Recovering leading indicators and sentiment

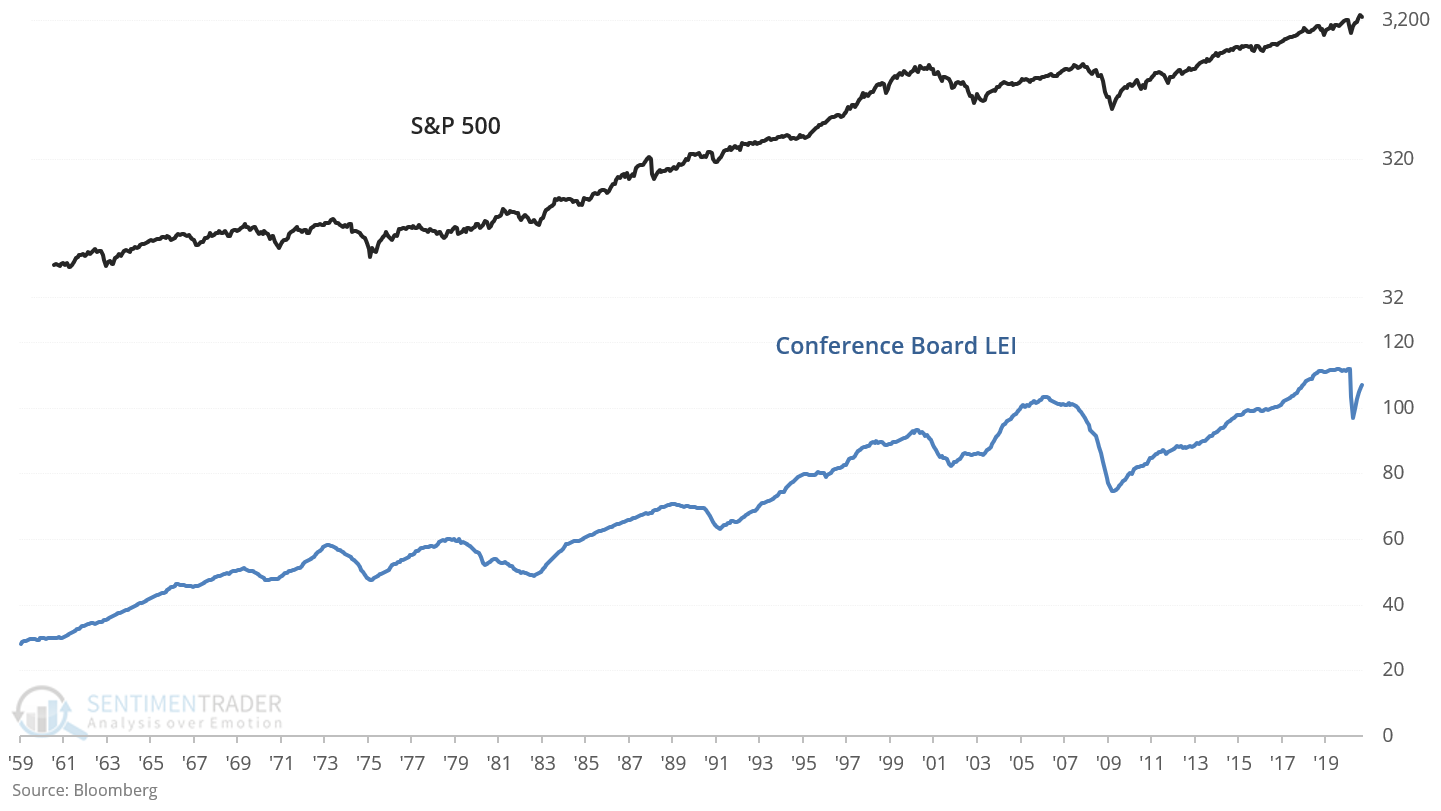

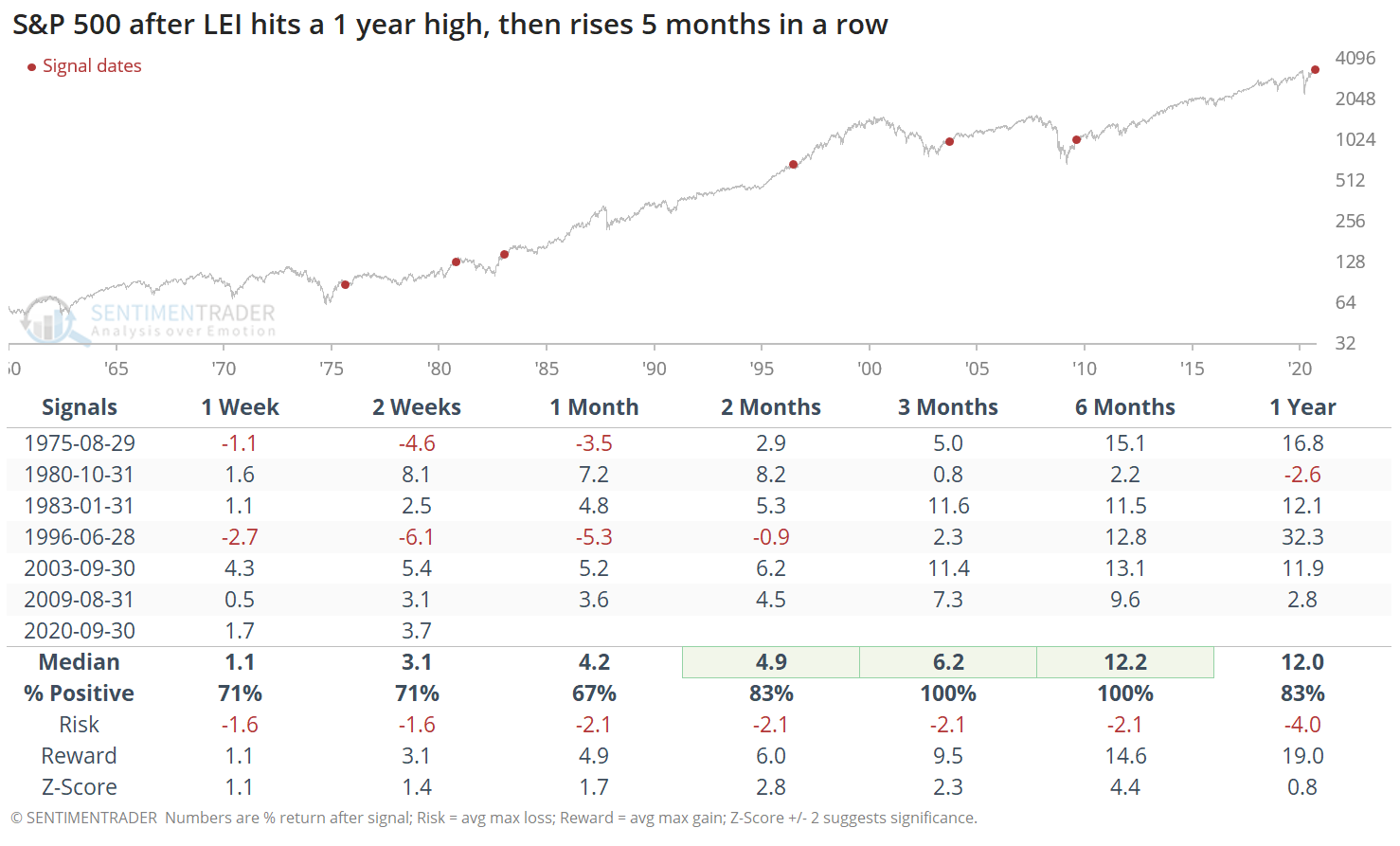

The Conference Board LEI continues to climb as the U.S. economy recovers. The LEI is up 5 months in a row after falling to a multi-year row:

When this happened in the past, the S&P 500 usually posted strong gains over the next 6 months:

