S&P Nearly Ends Its Correction And Staples Their Downtrend

This is an abridged version of our Daily Report.

Still waiting for the cigar

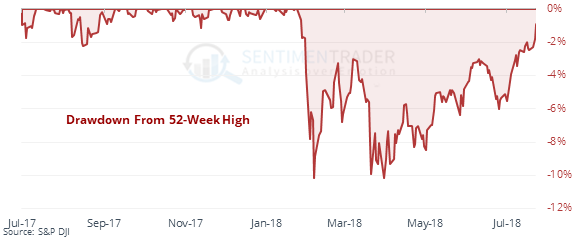

The S&P 500 rallied to within 1% of its previous high, nearly erasing the 10% pullback it suffered earlier this year.

Other times it got so close to a high, it took an average of another 4 days to reach it, with generally positive returns once it reached this point.

Staples keep on chugging

Previously the most-hated sector, Consumer Staples nearly closed above the 200-day average and flirting with it intraday. A close above its average would end one of its longer streaks in a downtrend, which has usually led to further gains over the next 2-3 months.

Thanks, Facebook

The massive decline in Facebook dominated tech indexes, leading to something that’s never happened before. The Nasdaq Composite was down 1% on the day, yet there were more advancing that declining stocks on that exchange, (almost) more up than down volume, and more 52-week highs than lows.

A negative spread

The spread between Smart Money and Dumb Money Confidence has moved into extreme territory at -25%.

For access to the full report, indicators, charts, screens, and Backtest Engine, log in or sign up for a free 30-day trial today. |