Smart Money Sells As Rates Pick Up

This is an abridged version of our Daily Report.

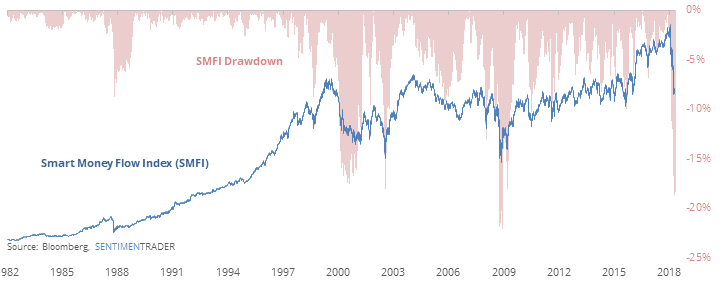

Smart money keeps selling

The Smart Money Flow Index is not improving, as late-day sellers continue to show up. Assuming that means large, “smart” money managers are getting out (an iffy conclusion), it’s a warning sign.

The only time in 35 years it was this bad with stocks so near a high was in 2000.

Backup in yields has hurt stocks

Bond yields have risen substantially in the past three weeks and are near a multi-year high. That has caused trouble for stocks in the past, with the S&P struggling over the next two months. Bond yields themselves have usually continued to rise.

Staples aren’t very stable

The Optimism Index on XLP fell below 8 due to Thursday’s large loss, and the fund is not looking good.

Rate troubles

Perhaps due to concerns about rising rates, investors yanked money from rate-sensitive funds heading into Thursday. ETF outflows were dominated by Financials (XLF) and bond funds (LQD, HYG, and JNK).

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |