Retail Traders Storm Back As Key Reversals Spike

Retail rebound

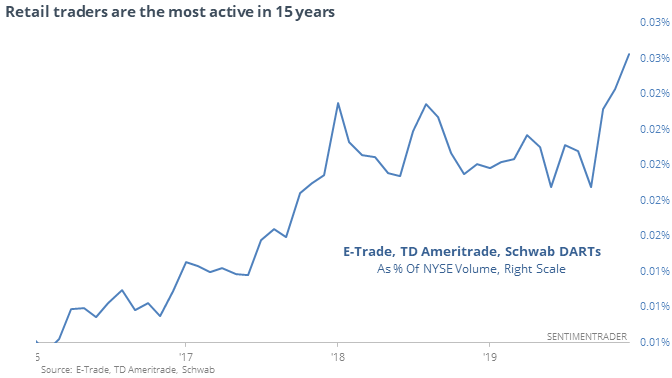

With a combination of no commissions and a runaway market, retail traders haven’t been this active in 15 years. Brokerages with a heavy retail customer base have seen trading activity skyrocket relative to overall market volume.

The introduction of commission-free trading throws a big wrench into this data, because when something is free, people use more of it, and it will become more difficult for the brokers to define what exactly it means for a trade to generate revenue. But activity spikes like this have not been positive for stocks.

Key reversals

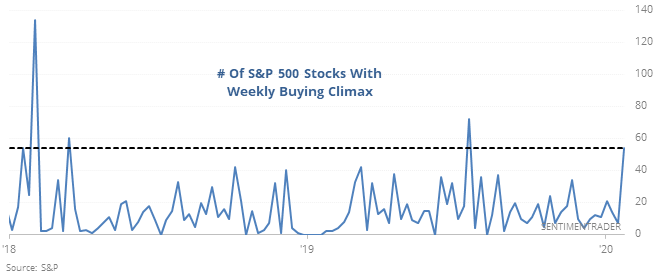

Last week, there was a jump in the number of stocks within the S&P 500 that reached a 52-week high then reversed to close below the prior week’s close. More than 10% of stocks triggered one of these buying climaxes, the 2nd-most in almost 2 years.

Over the past 25 years, any week with more than 50 buying climaxes saw an annualized forward return of -3.3% in the S&P 500, compared to nearly +23% after a week with no climaxes.

This is an abridged version of our recent reports and notes. For immediate access with no obligation, sign up for a 30-day free trial now.

We also looked at:

- Performance in various markets after recent viral outbreaks

- The Dow has given up its 2020 gains