Robinhood traders make big bets on a decline

At the end of May, we looked at user behavior among Robinhood account holders. The commission-free platform has become enormously popular during the past couple of months, ostensibly as an outlet for bored gamblers.

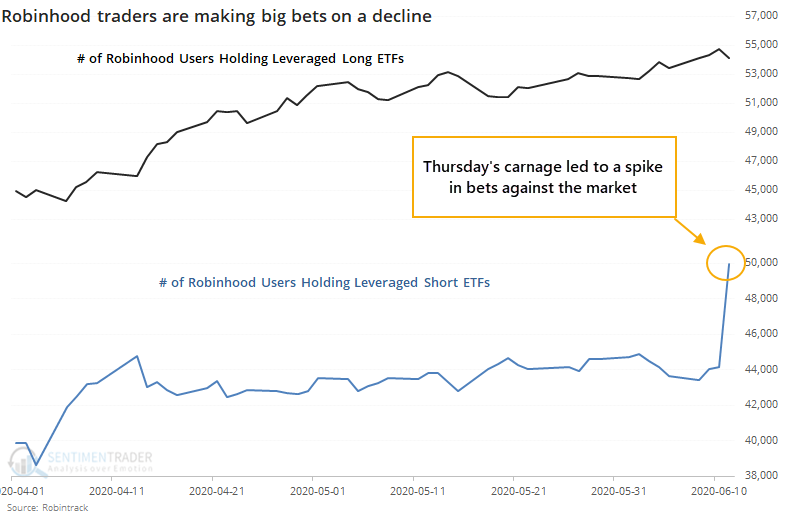

At the time, they were showing a modest preference for leveraged long ETFs, maybe a slight negative for stocks. If we check how they behaved during Thursday's rout, we can see a clear change in sentiment.

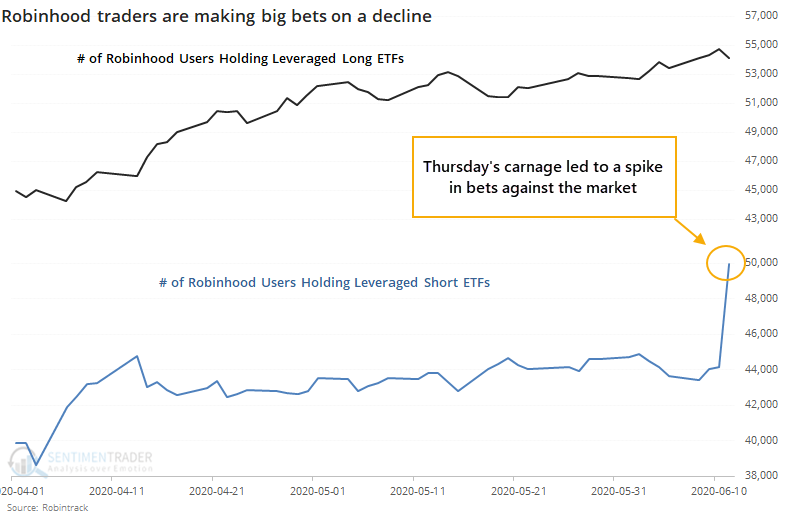

The data hasn't been around long, and Robinhood's popularity among fast-fingered traders has been a "thing" for an even shorter amount of time, but below we can see the one-day user growth in accounts holding the leveraged long ETFs minus the growth in users holding leveraged short ETFs.

There was a 1.2% drop in users holding the long ETFs and 13.1% rise in users holding the short ETFs, for a net difference of more than 14%, among the largest in two years.

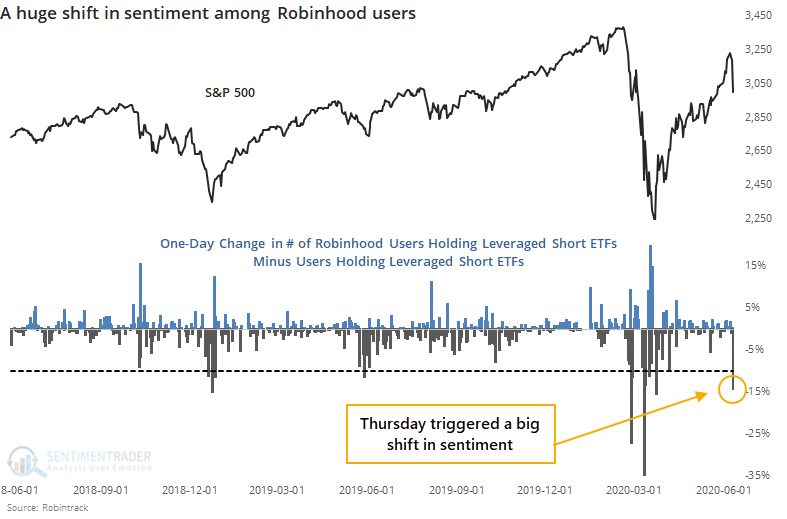

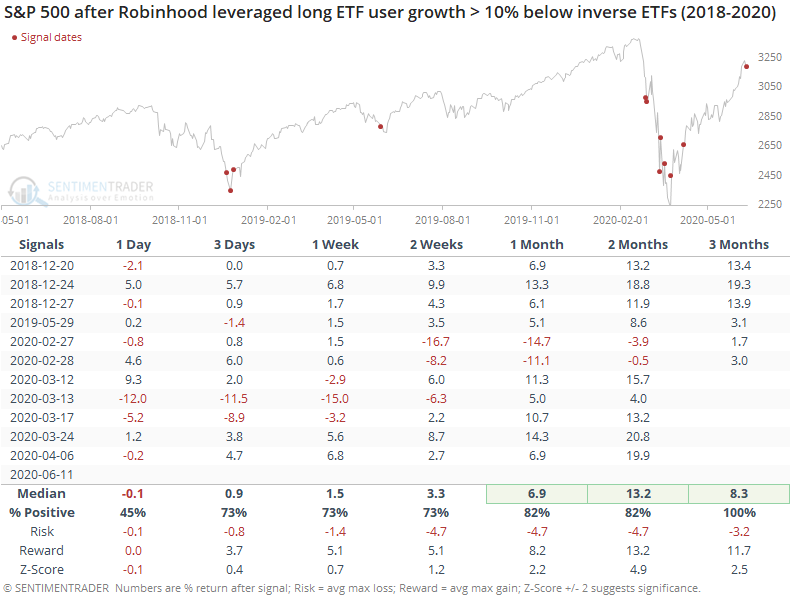

Below we can see the S&P 500's shorter-term returns following any day with at least 10% more growth in short bets vs long bets.

It's not a shocker that this happened during the most volatile stretches in recent years. It was an excellent bottoming signal in 2018 and 2019, but triggered very early in March of this year. Even so, the 2-3 month returns were solid.

Maybe Robinhood will stick around and this can develop into a reliable indicator of retail sentiment. More likely, volatility will pick up, users will move on to their regular jobs and sports betting, and interest in the platform will wane. As it stands, it's a decent reflection of rapidly changing sentiment, and at the moment it suggests that Thursday's panic might be enough to be a decent positive sign over the medium-term.