Speculative options traders return

Two months ago, options traders were making stunning bets that stocks would continue to rise. In 20 years, they had never behaved so aggressively. After a stumble, the S&P 500 has managed to climb above where it was then, while broader indexes like the New York Composite still remain below their June highs.

And now the traders are back.

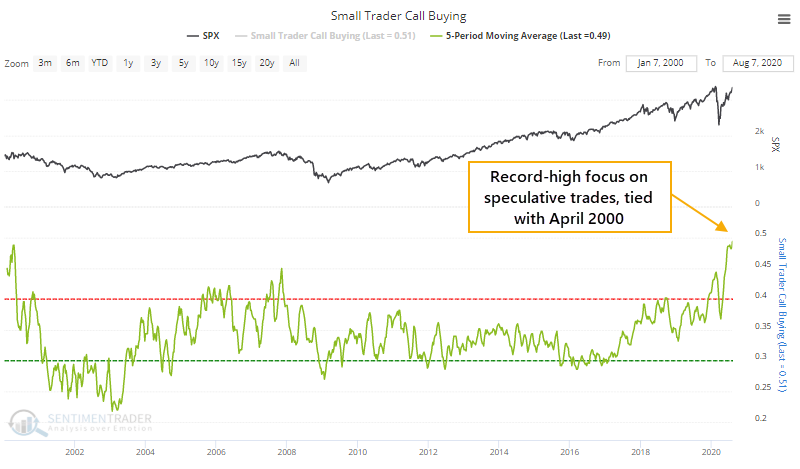

Last week, the smallest of options traders, those using fewer than 10 contracts, spent more than half of their total volume on purchasing speculative call options. This has been consistent over the past five weeks, tying with April 2000 as the most ever.

