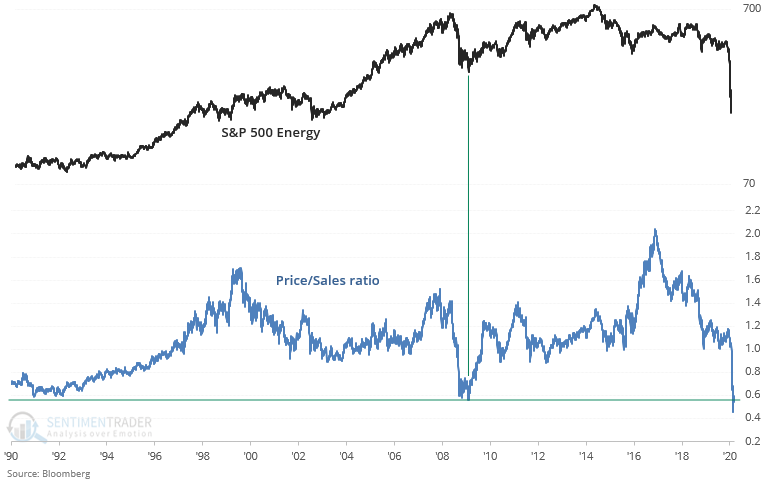

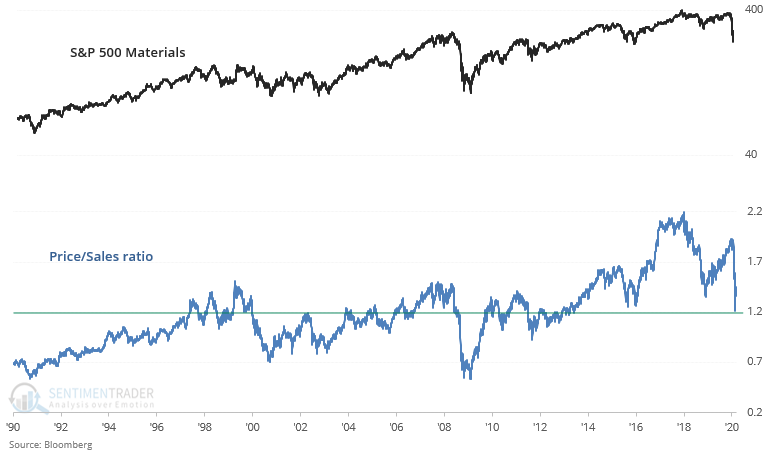

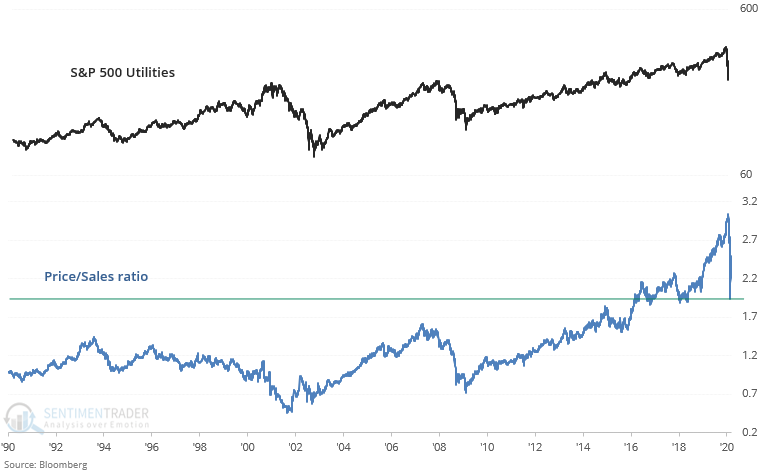

Price/Sales for various sectors

I looked at valuations within and outside the U.S. via Price/Earnings and Price/Book ratios over the past 2 weeks. This will be the last U.S. valuation post I do in a while unless valuations drop significantly over the next few weeks. Let's look at some Price/Sales ratios within the U.S., which don't scream UNDERVALUED, except for the energy sector.

Energy Price/Sales: 0.59

This is extremely low - lower than what we saw during the 2008-2009 global financial meltdown.

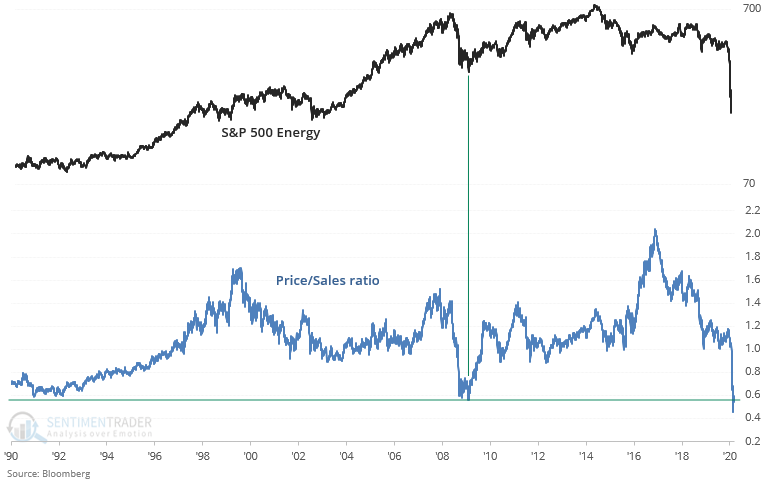

Communication Services Price/Sales: 2.5

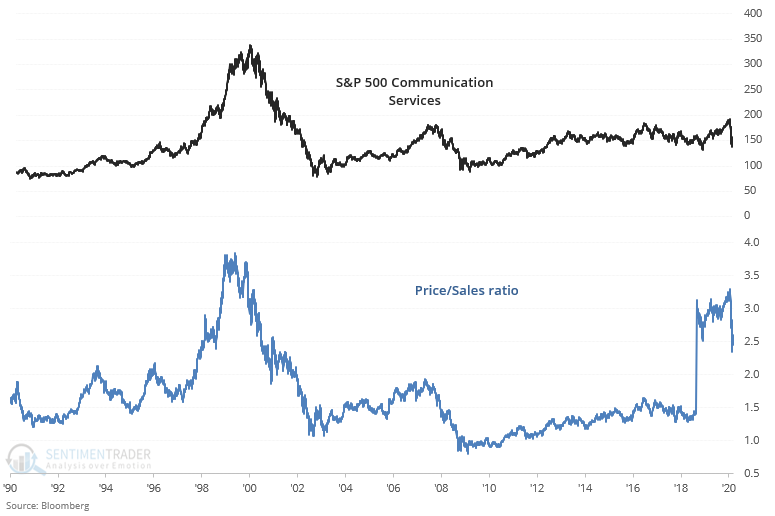

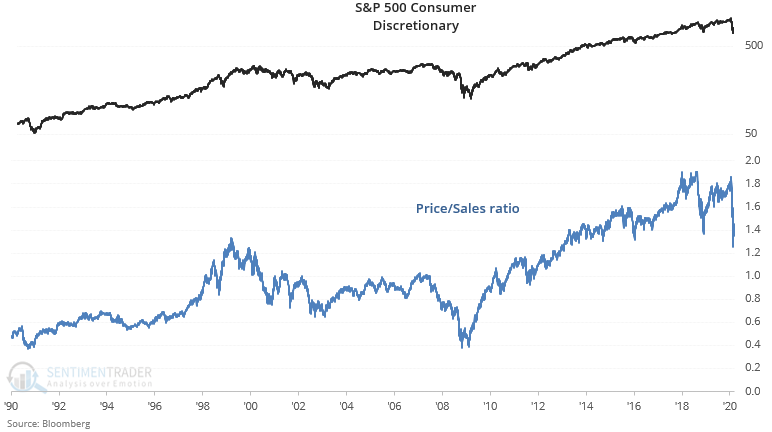

Consumer Discretionary Price/Sales: 1.35

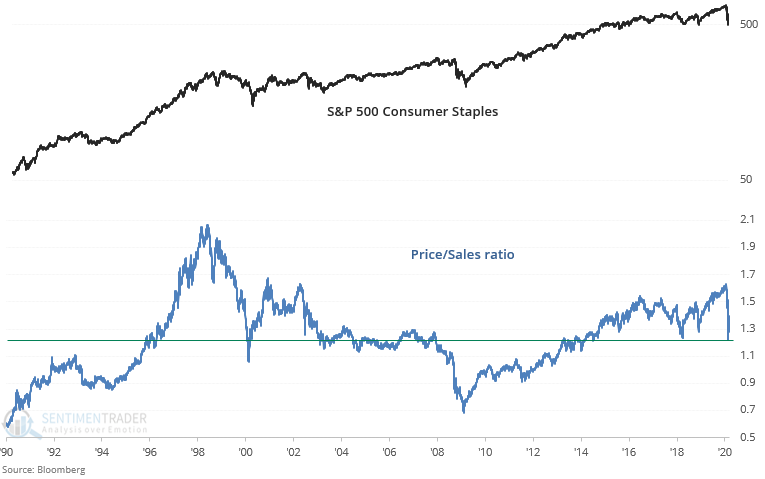

Consumer Staples Price/Sales: 1.37

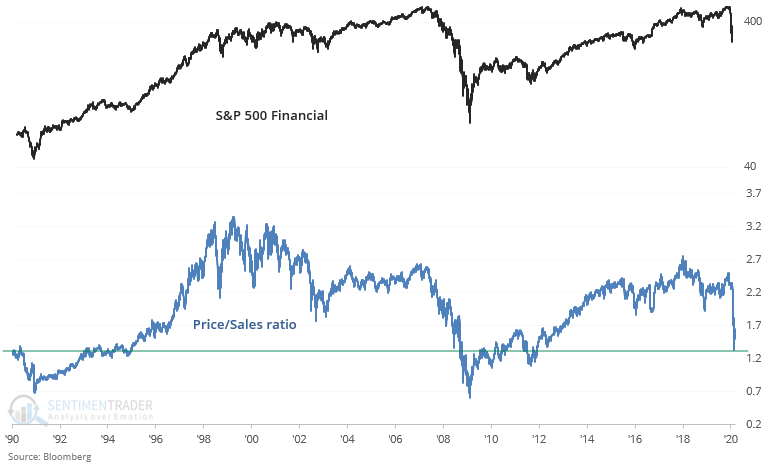

Financials Price/Sales: 1.53

Health Care Price/Sales: 1.55

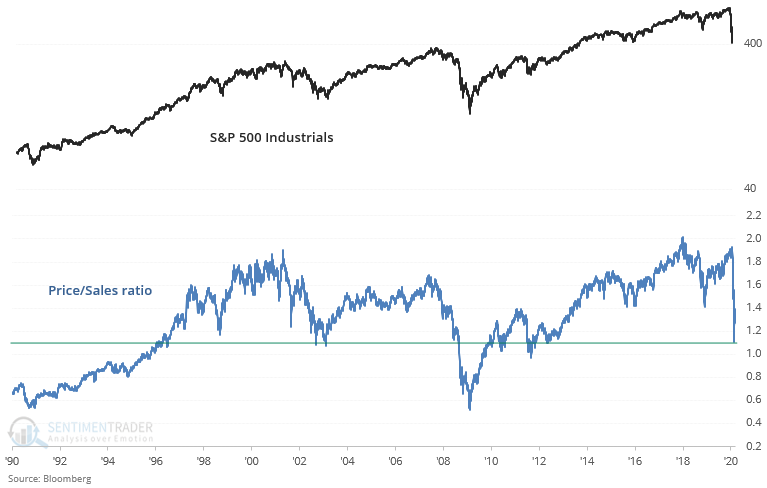

Industrials Price/Sales: 1.29

