Short covering in the dollar as the trend turns

There is a broad spectrum of investors looking for the dollar to rally, which should help trigger a pullback in stocks, metals, and commodities. The trouble is, many of their arguments were the same ones used in September.

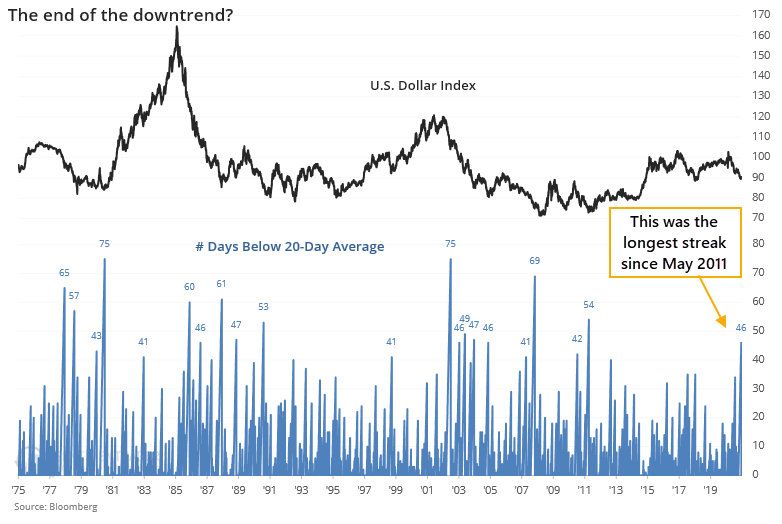

On the surface, the arguments have a little bit of support. The buck closed above its 20-day moving average for the first time in months on Monday. That ended a streak of 46 days below that average, the longest in nearly a decade.

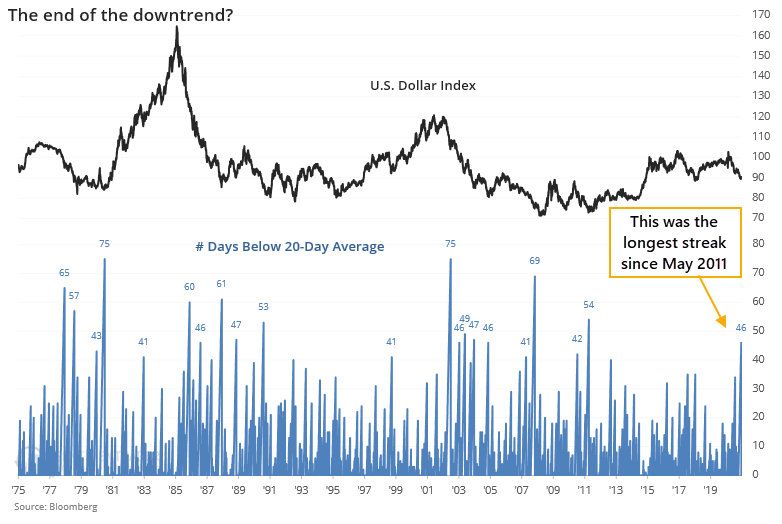

This is the kind of streak the dollar consistently underwent during structural bear markets, with only the last one in the sequence (sometimes) ending up leading to sustained gains. Out of the 17 times when it ended a long streak below its 20-day average, the dollar was higher 6 months later only 5 times.

There is an argument being made now that the dollar will surely rally because there is a massive short base, and the recent spike will cause those investors to cover, driving the dollar still higher. But that was the case in September, too, and as we saw at the time, that kind of argument hasn't been very successful.

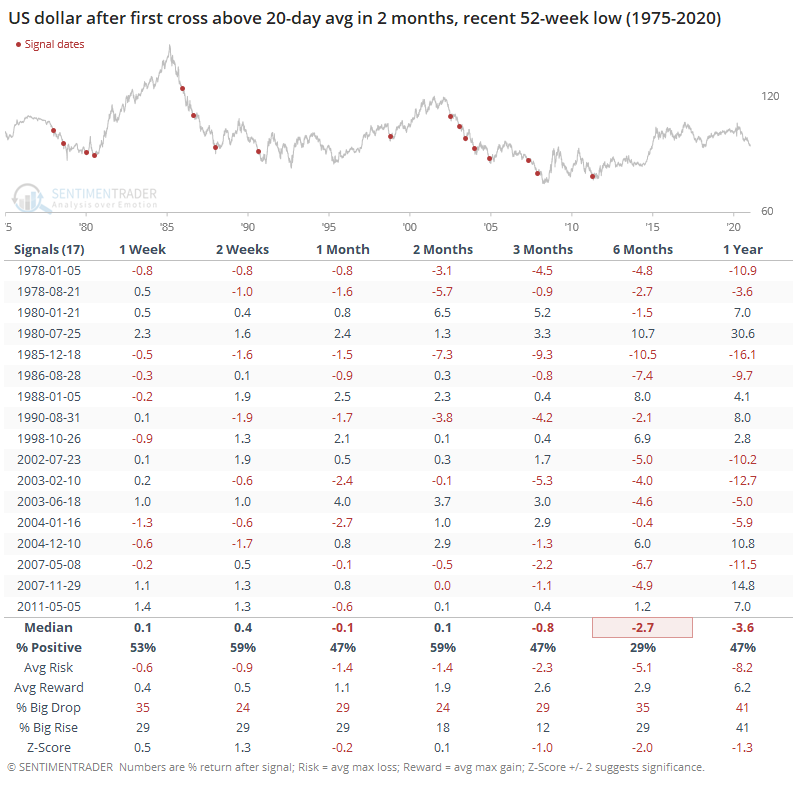

It's a tempting argument, with large speculators holding nearly 40% of dollar futures open interest net short, one of their largest positions ever. On a chart, it seems like the extremes tend to line up with turns in the dollar, but charts can be misleading.

From the chart, we can see that the dollar's annualized return when speculators held more than 20% of open interest net short was -1.2%. Returns were significantly higher when speculators were net long a large share of open interest. This is the opposite of what we see in most other contracts.

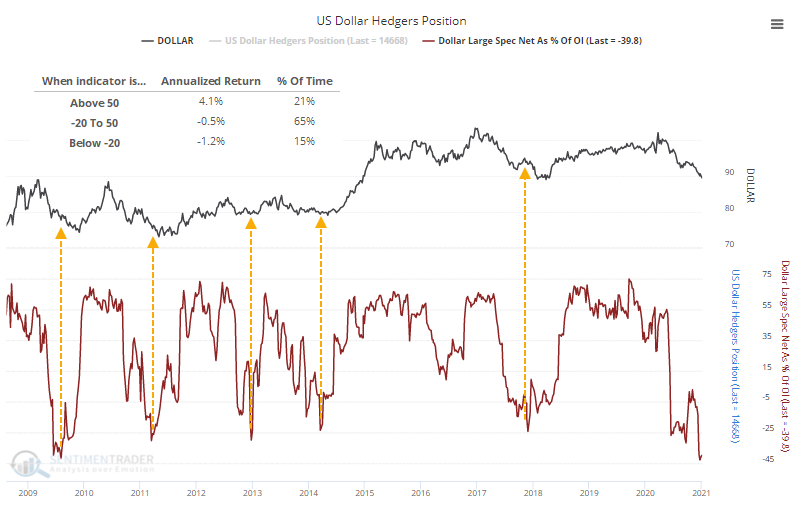

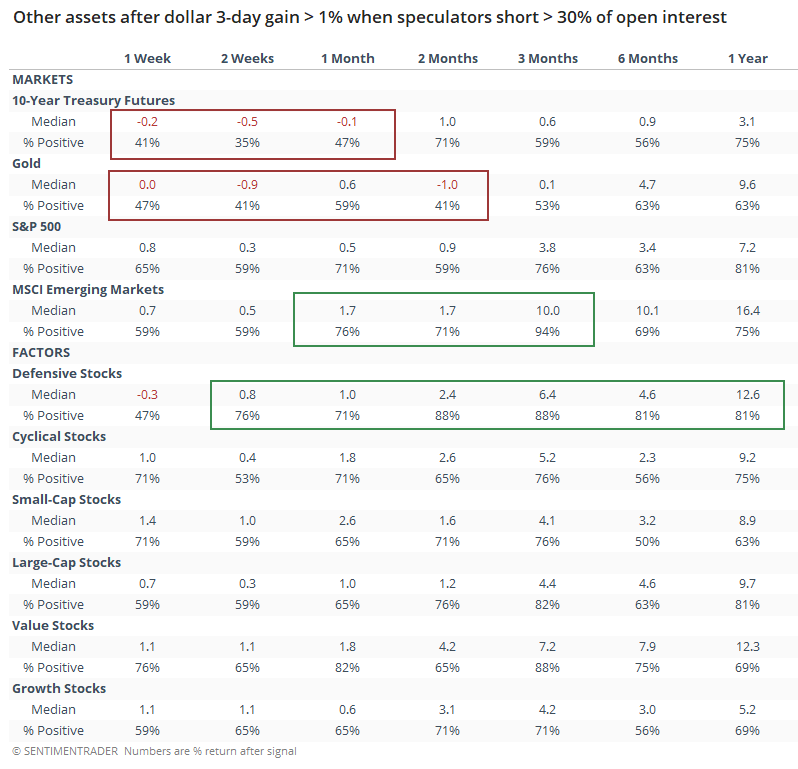

Let's go with the argument that the dollar's recent jump is going to ignite a massive short-covering rally. The table below shows all 3-day rallies of more than1% when speculators were holding at least 30% of dollar contracts net short.

Again, this is the kind of behavior that has triggered during structural bear markets, not bull markets. While the buck did manage to add to its gains over the short-term most of the time, those gains tended to prove fleeting.

For what it's worth, it was a better sign for emerging market stocks, which were higher 94% of the time over the next 3 months. This is not what dollar bulls would expect.

Every time we've looked at rallies, or potential inflection points due to extremes, over the past year, the evidence has suggested that failure was more likely than success. Extremes in the dollar have not been good indications of positive forward returns, nor have short-term rallies. There is still little hard evidence that the nascent rally in the buck is likely the beginning of a sustained advance.