Small cap stocks near historic volatility extreme

Large-cap stocks, defined by the S&P 500, jumped to a record high on Friday. Other parts of the market, including small-caps, have been dragging.

Small-caps have a major influence on breadth statistics, a big reason why the S&P was meandering near an all-time high on Monday, yet breadth metrics were the worst in history.

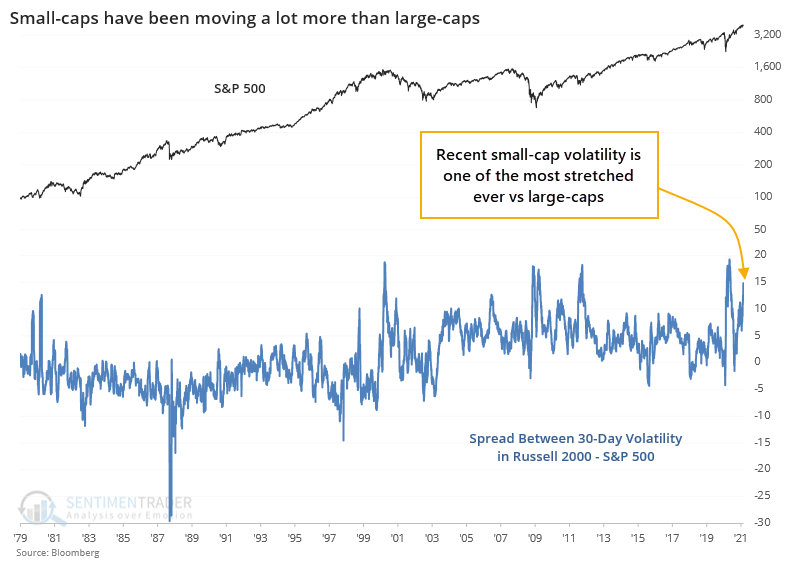

Monday's activity was further evidence that volatility in those small-caps has jumped in recent weeks, even as the broader market stays relatively calm. Over the past 30 days, historical volatility in the Russell 2000 is now about 15 points higher than that for the S&P 500, one of the widest spreads in 40 years.

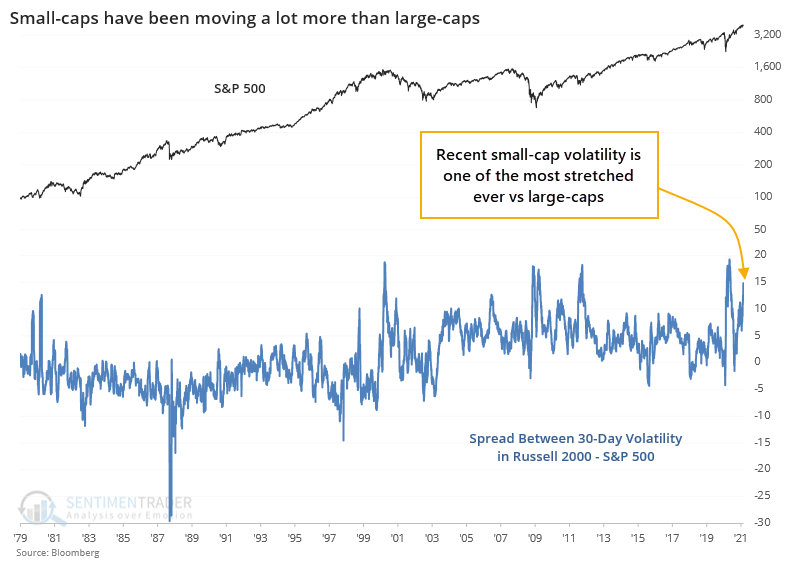

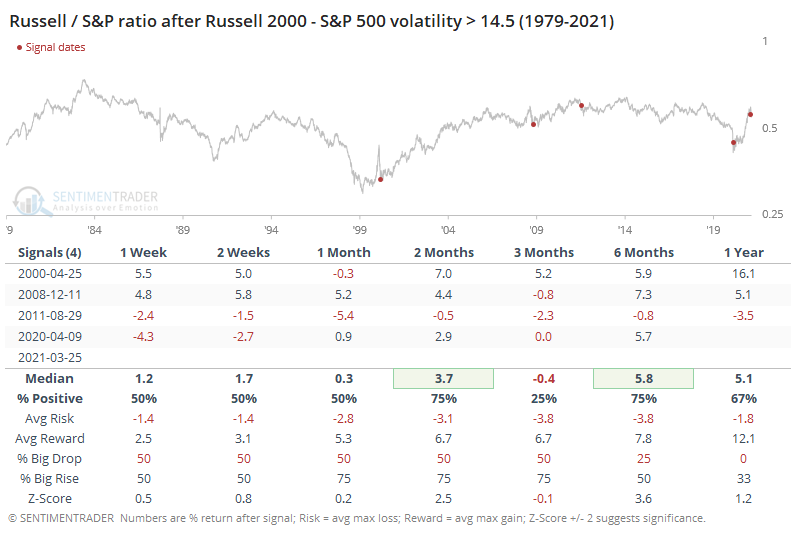

There aren't a whole lot of precedents for this kind of behavior since the inception of the Russell 2000 index. The handful of times that volatility between the two indexes reached the current level of extreme, the S&P didn't do so great going forward, excepting the last occurrence in the aftermath of the pandemic.

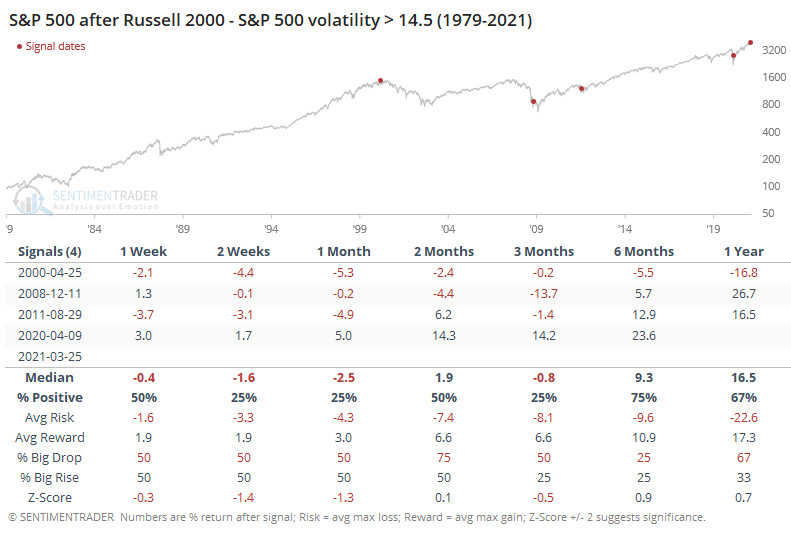

The Russell also showed mixed returns over the shorter-term, but at least by 6 months later showed a positive return each time.

This means that the ratio of the Russell to S&P tended to rise as smaller stocks outperformed in the wake of their higher volatility. But it was a volatile ride.

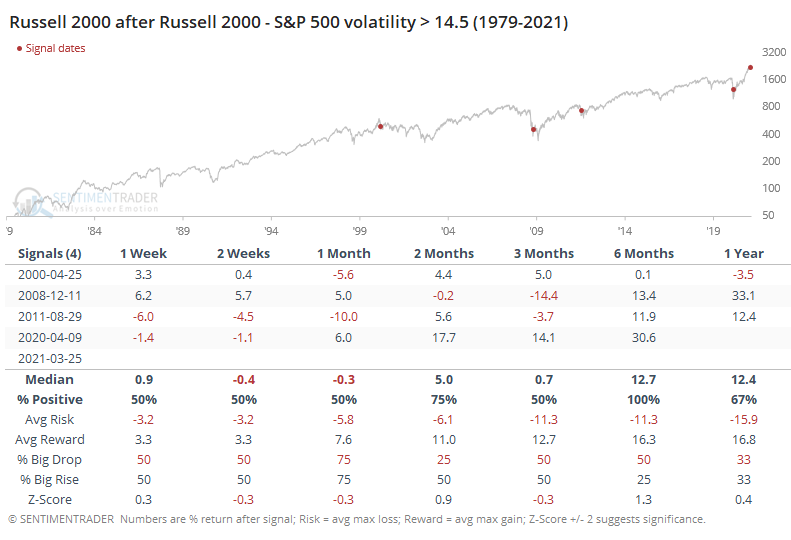

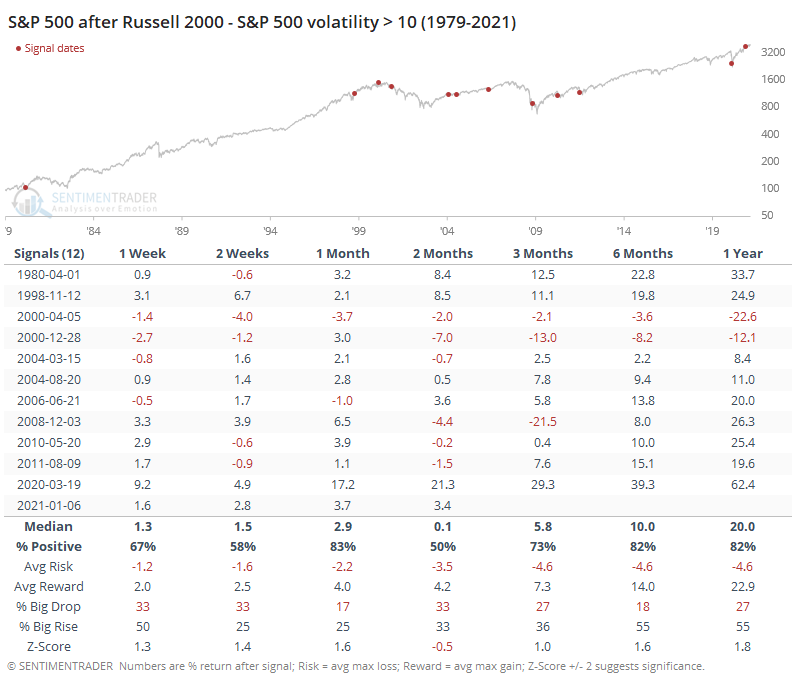

To get a larger sample size, we have to lessen the threshold to a spread of 10 points. That gives us more history to work with to see if there's any solid conclusion here, but it also means that it's less applicable since the lesser extreme triggered nearly 3 months ago.

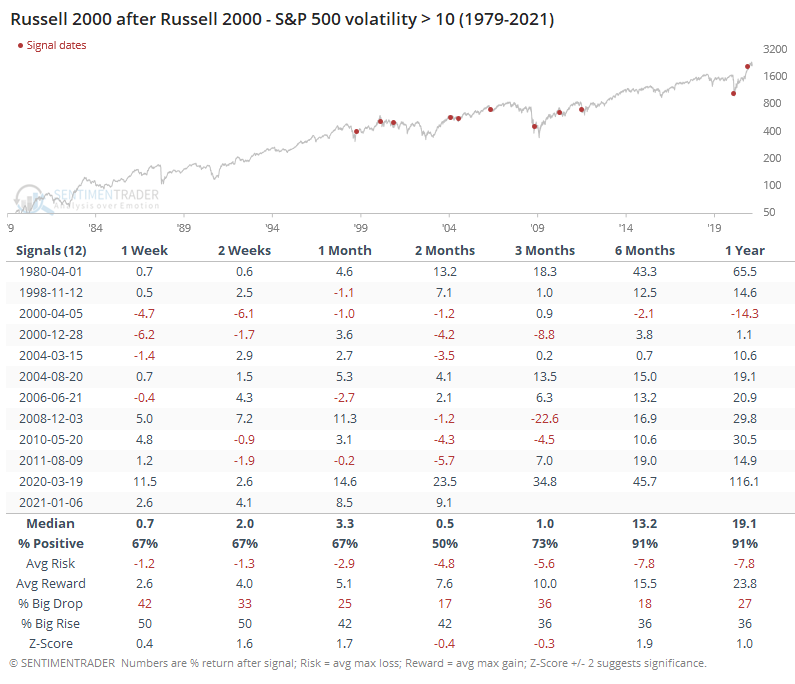

Again, the Russell tended to do better.

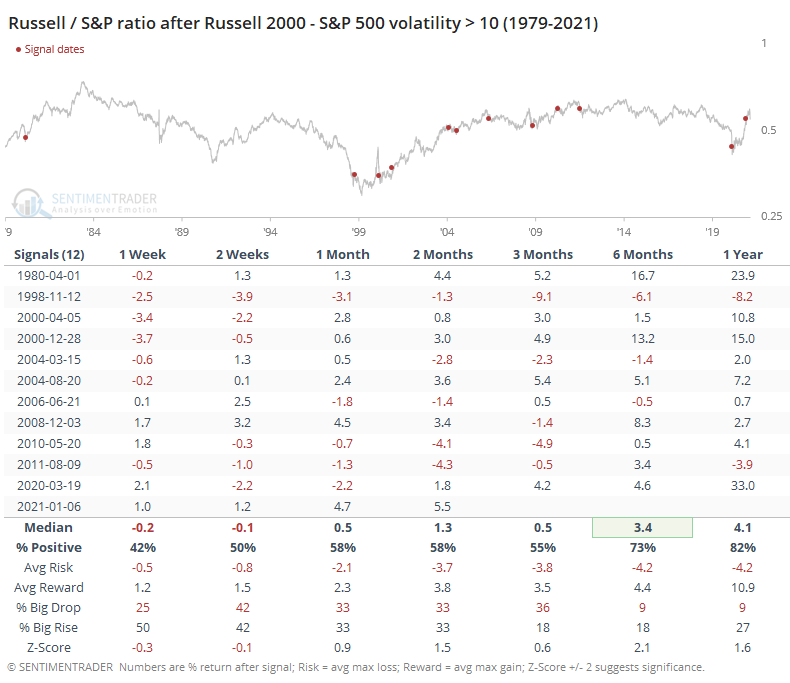

The ratio of the Russell to S&P was still volatile, but over the next 6 months, the disparity in favor of smaller stocks was especially wide.

As markets hit new highs and then become volatile, there is a tendency to think that it necessarily suggests a trend change. If overall levels of current and implied volatility start to persistently march higher, then the likelihood of a sustained decline becomes more probable. Currently, the simple fact that small-caps have been swinging so much more than large-caps isn't giving us too much of a hint that that's likely just yet, though.