Seasonality And Sentiment Screen

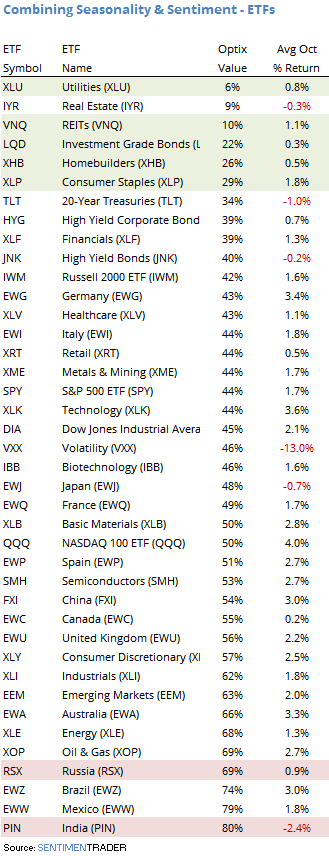

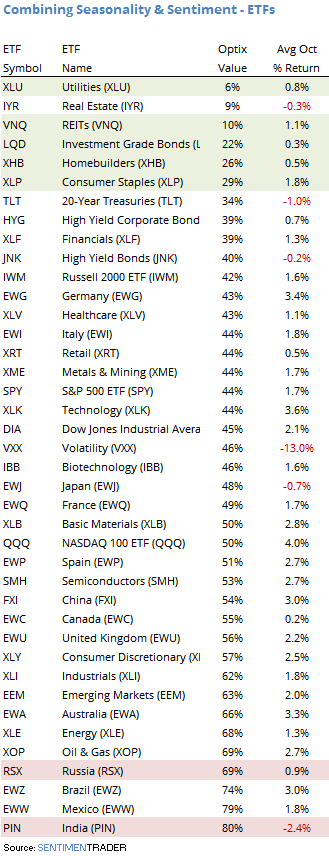

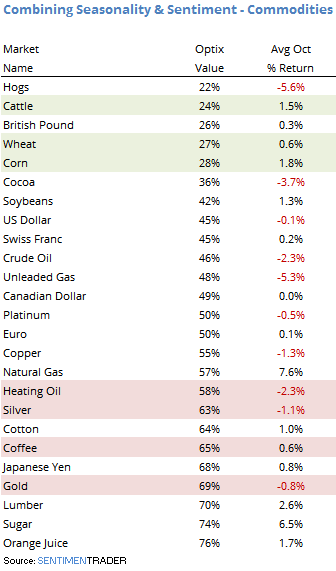

Near the beginning of each month, we try to run a Seasonality and Sentiment screen, which takes a look at the commodities and ETFs we track that have a tendency to rise (or fall) this month as well have a current Optimism Index reading that's near an extreme.

Among ETFs, it's clear that rate-sensitive issues have taken a hit to sentiment. The Optix is only 6% on utilities (XLU), and is also low on a few other defensive groups which have tended to show positive average returns in October.

At the other end of the spectrum, India (PIN) has tended to decline in October with a -2.4% average return, yet it's Optix is high at 80%. Russia is also a getting extended during a period when it doesn't show the best average return.

Among commodities, cattle and hogs are showing pessimism, but this is a seasonally weak period for hogs. Not so much for cattle, however. Wheat and corn also have low optimism in a seasonally strong window.

The precious metals, getting hit today, kind of deserved it. Both silver and gold are showing relatively high optimism during a seasonal weak spot.

To see current charts for each of them, follow these links:

- ETF Optimism Indexes

- ETF Seasonality

- Commodity Optimism Indexes (select "Optix" from the Group drop-down box)

- Commodity Seasonality