Russell 2000 is the first to lose its long-term trend

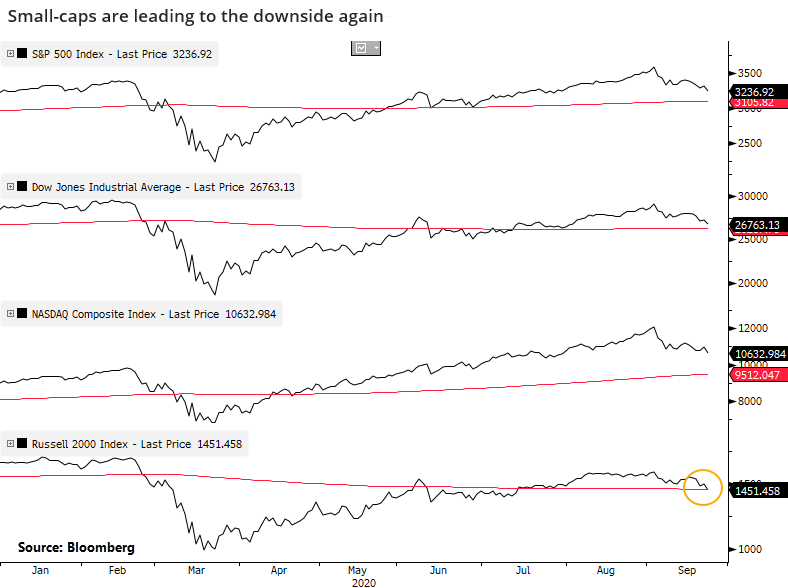

When markets started to crack in February, it was smaller-cap stocks leading to the downside.

That has to bring up some bad memories because it's happening again. The Russell 2000 is the first of the "big four" indexes to fall below its 200-day moving average.

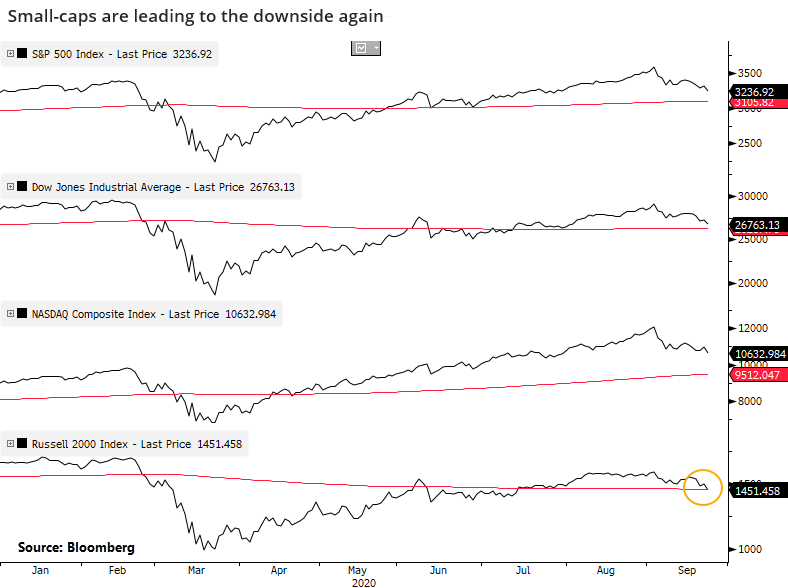

When it led to the downside, its shorter-term returns were poor. The table below shows the Russell 2000's returns when all four indexes had been above their respective 200-day moving averages for at least 30 days, and then the Russell was the first index to fall below.

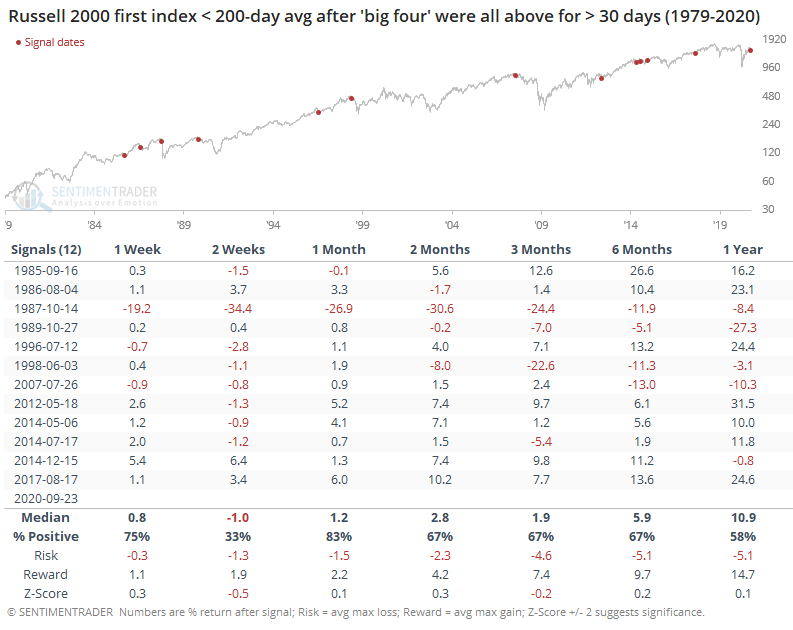

The other indexes held up better.

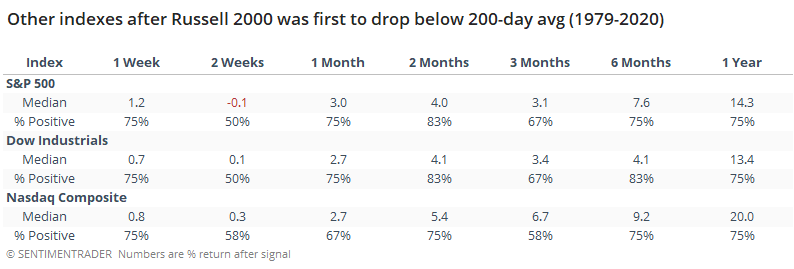

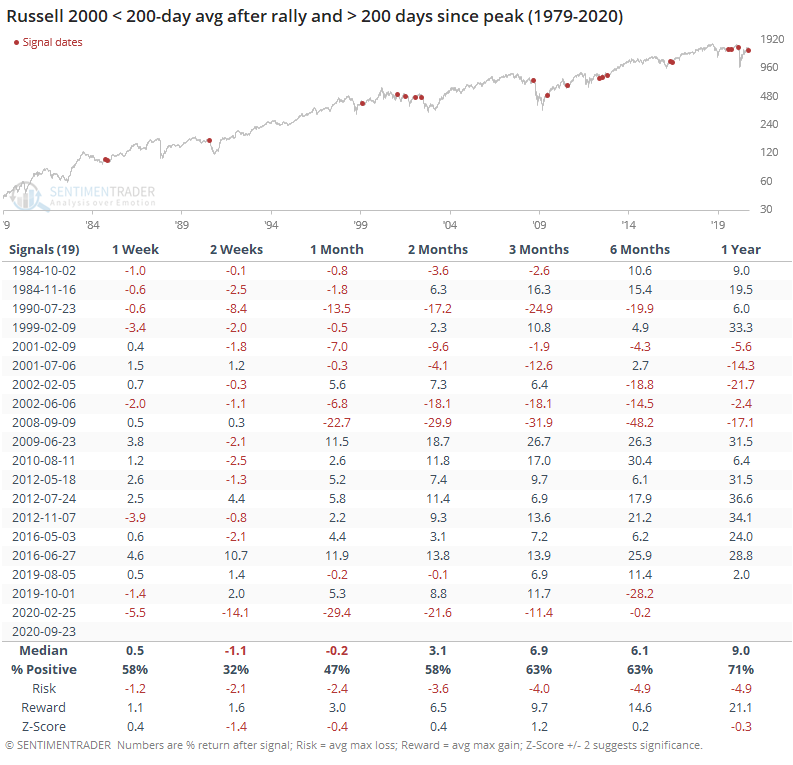

Focusing on the Russell alone, it's been more than 500 days since that index peaked in 2018. So the July-September period when it was hovering above its 200-day average was counter to the long-term trend it's been in.

Below, we can see the index's returns when it had been at least 200 days since a multi-year peak, and then it fell below its 200-day average after having been above it for between 10 - 100 days. In other words, the end to a short- to medium-term rally within a longer-term downtrend.

Again, fairly weak for the Russell in the shorter-term. Much of the risk over the next few months was focused on the first few weeks. Based on these two looks at troubles among smaller company shares, it's a concern in the shorter-term, but not much beyond that.