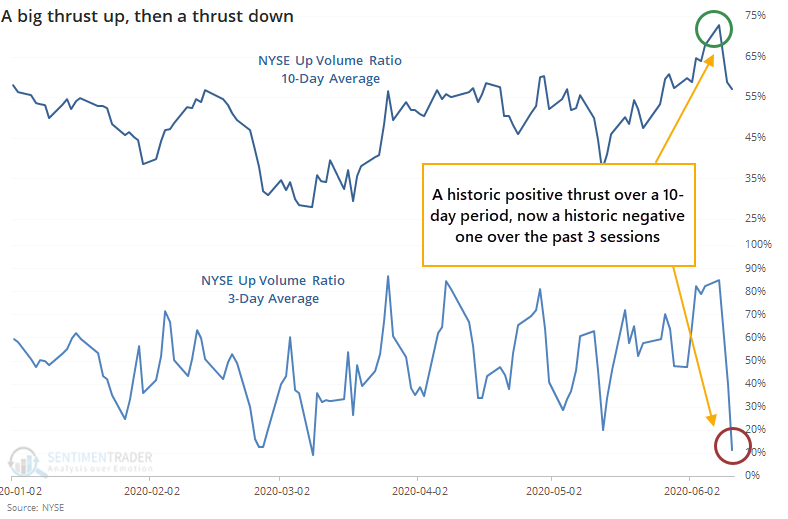

Short-term breadth is as horrid as longer-term is impressive

Some of the most compelling aspects about stocks since late March, and which have continued recently, are the breadth thrusts and recoveries have an almost unblemished record at preceding higher prices over a 6-12 month time frame.

That seems like it's in jeopardy now. Over the past few days, there has been a tremendous thrust down. It's very rare to see such extremes in close proximity - unprecedented, really. Welcome to 2020.

The worry is that selling pressure like this tends to cancel out any potential positives from the positive thrust. To check, below we can see every time since 1962 when the 10-day average of the NYSE Up Volume Ratio was above 65% then the 3-day average plunged below 15%.

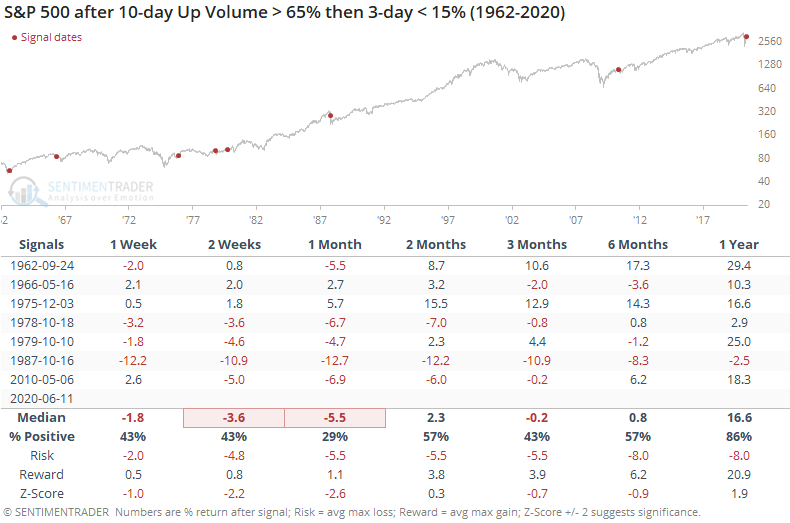

Like a lot of things over the past few months, there is a small sample size. Of the 7 other times we've seen an up/down thrust like this, 6 of them traded lower over the next 1-3 months. Only December 1975 managed to turn higher immediately and never look back.

By a year later, all but one of them were positive, and that exception was small.

This is another suggestion that the short- to medium-term could (should) be rocky, but these kinds of developments are also typically seen during long-term recoveries.