Shanghai Selling And Seasonality

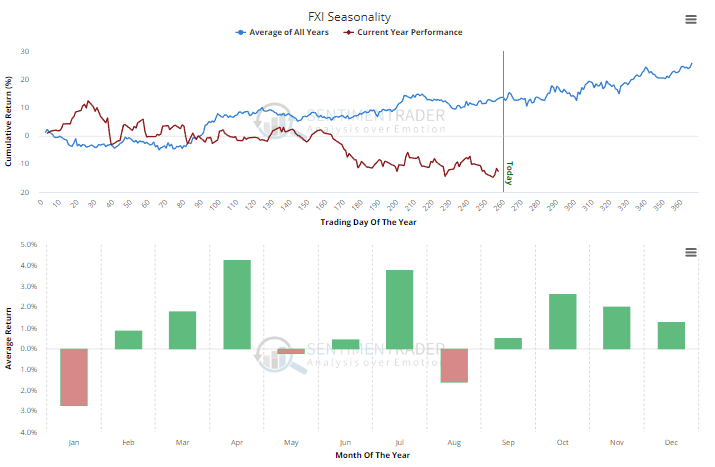

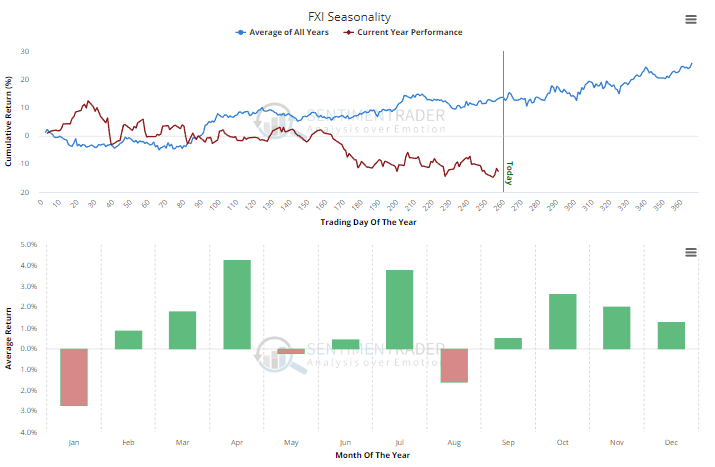

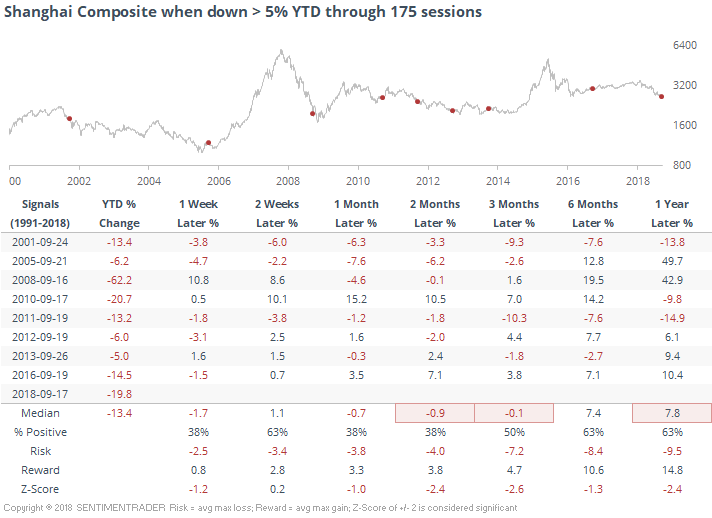

Stocks in China have dropped again, with the Shanghai Composite now off around 20% year-to-date. Going back to its inception in 1990, this is its 3rd-largest YTD decline through 175 sessions of the year. Given that seasonality in the main Chinese equity ETF, FXI, is turning positive, let's take a look at similar declines.

Below, we can see the Shanghai's returns following a 5% or larger year-to-date decline through 175 sessions. Returns were mixed, but mostly weak, especially over the next 1-2 months.

The two years with larger YTD losses, 2008 and 2010, led to excellent rebounds during the next 6 months, so that's a little something. But other years with larger than 10% YTD losses had mixed results.

Overall, not a lot to go on, and the evidence for a potential seasonal-and-oversold rebound is scant.