Record Outflow As Mom-And-Pop Sit On The Sidelines

Record flow

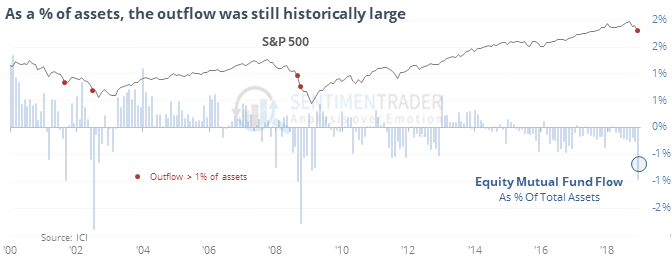

Comprehensive data on mutual fund flows confirm that the massive loss in December for equity funds was the largest on record, dating back 35 years. As a percentage of assets, it was exceeded only by July 2002 and October 2008 in recent history.

Money market funds saw huge inflows, but that was not as consistent as an indicator of investor pessimism.

Back to disbelief

After more than two years of expecting stocks to rally, U.S. consumers have become pessimistic. This has ended a streak of 25 months with more consumes expecting stocks to rally than to decline. Other times long streaks of optimism ended, it was a short-term negative for the following month, but not so much after that.

Mom and pop aren’t buying

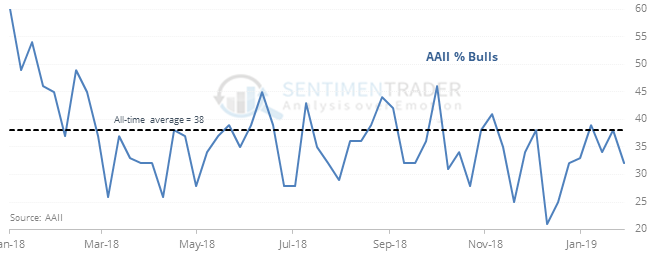

After a 5-week rally in stocks, bulls make up only 32% of respondents in the AAII sentiment survey, well below the all-time average of 38%.

There was a distinct difference in performance depending on whether mom-and-pop bought into the rally. After similar rallies with so few bulls, there was a strong tendency to see gains continue. When bulls had rebounded above 40%, stocks fell every time going forward.

The Commitments of Traders report was released, covering positions through December 24

The CFTC will be updating this twice per week until they’re caught up. FWIW, there were no new extremes of note in the report.

This post was an abridged version of our Daily Report. For full access, sign up for a 30-day free trial now.