South Korean stocks have been hammered, and investors fled

Key points:

- South Korean stocks have been hit hard since the summer

- That has triggered multiple extremes in long-term breadth metrics

- There are also signs that U.S. investors have fled the most popular ETF for that market

- Those conditions suggest a medium- to long-term rebound in funds like EWY

Sellers have dominated South Korean stocks

South Korean stocks have been hammered since their summer peak. In U.S. dollar terms, the Kospi dropped more than 18% before a strong rebound in recent days. The combination of rising Covid cases and a tightening central bank hasn't gone over well.

Earlier this week, Dean pointed out that nearly two-thirds of stocks in the Kospi index fell so hard, so fast, that they exceeded their Bollinger Bands. That was the 7th-highest reading in 17 years, but buyers then showed up, and the stocks started to recover.

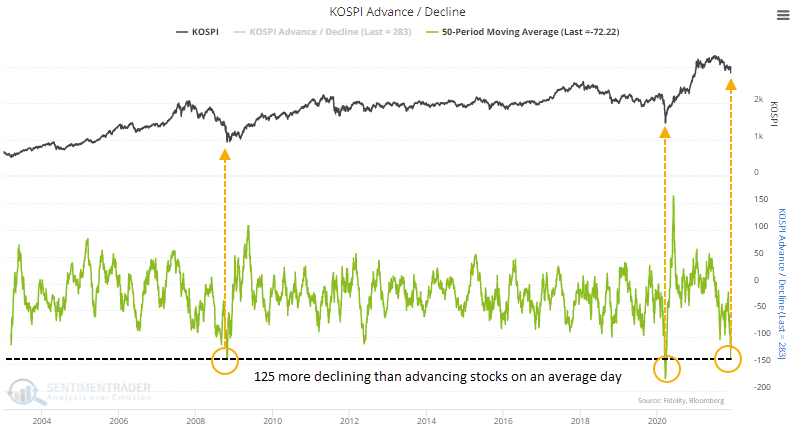

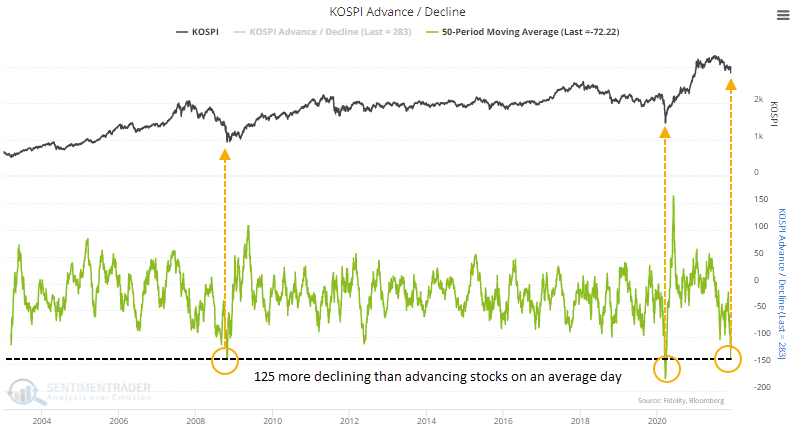

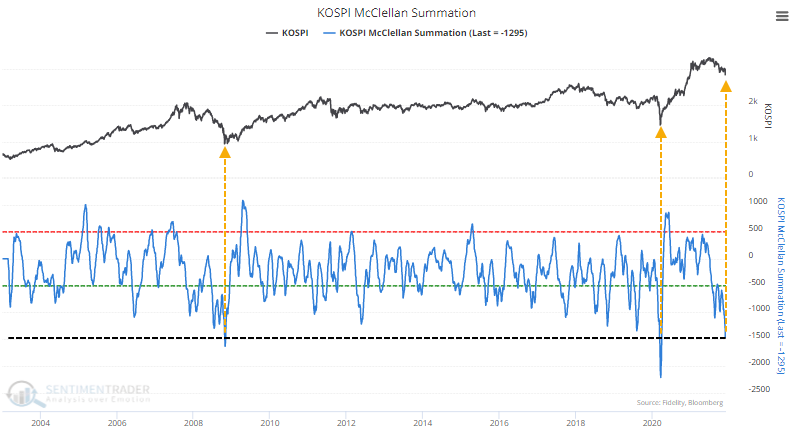

We can see that the damage has been widespread with the advance/decline figures. On an average day heading into December, 125 more stocks declined than advanced. Only the global financial crisis and the pandemic panic can match this.