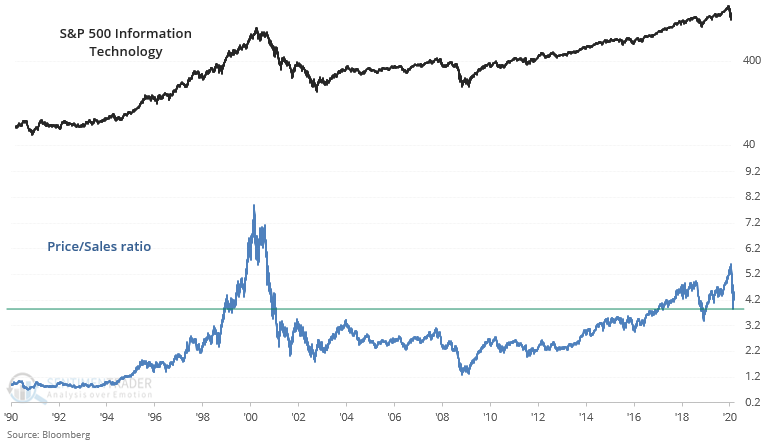

Information technology Price/Sales: 4.28

Materials Price/Sales: 1.37

Utilities Price/Sales: 2.31

Overall, price/sales ratios across various sectors are a little low, but not extremely low. The only sector that's extremely cheap (via Price/Sales) is the energy sector. For what it's worth, I'm not a big fan of Price/Sales ratios since earnings matter more than sales in the long run. Take this valuation indicator with a grain of salt.