Smart money insiders buy stocks and futures

The latest Commitments of Traders report showed that "smart money" hedgers have finally started doing some buying in stocks. Most other bond and commodity contracts saw minor retreats from extremes.

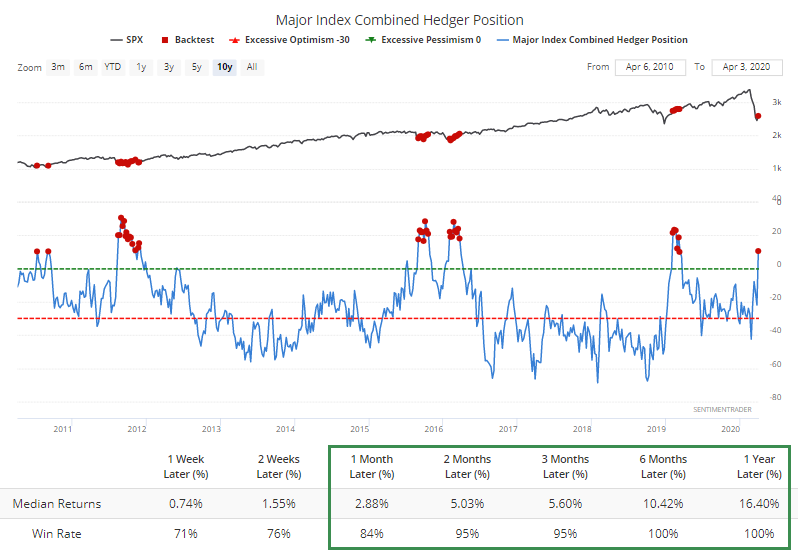

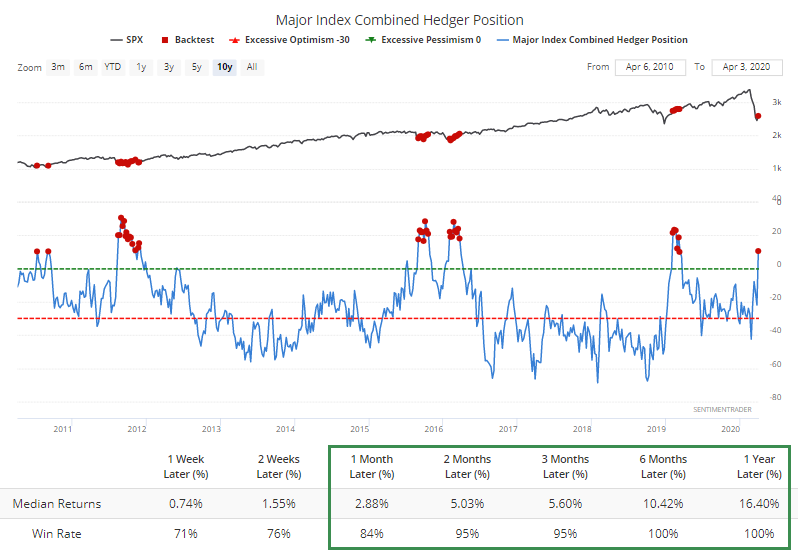

The 3-Year Min/Max Screen shows new multi-year highs in hedger positions in the Dow also the Hedgers Combo indicator. Their aggregate position in the major equity index contracts was more than $10 billion long as of Tuesday.

Over the past decade, it's been rare to see them this aggressive. Each instance led to dramatically higher prices for the S&P 500 according to the Backtest Engine.

Granted, the past decade was dominated by bull market(s), and it's hard to make the case we're in the same environment. Going back further, this data didn't do as well. It seems as though something changed along with the 2008 financial crisis in how traders used these futures contracts.