Bad internals are starting to reverse

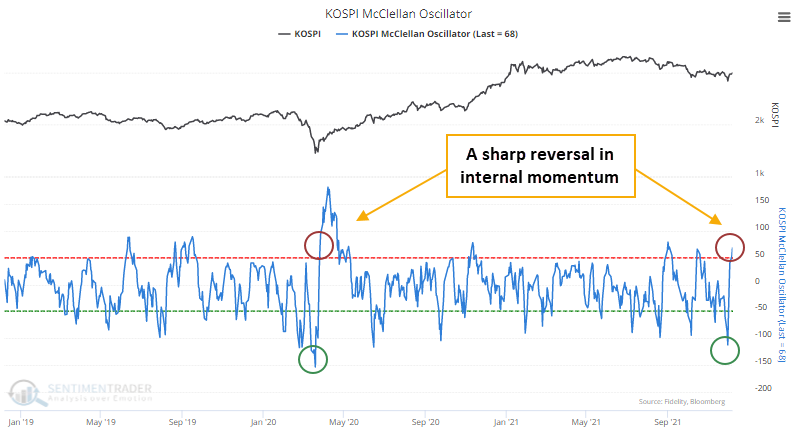

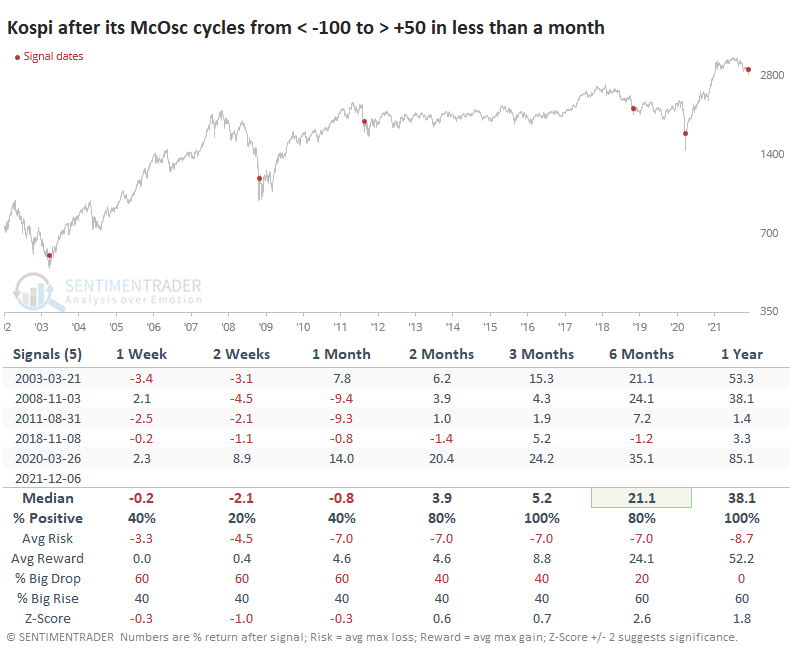

The horrible performance of the average stock in the Kospi is starting to reverse. The McClellan Oscillator for the Kospi has reversed from deeply oversold to very overbought very quickly, just like it did following the pandemic panic.

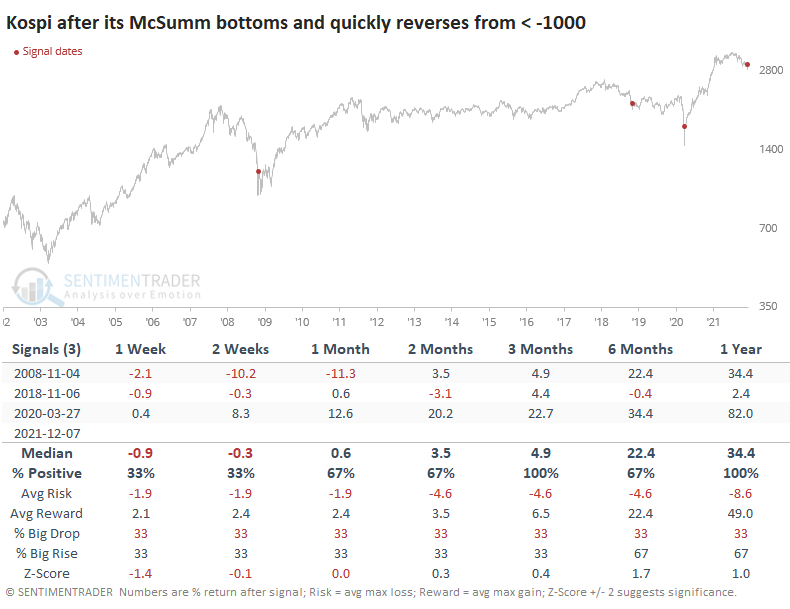

Similar cycles from one extreme to the other led to gains every time. There were some short-term wobbles, but over the next 2-12 months, the Kospi performed very well...as much as we can read into such a tiny sample size.

