Rebounding housing and commodities

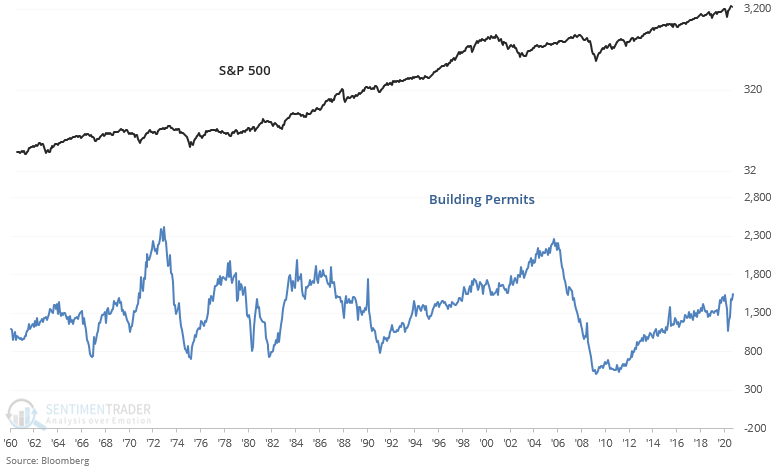

The residential housing market has fared relatively well during this pandemic, mostly thanks to massive government support around the world. Building Permits have surged towards the highest level since the GFC, completely wiping out any slowdown during the pandemic.

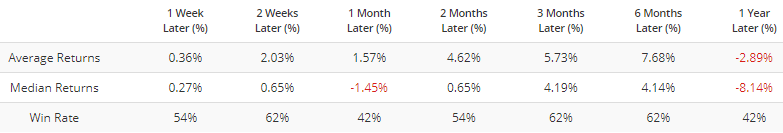

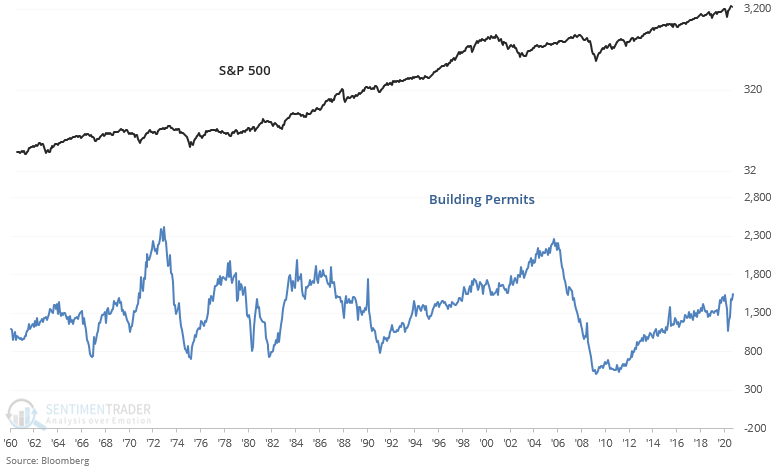

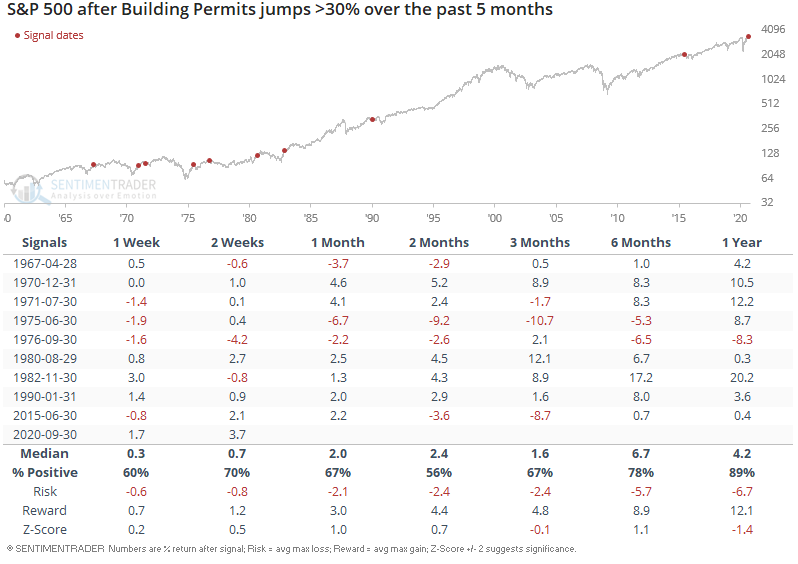

Housing market indicators are useful for understanding the state of the broad U.S. economy. When building permits jumped more than 30% over a 5 month period (i.e. the U.S. economy has already recover markedly), the S&P 500's forward returns over the next year were worse than random as most of the post-recession gains had already occurred:

