Sometimes the Middle is Not a Bad Place to Be (Part II)

This is part 2 of a 3-part series, click here for part 1

In Part I, I highlighted the fact that Mid-cap stocks significantly outperformed both Large-cap and Small-cap stocks on a buy-and-hold basis between 1981 and 2020. I also offered a possible theory as to why this happened and why it may continue. In Part II let's take a closer look at when Mid-caps really shine – and when they don't.

Mid-caps, Seasonality and the "Power Zone"

The adage "Sell in May and Go Away" – first popularized by Yale Hirsch, founder of The Stock Trader's Almanac back in the early 1970's – is probably the most well-known seasonal trend in the stock market. For our purposes here we will deem:

- The months of November through May as the "Power Zone"

- The months of June through November as the "Dead Zone"

Instead of analyzing the performance of the various size classes (large, mid, small) on a buy-and-hold basis, let's analyze their performance during the Power Zone and Dead Zone separately.

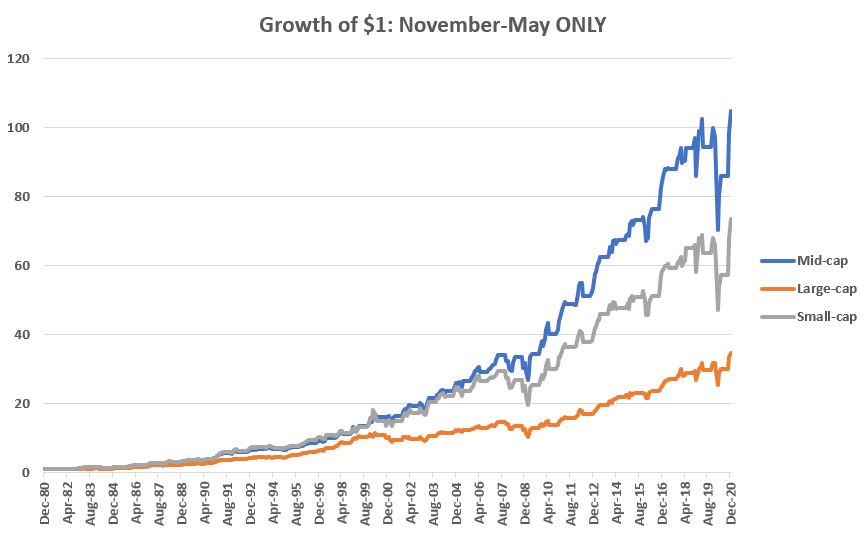

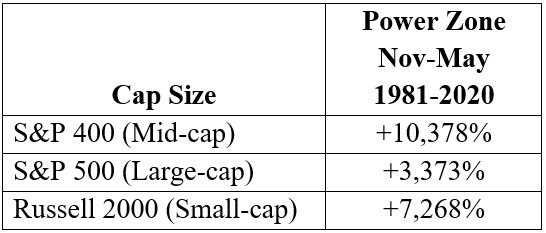

The chart below displays the growth of $1 for each index if held ONLY during the months of November through May every year from January 1st, 1981 through December 31st, 2020.

As you can see, Mid-caps significantly outperformed Large-caps and handily outperformed Small-caps during these months.

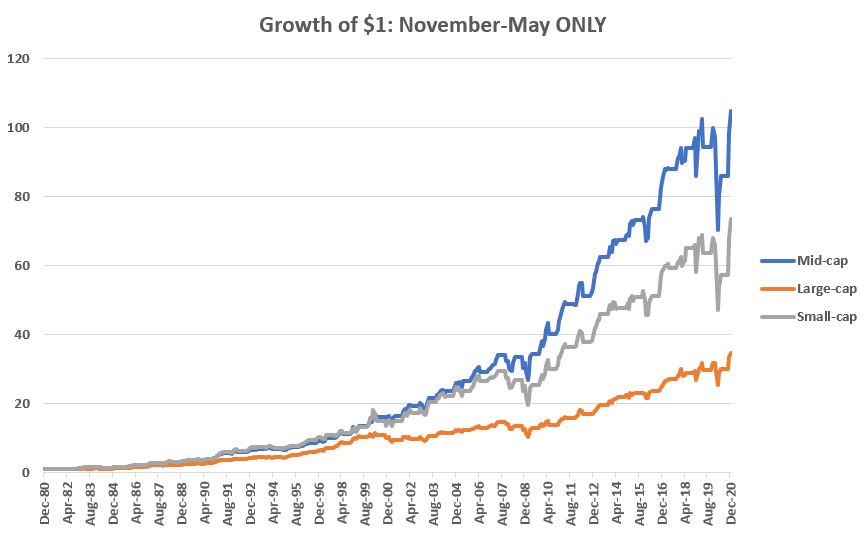

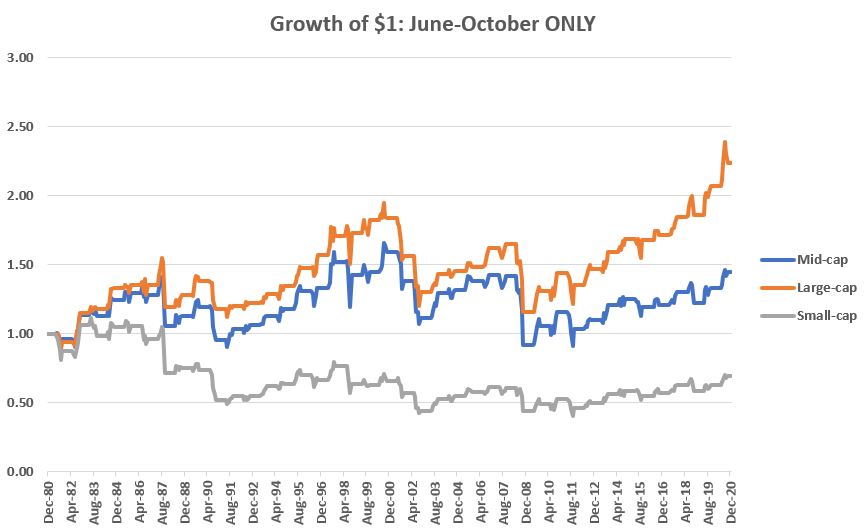

Now let's look at the Dead Zone months of June, through October. The chart below displays the growth of $1 for each index if held ONLY during the months of June through October every year from January 1st, 1981 through December 31st, 2020.

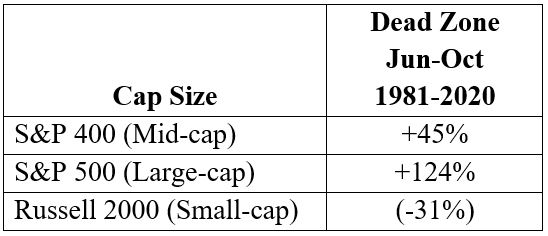

As you can see, Large-caps gained the most during June through October (although it should be noted that 124% in 40 years, including riding some massive declines in 1987, 2000-2002 and 2008 may temper one's enthusiasm) and Small-caps actually lost during these months on the whole.

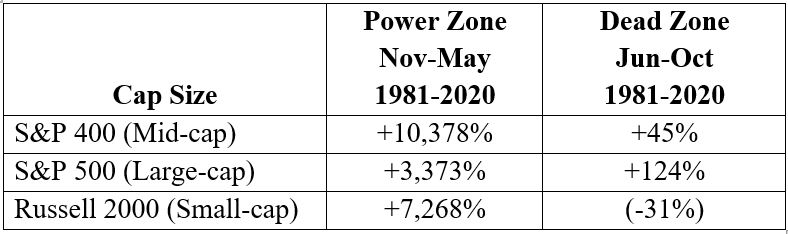

The table below puts all of the relative returns into perspective.

A Thought for Buy-and-Hold Investors

For an investor who wanted to remain fully invested in the stock market with some portion of their capital, it would appear that one rudimentary approach would be to hold:

- Mid-caps during the Power Zone months of November through May

- Large-caps during the Dead Zone months of June through October

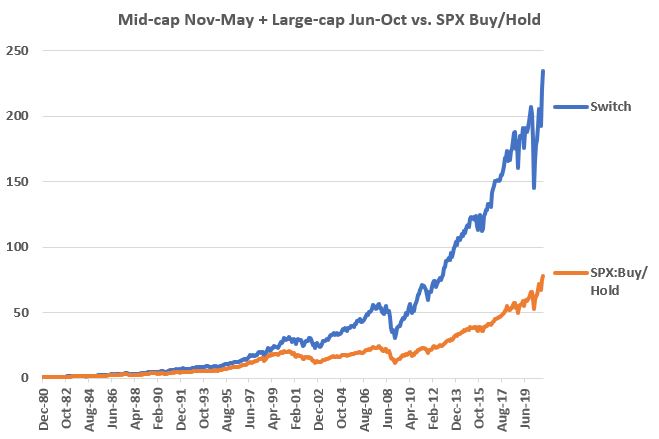

The chart below displays the growth of $1 invested using the "Switch" strategy – such as it is – above, versus simply buying-and-holding the S&P 500 Index.

The Switch strategy showed a hypothetical 40-year gain of +23,361% versus +7,677% for simply buying and holding the S&P 500 Index. We are by no means "recommending" this is a standalone strategy. Still, in a hypothetical backtest over the last 40 years this simple method outperformed buying-and-holding the S&P 500 Index by a factor of 3-to-1.

The key takeaway - Jay's Trading Maxim #65: Sometimes it's not just what you hold, but when you hold it that counts.

Stay tuned for Part III.