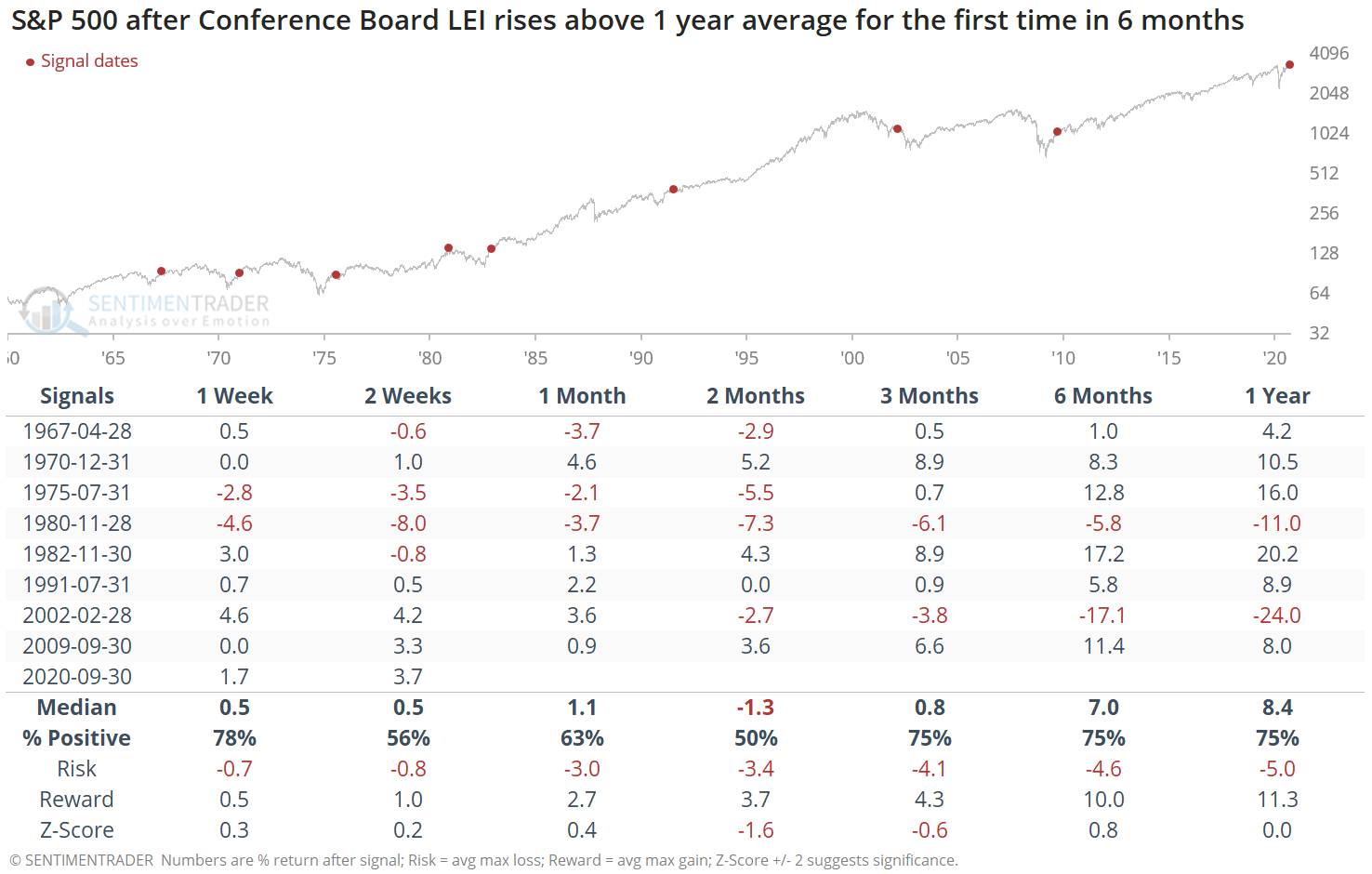

Looking at this from a difference way, the LEI has risen above its 12 month average for the first time in half a year. When this happened in the past, the S&P 500's forward returns over the next 6 months were still slightly more bullish than random:

