Penny stocks see another surge

Over the past couple of months, we've been raising the alarm on several pockets of speculative activity, which had reached or exceeded all prior records.

Bullish options trading, IPO and add-on volume, and penny stock trading were among the most egregious examples. With the latter, it's only getting more extreme.

The latest figures are out, covering activity through the end of February, and it shows an increasing willingness to trade the riskiest securities available to individual investors.

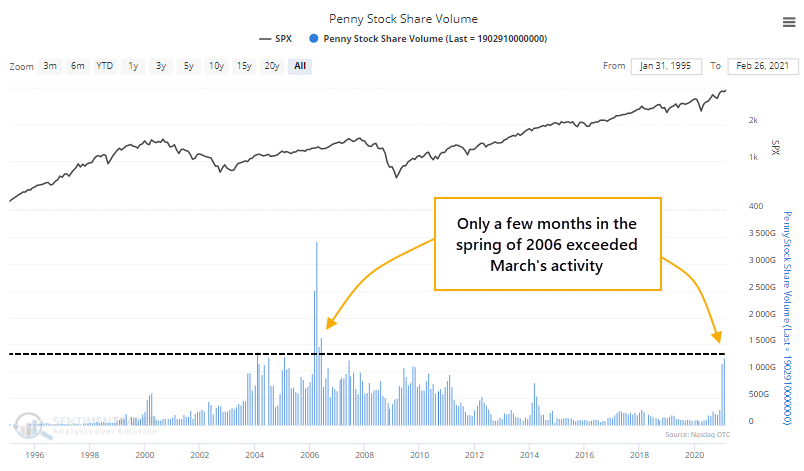

The number of shares traded has jumped to nearly 2 trillion shares (yes, trillion).

Zooming out further, we can see that only a few months in early 2006 exceeded this pace of activity.

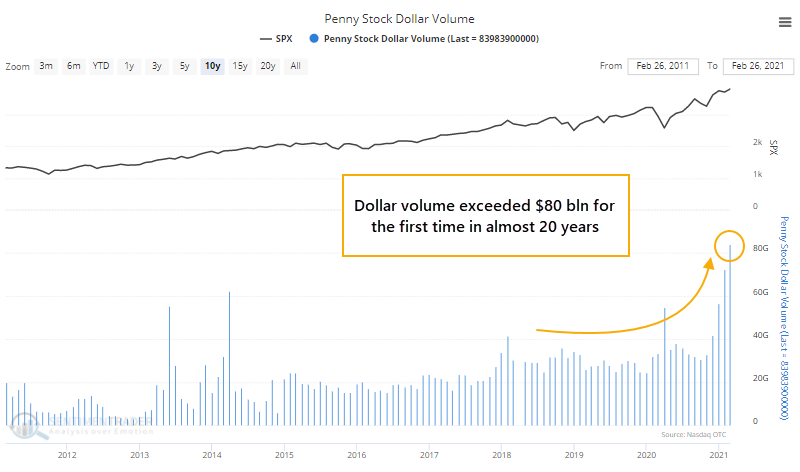

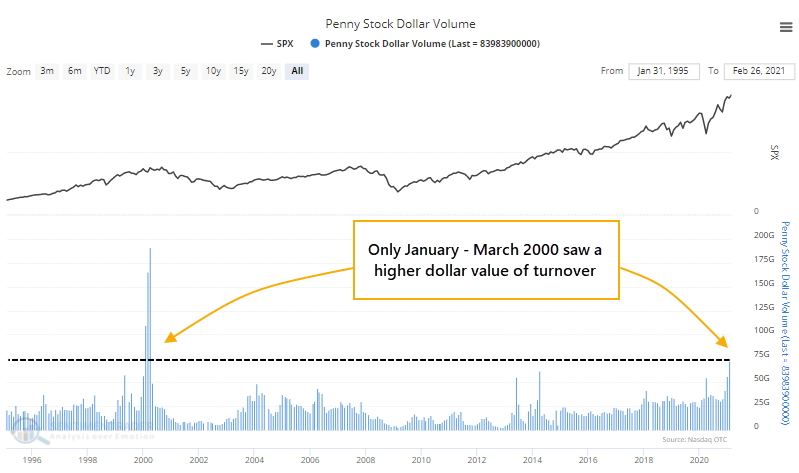

The dollar volume traded rose to nearly $84 billion, again the highest in the past decade.

Going back nearly 30 years, February's activity was only exceeded by January - March of 2000.

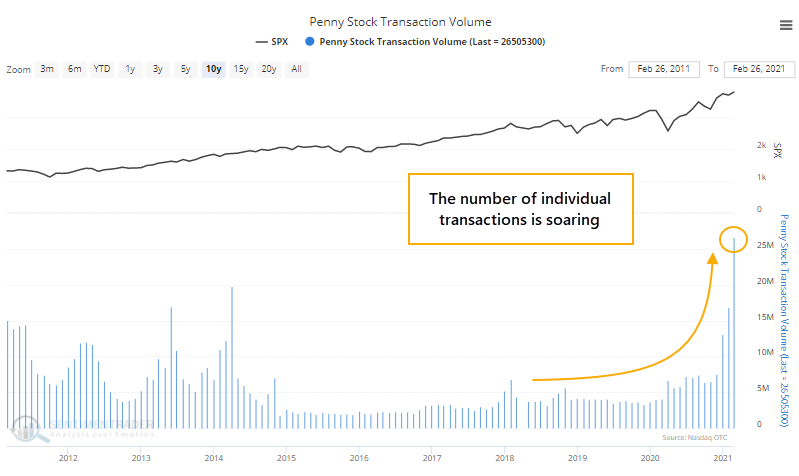

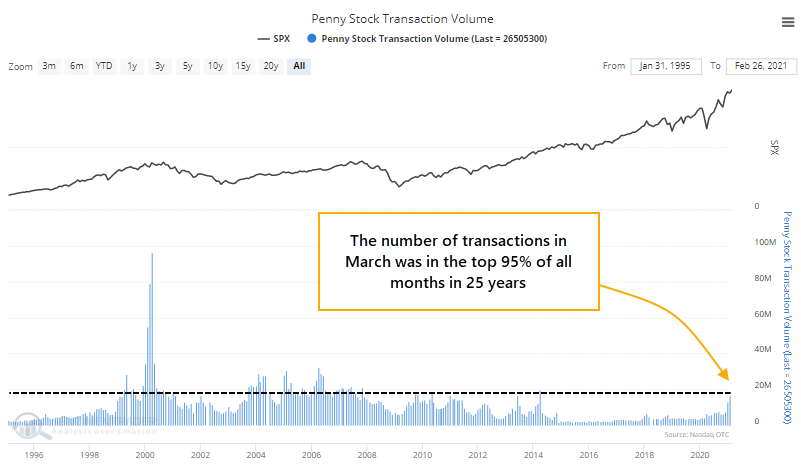

It wasn't just a handful of large trades accounting for this volume, either. The number of transactions exceeded 26 million, again the most in a decade.

There have been several periods where there were more transactions, so not quite as extreme as the other two measures.

Like the "split" market conditions we've looked at a few different ways recently, part of this activity is influenced by a small corner of the market. Trading in a single stock, Healthier Choices Management Corp, accounted for a big part of February's over-the-counter activity. But as with other indicators, we've never had success trying to outguess whether the indicators matter or not. For a time, these figures were skewed by trading in Fannie and Freddie shares. We didn't arbitrarily adjust for that then, and won't now.

Taken altogether, while there might be some minor caveats, we'd consider this surge in turnover in the most speculative corner of the market to be a long-term negative.