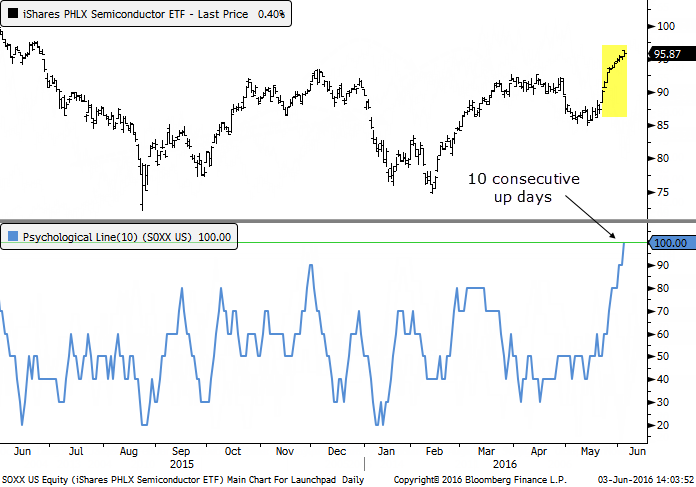

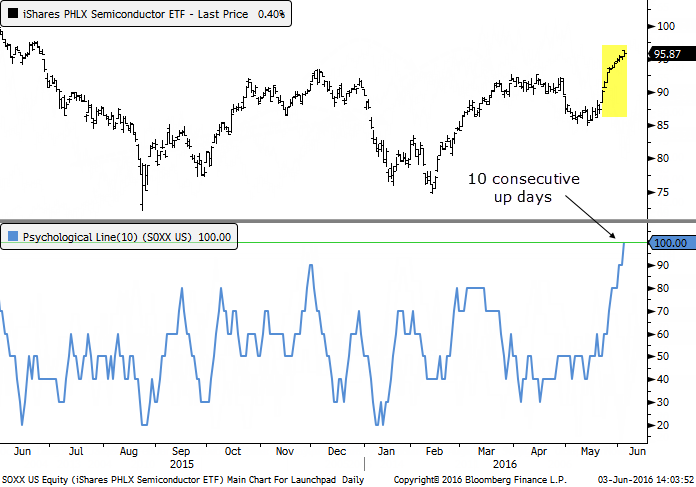

Semis Going For 10th Up Day

The SOXX Semiconductor ETF has been a leader over the past couple of weeks, but it's looking tired today as it has traded to its highest price since last June but has sold off from a large opening gap up. More on that in a bit.

If it can hold on and close higher today, it'll be the 10th consecutive positive close, a rare feat.

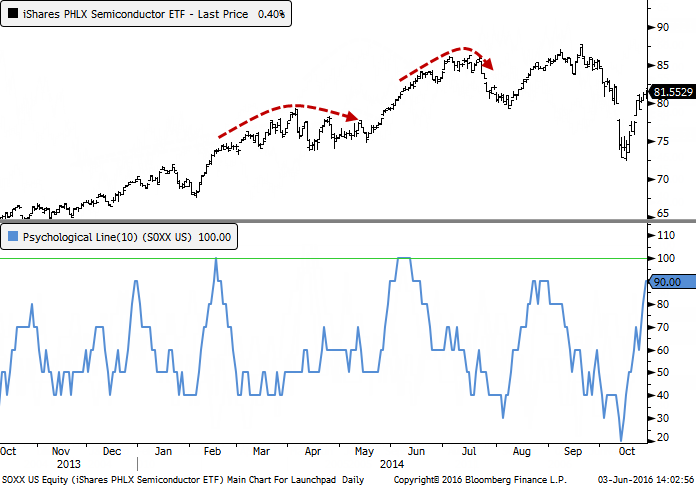

Since its inception in 2001, SOXX has managed 10 consecutive positive closes only four other times. The all led to rounding peaks over the next several months, with buyers persisting in the short-term but not able to hold the gains in the medium-term.