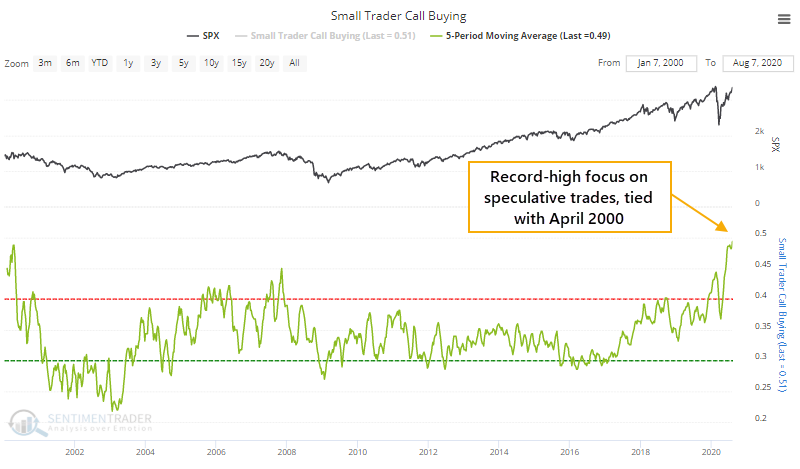

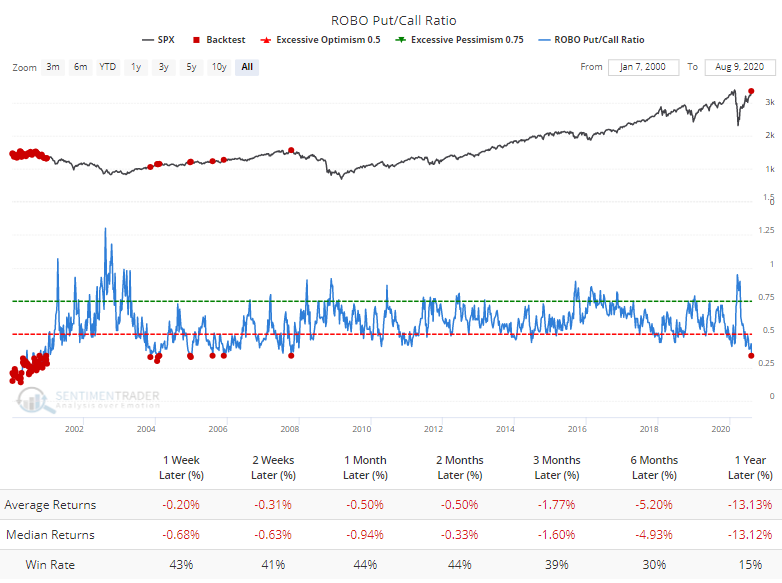

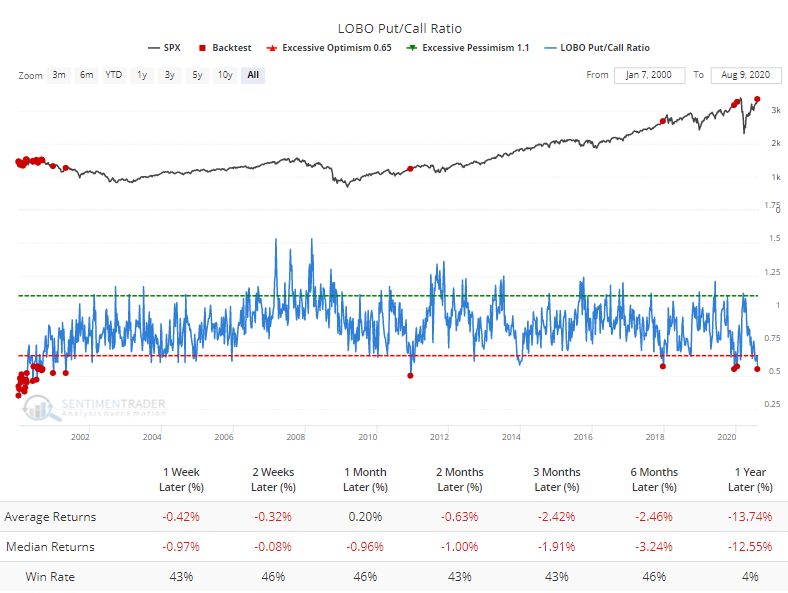

They pulled back on hedging activity last week, with less of an emphasis on put buying. So the ROBO Put/Call Ratio plunged to the lowest level since October 2007. The Backtest Engine shows poor returns following similar readings.

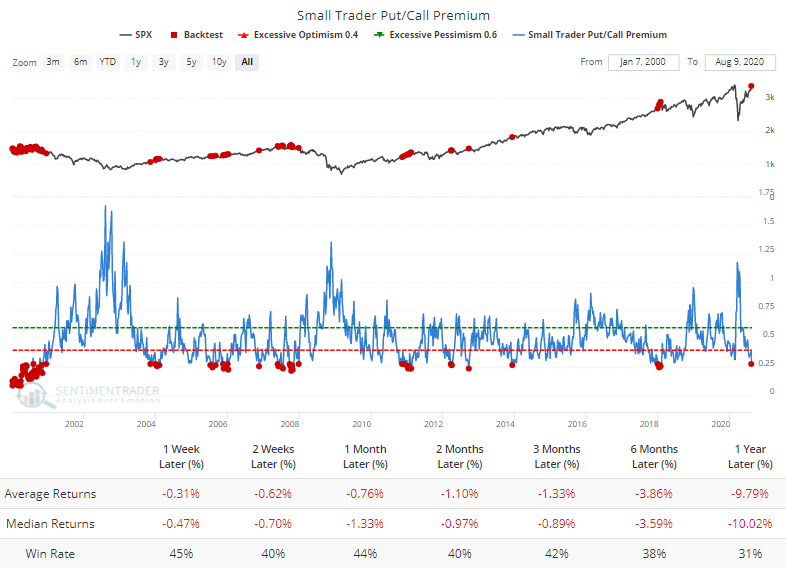

It's not only the raw volume of contracts traded that's notable, but it's also the money they're spending. The premiums that small traders are paying to jump into these call options are heavy relative to the amount of money they're spending on hedging activity. The Put/Call Premium has fallen to an extremely low level and the S&P has struggled after similar readings.

The largest of options traders, those using 50 contracts or more, never get as enthusiastic as the smallest traders. But even they are showing one of the most extreme skews toward speculative activity in 20 years, which has also preceded poor returns.

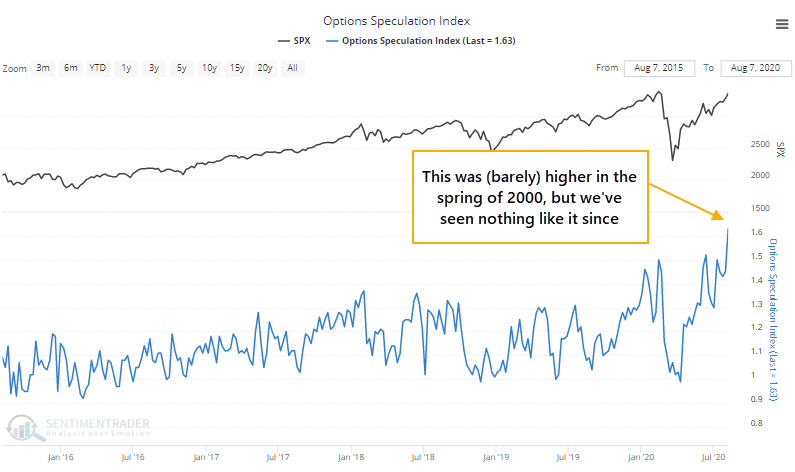

The most comprehensive options indicator we follow, the Options Speculation Index, takes into account trading activity among all traders on all U.S. exchanges and compares the volume flowing into bullish strategies versus bearish ones. It just spiked to 1.63, meaning that traders opened 63% more bullish strategies than bearish ones last week. We haven't seen this kind of behavior since the spring of 2000.

There isn't any way to put a positive spin on this kind of behavior. Perhaps if we've just entered some kind of 1999-style speculative orgy that will lead to an exponential rise then exponential fall, maybe. More likely is just a tough market for new bulls to hold onto shorter-term gains. Even though some recent extremes have failed to lead to much weakness in the popular indexes, it would be exceptionally unusual to see stocks continue to power higher without interruption after seeing such confidence among traders using speculative, leveraged, expiring instruments.