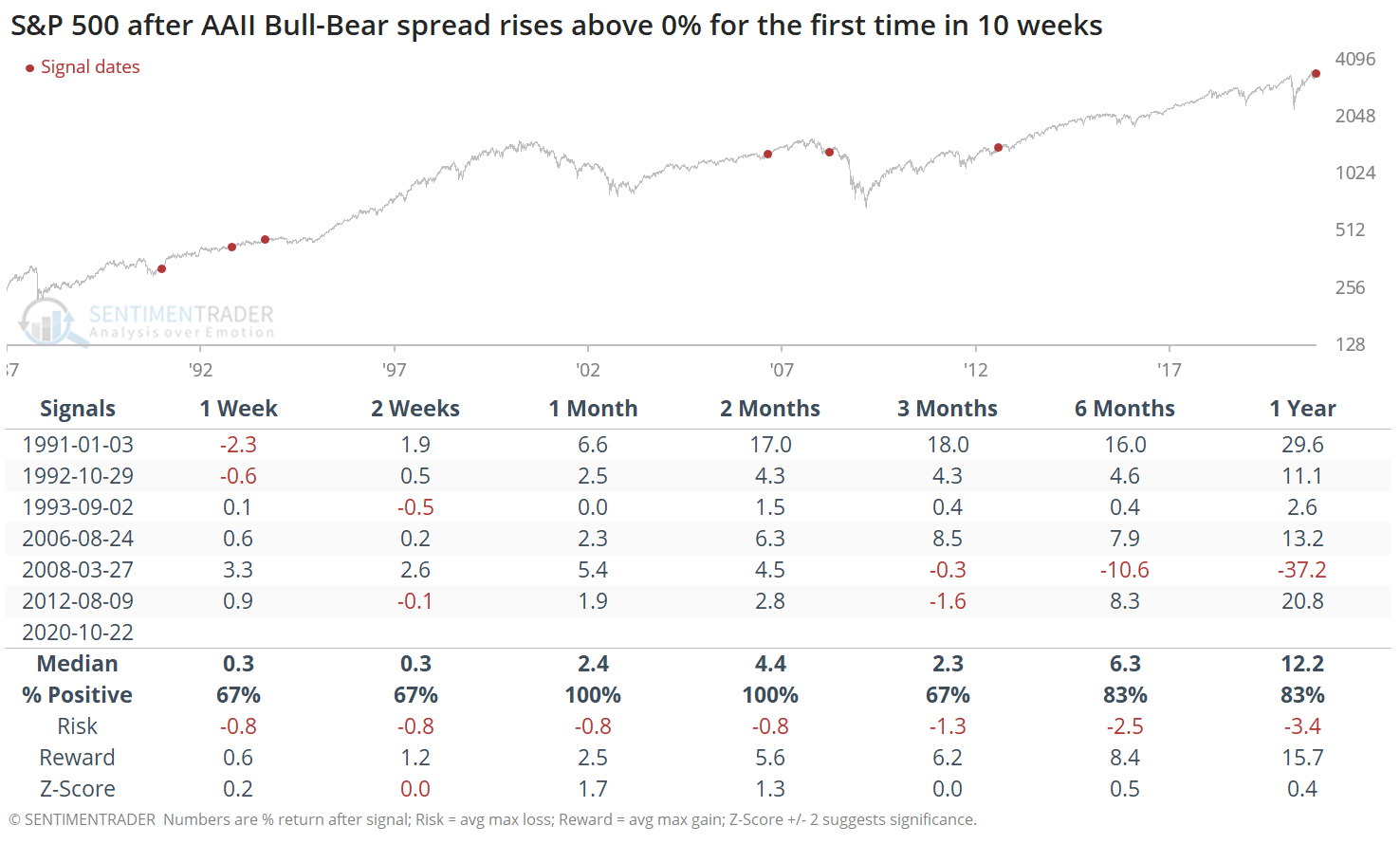

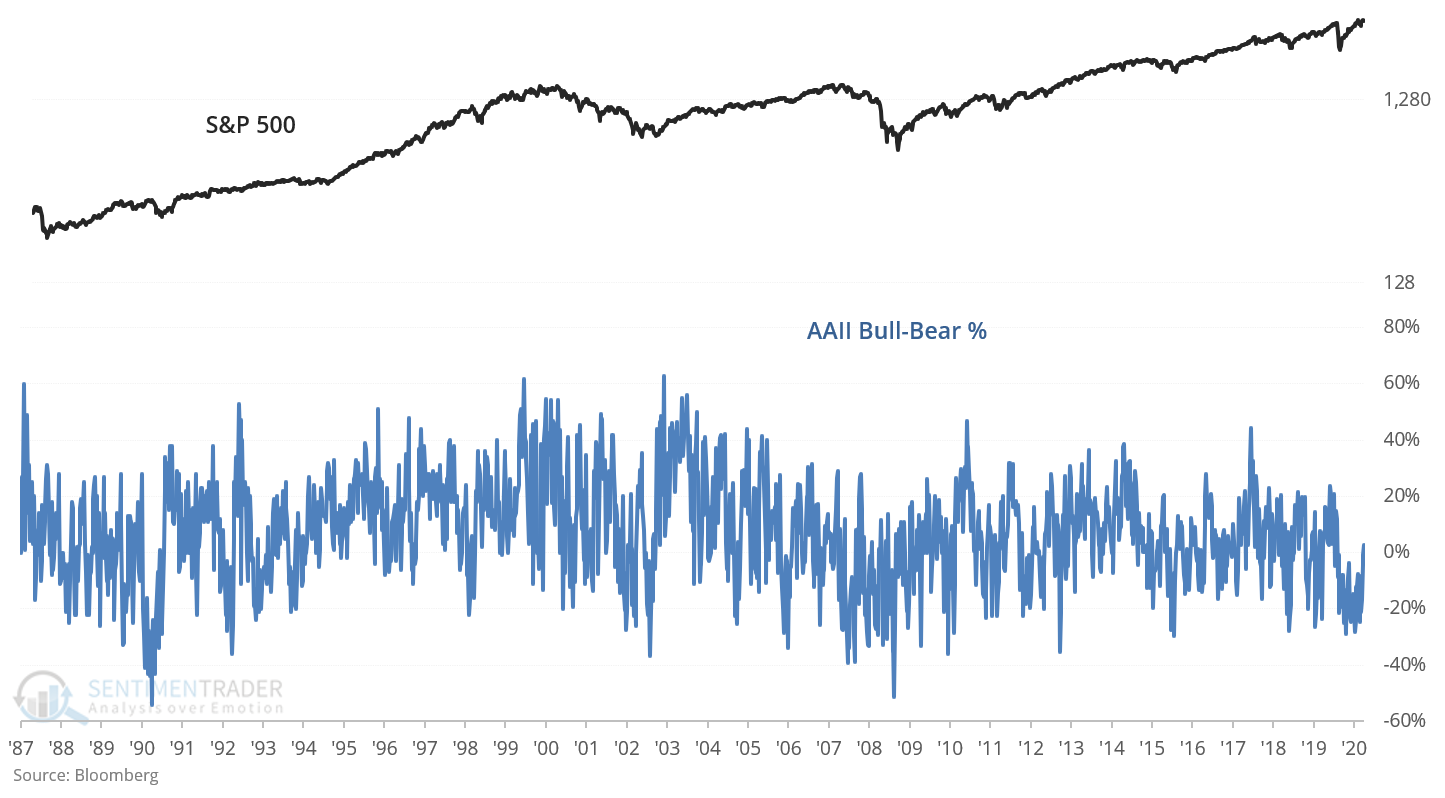

As the folks at Bespoke noted, the AAII Bull-Bear ratio has risen above 0% (more bulls than bears) for the first time in months. AAII sentiment has been consistently more bearish than other sentiment indicators over the past half year:

When this happened in the past, the S&P 500 always rallied over the next 1-2 months: