Smart Money Buys In As Other Managers Sit Out

Smart money piles in

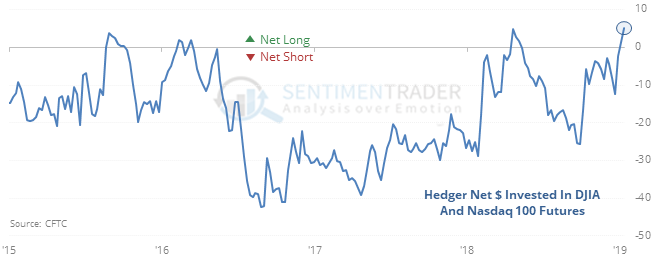

As delayed reports get released, we’re seeing that “smart money” hedgers were busy buying Nasdaq and DJIA futures in January. This is unusual since the market was rising, and it’s even more unusual how aggressive they were.

When they went net long those contracts since the financial crisis, the S&P rose in the months ahead every time.

Leaving the U.S.

A different kind of money manager that focuses more on longer-term fundamentals seems to not be seeing the same value that futures traders are. The monthly BofAML survey shows that fund managers are underweight the U.S. and heavily overweight emerging markets, which has tended to lead to an upswing in the ratio of SPY to EEM.

The Commitments of Traders report was released, covering positions through January 15

Due to the government shutdown, the CFTC is releasing this report twice per week until they are caught up. The 3-Year Min/Max Screen shows that through January 15 shows the multi-year extreme in Nasdaq futures, as well as the Nikkei and a couple others.

Back to optimism

Nearly 45% of our indicators are now showing excessive optimism, the most since January 2018. According to the Backtest Engine, readings above 43% led to an annualized return in the S&P 500 of -11.8% (those are next-day returns, annualized).

This post was an abridged version of our previous day's Daily Report. For full access, sign up for a 30-day free trial now.