Small Caps Can't Keep Up with S&P's Torrid Pace

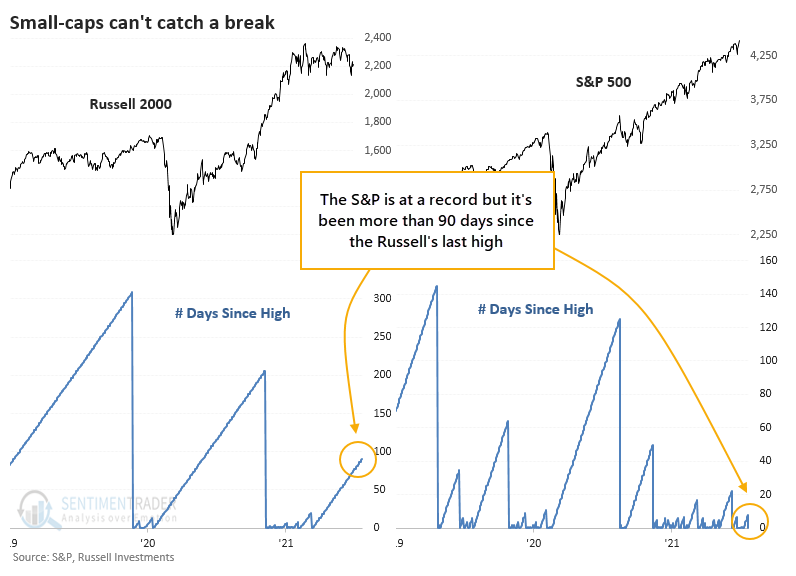

It was a historically persistent and consistent rally for the S&P 500 in the first half of 2021, and things aren't changing much. After a blip on Monday, the index is right back to a record high.

For smaller stocks, it's been much more of a struggle. The Russell 2000 hasn't set a new high for more than 90 days now.

This is part of the reason why some breadth metrics have been struggling. Divergences like that do tend to precede trouble, but clearly, that's having no impact yet and hasn't for this entire year.

