Russell's Band Bounce And Lack Of German Confidence

This is an abridged version of our Daily Report.

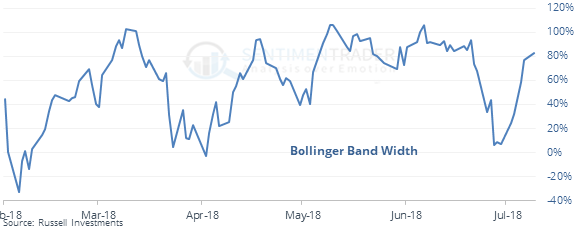

Russell band bounce

The small-cap Russell 2000 has bounced from its lower Bollinger Band to its upper in just a week’s time.

That kind of rebound has preceded impressive gains over the next six months.

German vote of no confidence

A German economic poll shows the least optimism in more than 5 years. Other times the survey fell so low then recovered, the DAX powered higher.

Fourth day of gains is the smallest

The S&P 500 futures gained more than 0.75% three days in a row, then added a gain of less than 0.5% on Tuesday. That has happened 9 other times since 1982, leading to a positive return over the next 30 days only 1 time.

Mas optimismo

In the May 15 report, we saw how extremely low optimism had become on the Mexico fund, EWW. It continued to drop into June but has since more than made up the losses, and the 5-day average of the Optimism Index is now 88, the highest since 2009.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |