Some extremes are bouncing back

The stock market's once in a lifetime crash (-35% in just a few weeks from all-time highs) pushed many sentiment indicators to historic extremes. With stocks rallying right now, those sentiment indicators are also starting to bounce back from such extreme readings.

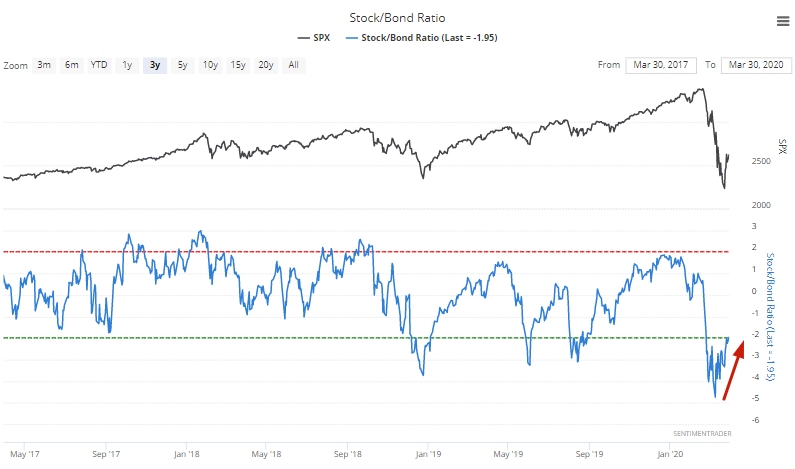

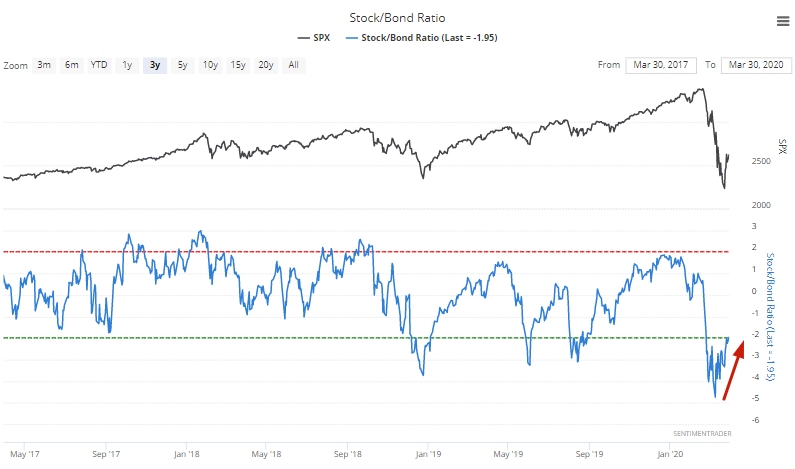

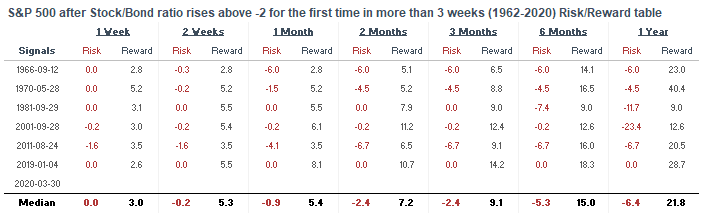

The Stock/Bond Ratio has risen above -2 for the first time in weeks: -2 is our threshold for excessive pessimism.

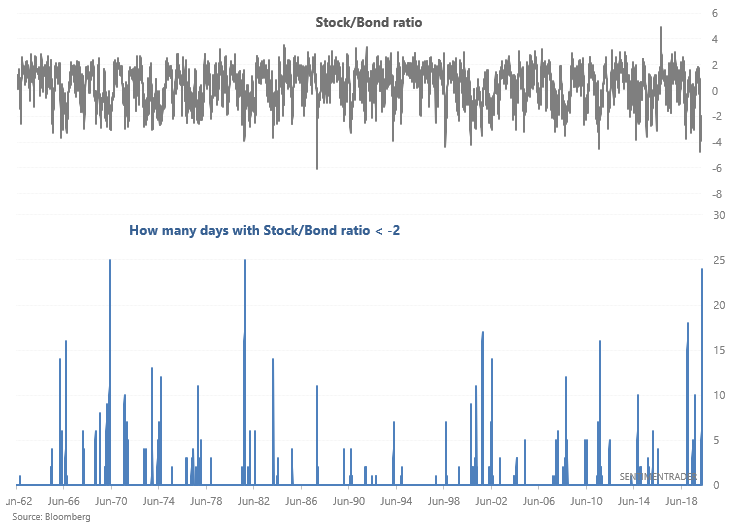

When the Stock/Bond ratio rose above -2 for the first time in more than 3 weeks (i.e. first time in a long time without excessive pessimism), the S&P always rallied significantly over the next 2-3 months:

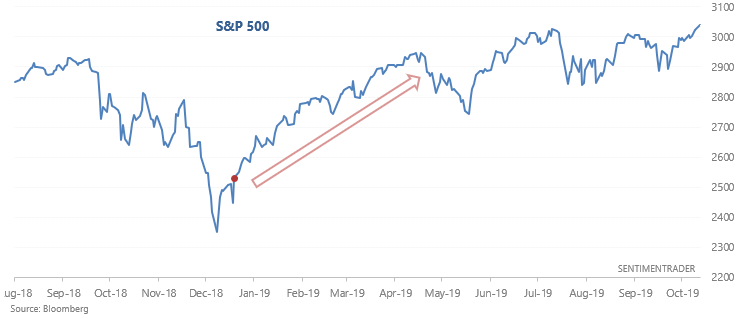

The most common pattern was for the stock market to rally more before retesting or making new lows. HOWEVER, it is not impossible for the market's bottom to be in already. This was clearly the case in January 2019, when the S&P went straight up.

But this was not the case in 2011. The S&P rallied a little more before retesting the lows:

Since the September 2001 case was in a bear market, the S&P rallied more before falling to much lower lows.

Same thing in September 1981: the S&P rallied further before making new lows.

In May 1970 the S&P rallied a little more before almost retesting the lows:

And in September 1966 the S&P rallied a little more before making marginal new lows.