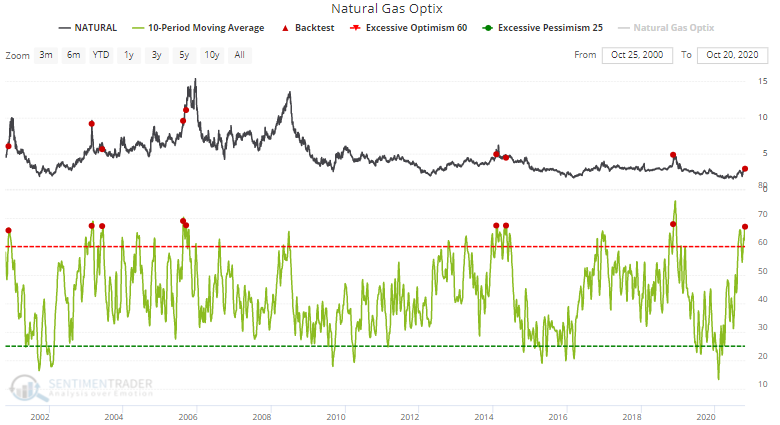

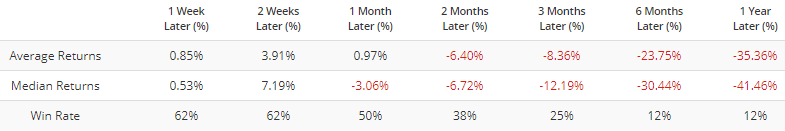

A few days ago I mentioned a surge in agricultural sentiment. That optimism is spreading to other commodities. For example, natural gas Optix's 10 dma is at 67, a level which in the last 20 years led to very poor returns for natural gas over the next few months and year:

Similarly, copper Optix's 10 dma is at the highest level in years (75):

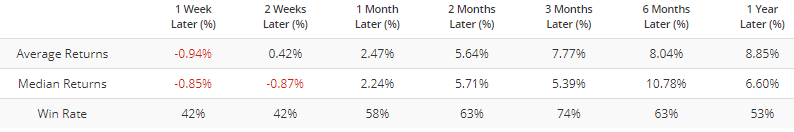

Although this wasn't consistently bullish or bearish if we look at all the data over the past 30 years (bull markets and bear markets included)...

... this has been consistently bearish over the past 10 years, primarily due to the fact that there was no major commodities bull market during this period:

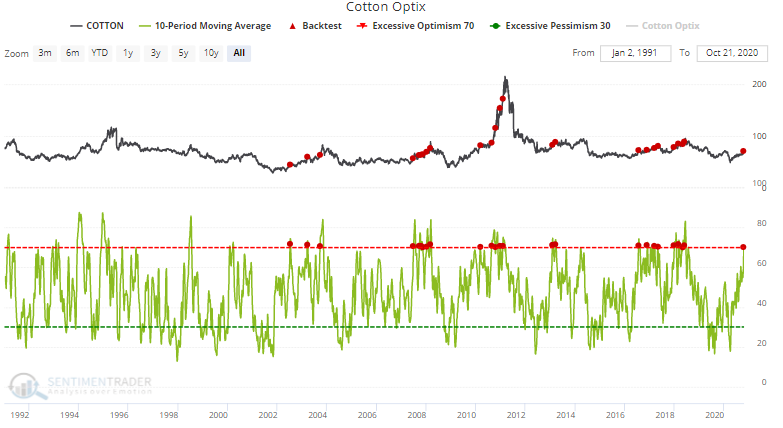

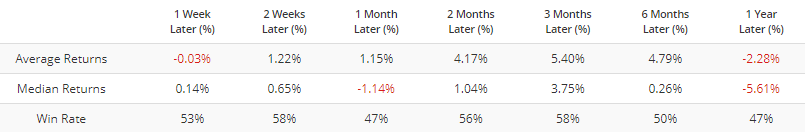

Cotton Optix's 10 dma is rising sharply (now at 70):

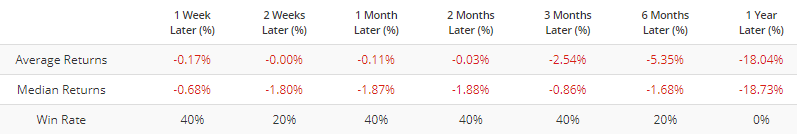

Once again, this led to mostly mixed returns if we look at all the data over the past 30 years...

...but looking at the past 10 years, this has been somewhat bearish for cotton over the next year: