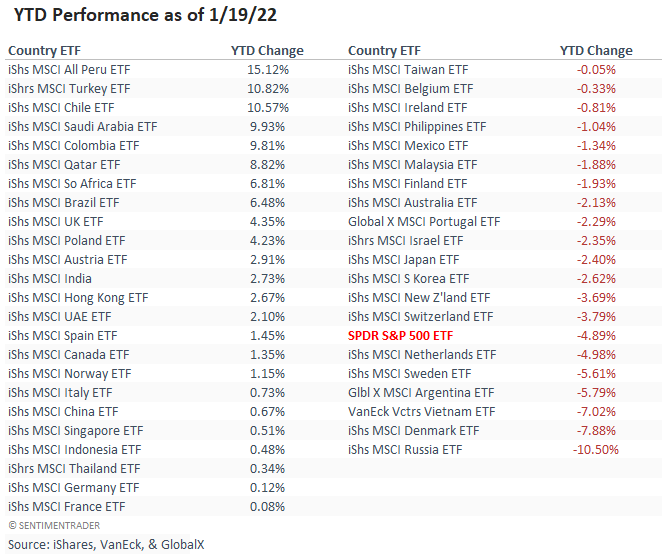

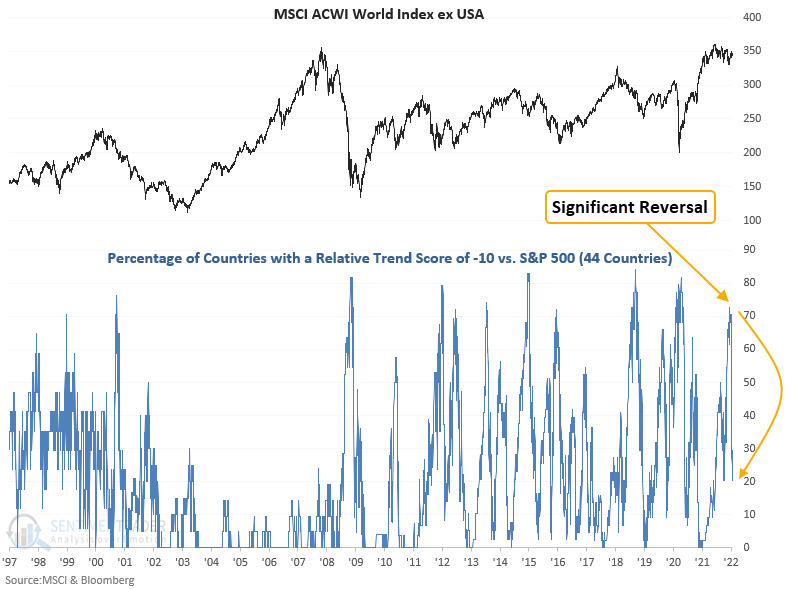

Overseas indexes show improving relative trends

Suppose I sort the Country table by the relative trend score change column. In that case, it shows a significant number of overseas indexes with an improving relative trend score versus the S&P 500. I count 29 out of 44 countries (66%) with an improving trend score on a rolling 5-day basis, with only one decline. And, the improvement is worldwide. i.e., it's not one region.

The number of countries with a positive relative trend score versus the S&P 500 increased by over 20% over the previous 3 weeks from a very depressed level.

The percentage of countries with a relative trend score of -10 shows a significant reversal from the highest level since October 2020.

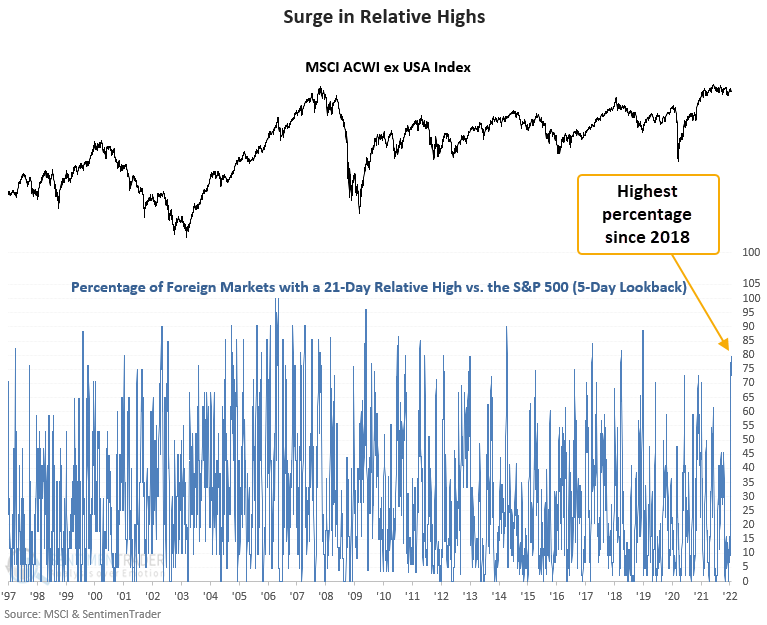

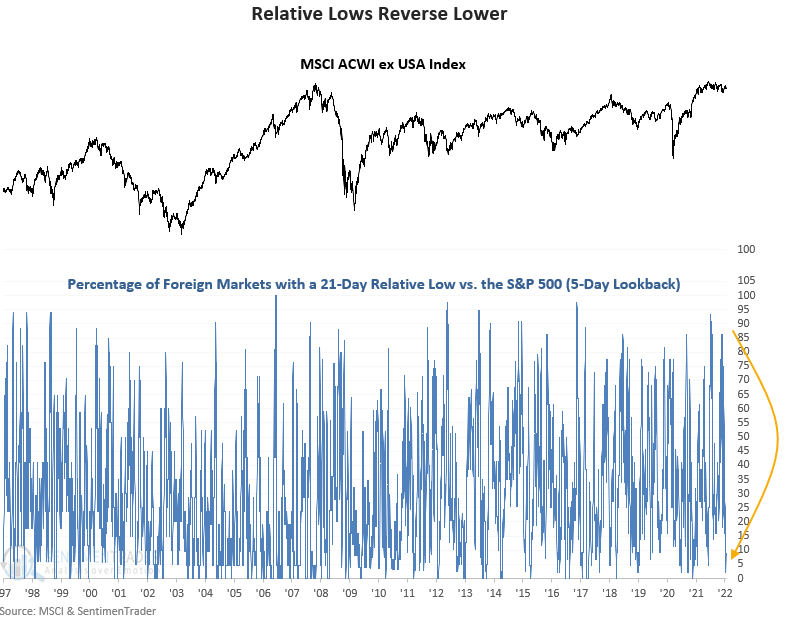

Relative highs are outnumbering relative lows

The percentage of foreign markets registering a 21-day relative high versus the S&P 500 surged to the highest level in more than 3 years.

At the same time, relative lows are almost non-existent.

A recent signal shows outperformance versus the S&P 500

In a recent note, I shared a trading signal that suggested the MSCI ACWI ex USA index could outperform the S&P 500 on a medium-term basis. While the trade is only four days old, the global benchmark outperforms the S&P 500 by 200 basis points.

What the research tells us...

Overseas indexes are showing near-term outperformance as long-term trends improve from depressed levels. While encouraging, I view the current backdrop as a rent versus own environment for a broad-based allocation to an index like the MSCI ACWI ex USA.