Because breadth was so wretched for so long, the Kospi's McClellan Summation Index sunk to one of its lowest-ever levels but has reversed strongly in recent days. Again, only the worst crashes in the past 20 years can compare to what we've seen in recent months.

There were only 3 other times when the Summation Index reversed quickly from below -1000, all of which led to gains over the medium- to long-term.

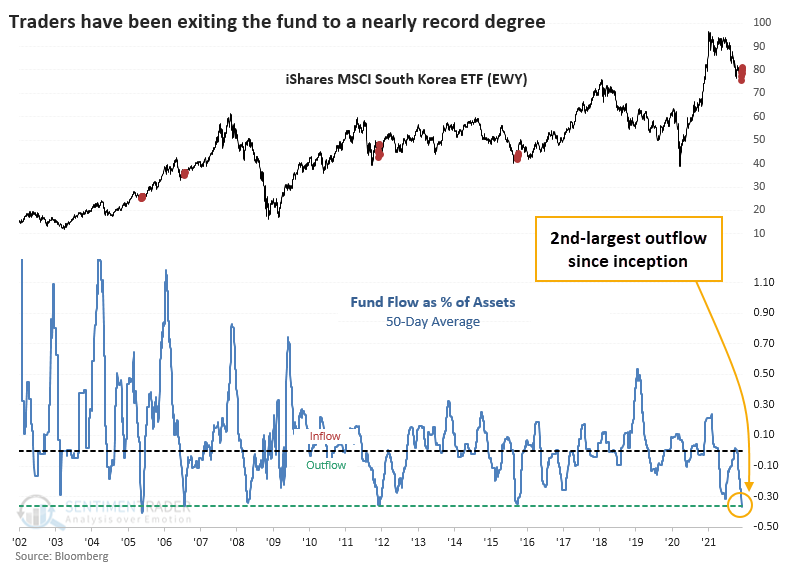

U.S. investors have been scared out

The declines in South Korean stocks when domestic markets were notching all-time highs triggered an exodus from the primary ETF focused on that market. The EWY fund has averaged an outflow of more than 0.35% of its assets every day for the past 50 sessions. That's the 2nd-largest outflow in the fund's history.

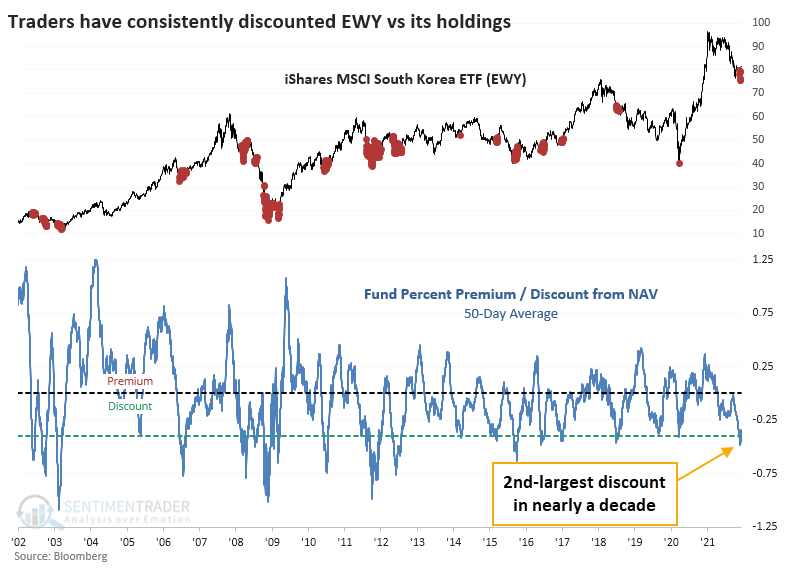

In relatively liquid funds, it's rare to see persistent premiums or discounts to their net asset value. The arbitrage incentive is too great for most funds to see significant, or lasting, differences between share price and underlying value. But EWY has averaged a discount of more than 0.4% from its underlying net asset value over the past 50 sessions, one of the largest in a decade.

What the research tells us...

As always, changes in structural forces or unique economic circumstances can override any technical or sentiment extreme in any market at any time. But the base case is that extremes tend to revert to the mean, and we're starting to see signs of that now in South Korean stocks. In recent months, that market has been hit hard, and investors have fled. That should lead to positive returns over the medium- to long-term.