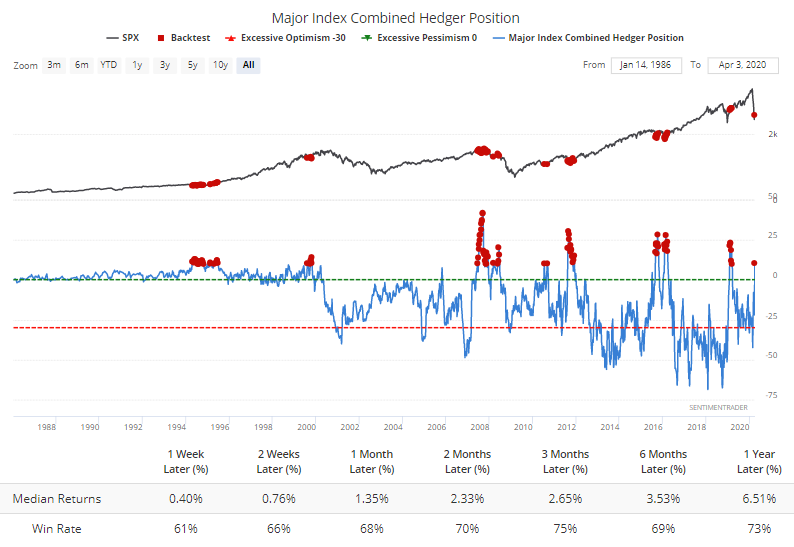

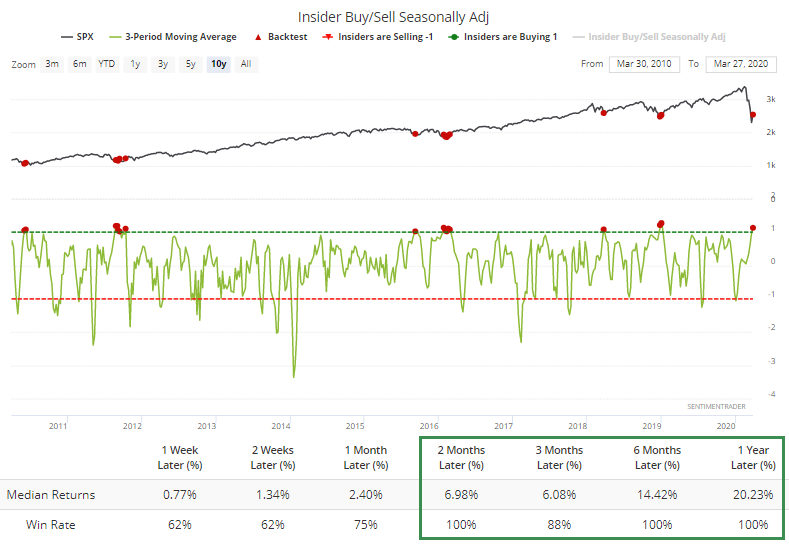

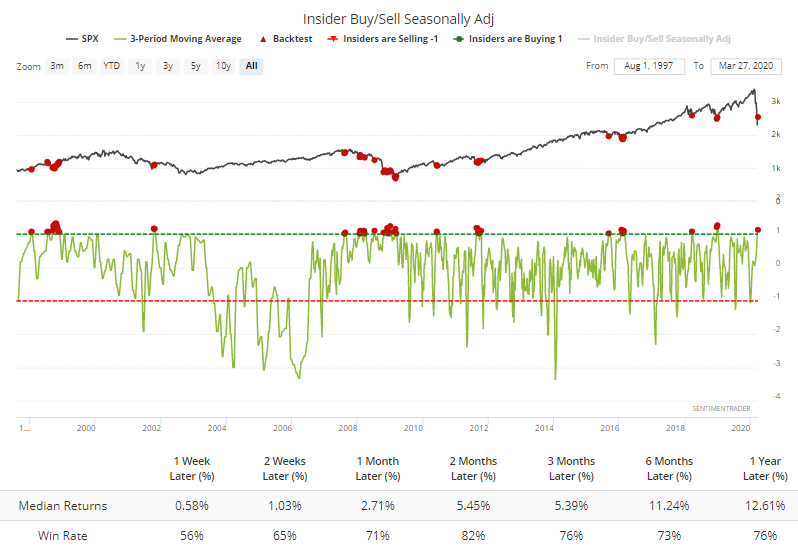

It's also worth mentioning that over the past few weeks, corporate insiders have picked up their pace of buying. On a seasonally-adjusted basis, they're longer than they've been at most other points in the past decade.

Again, bouts of insider optimism during a roaring bull market is often different than during a prolonged bear market, and when we include dates from 2008, returns deteriorated.

There's enough here to consider insider positions a positive. We just can't assume it's a pound-the-table buy signal like most of the other points over the past decade when trends were clearly more favorable.