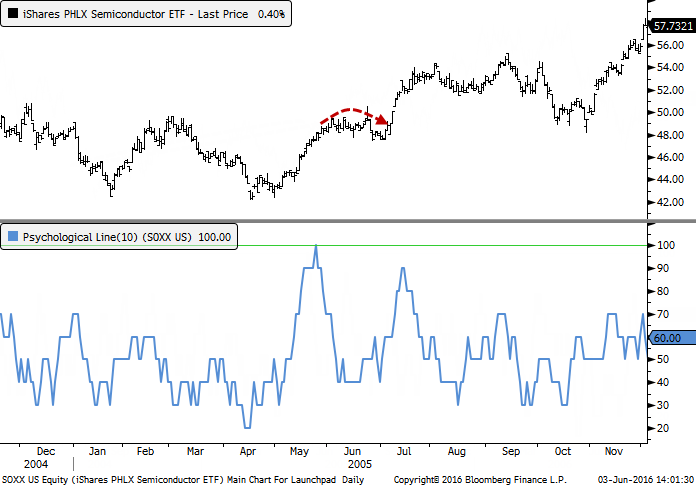

The first instance was in 2005. It gained over the next week or so, then gave those gains back during the next month.

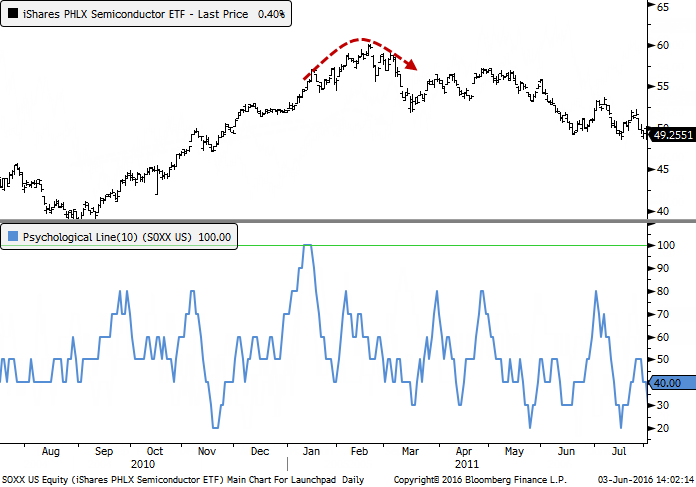

Next was early 2011. After an initial short-term selloff, buyers came in again and took it to higher highs over the next month. But once again, those gains were given back during a subsequent selloff.

The last two occurred in 2014. Both times, the SOXX rose for about the next 30 days, but in the month after that, the gains evaporated (barely, in the case of the one earlier in the year).

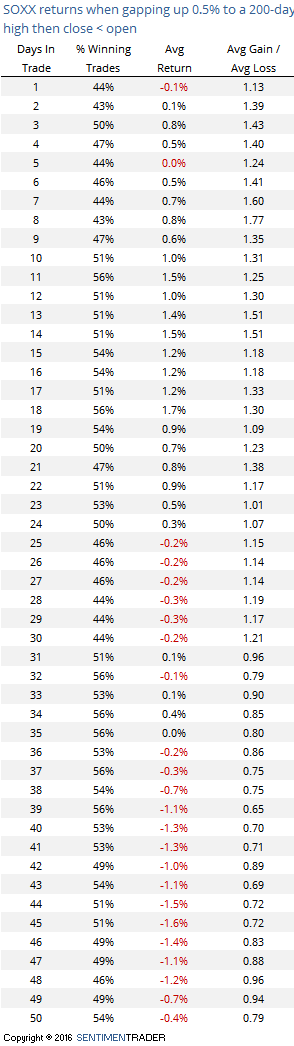

Now for the reversal. Since its inception, the SOXX has tended to fall back in the days and weeks following similar instances when it gapped up to a multi-month high but closed below the open.

For those looking to get into the sector, it looks riskier than usual, due to the reversal and the tendency to give back short-term gains when it had already gained for 10 days in a row.