NOT A BAD SIGN FOR STOCKS

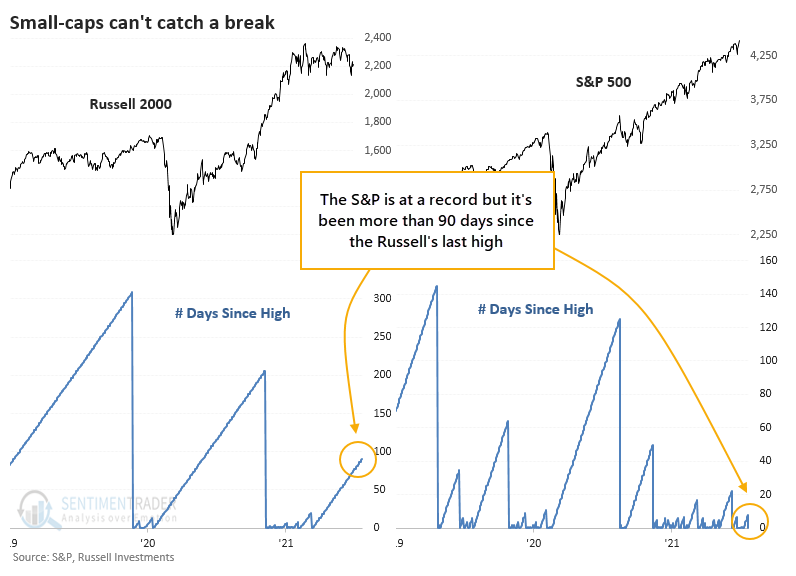

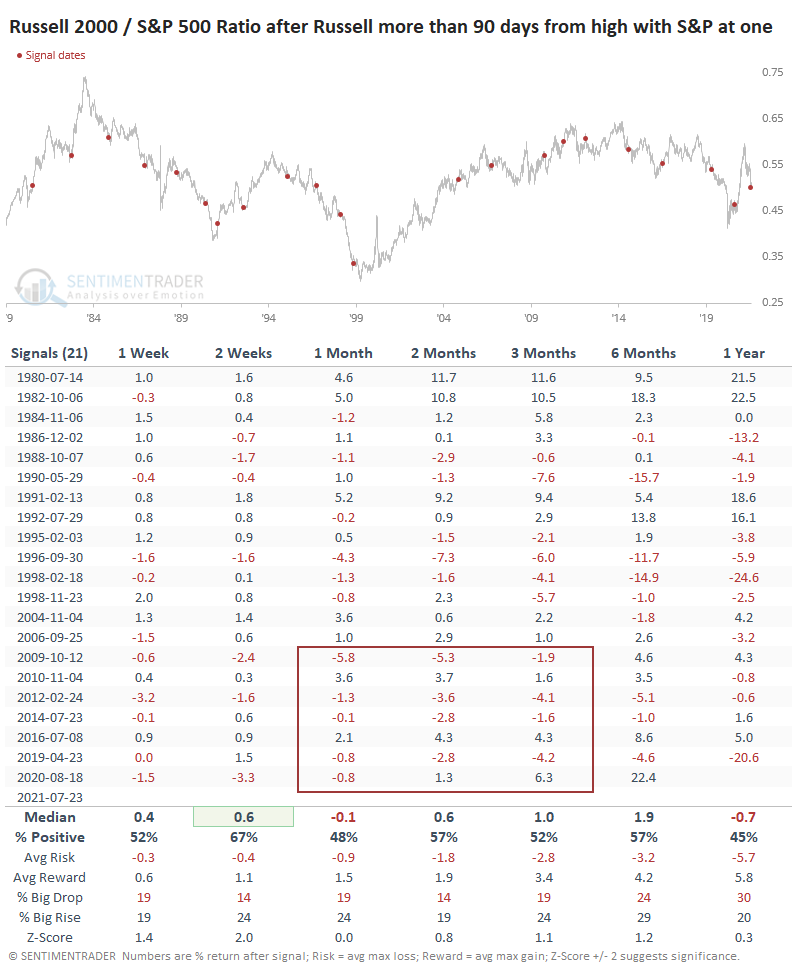

If we focus on the interplay of the two indexes and look for times when the S&P set a new high with the Russell not having done so for at least 90 days, it wasn't a bad sign at all.

Over the next six months, the S&P showed a positive return after 20 out of 21 signals, and the sole loser was erased in subsequent months. Over the next 6-12 months, the risk vs. reward was impressively skewed to the upside.

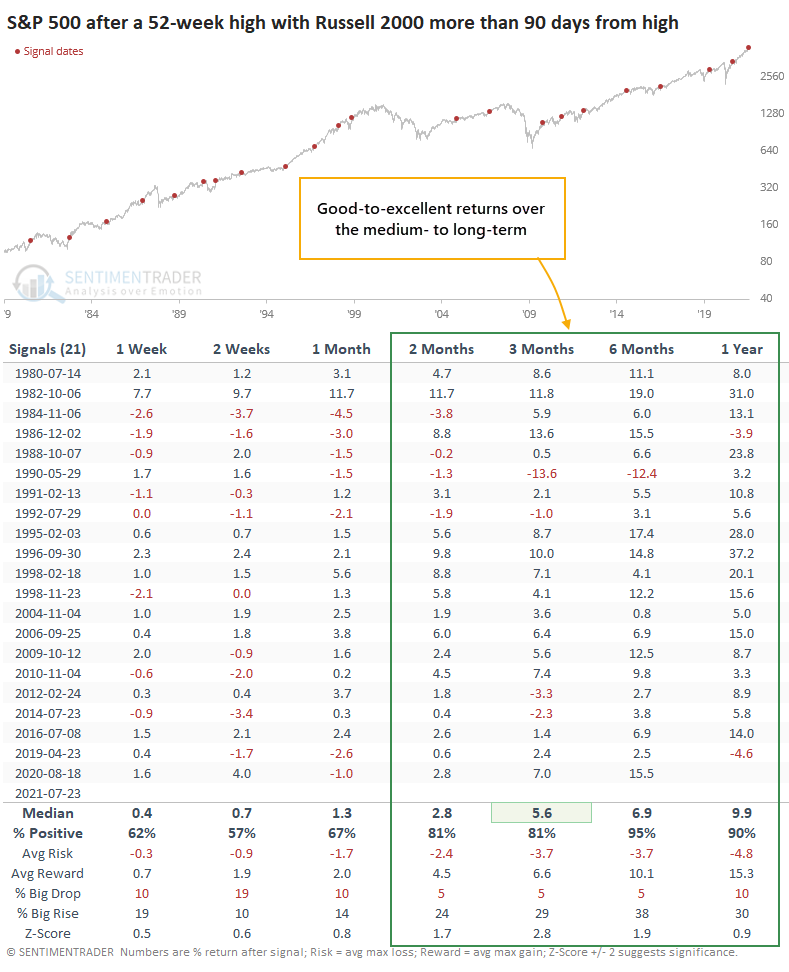

Even though it was lagging badly, the Russell tended to rebound going forward but not as consistently as the S&P. Because it's a more volatile index, its average returns tended to be higher, though.

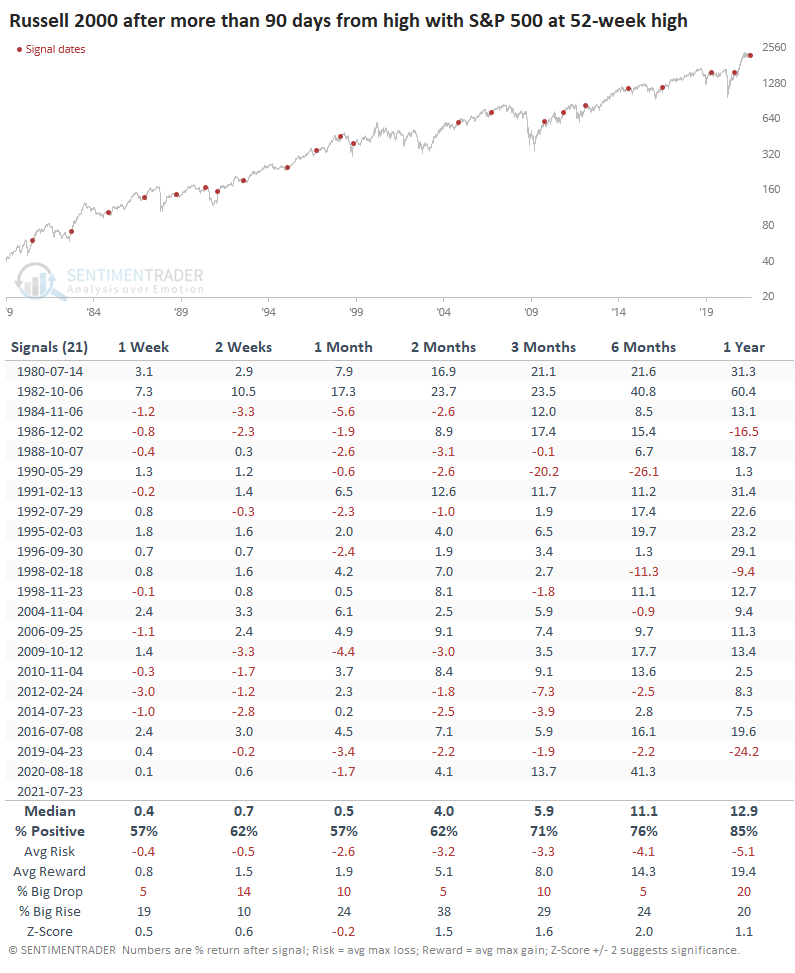

S&P VS. RUSSELL - A DRAW

Looking at the ratio between them, it was a mixed picture. Over the medium- to long-term, the Russell underperformed over a couple of time frames and outperformed slightly after a few others. Since the 2008 financial crisis, there was more of a tendency to underperform over the medium-term.

There is a frustratingly mixed picture with stocks right now. Sentiment is high (on most measures) but ebbing from earlier in the spring. Breadth has diverged negatively, and then we saw an impressive reversal of buying interest mid-week last week that never failed to lead to a rally. We very much favor a weight-of-the-evidence approach that incorporates work from different angles, and right now, that is nothing but a muddled mess.