Speculative Options Volume Nears Record as Hedging Disappears

After taking a pounding from almost certain options-related losses following a speculative surge in February, small options traders stormed back at the beginning of June.

With some indexes moving to new highs last week, these traders have no intent on missing out, with speculative call buying flooding the markets once again. The smallest of traders, those executing 10 or fewer contracts at a time, spent 53% of their total volume on speculative call buying last week, just under their all-time high.

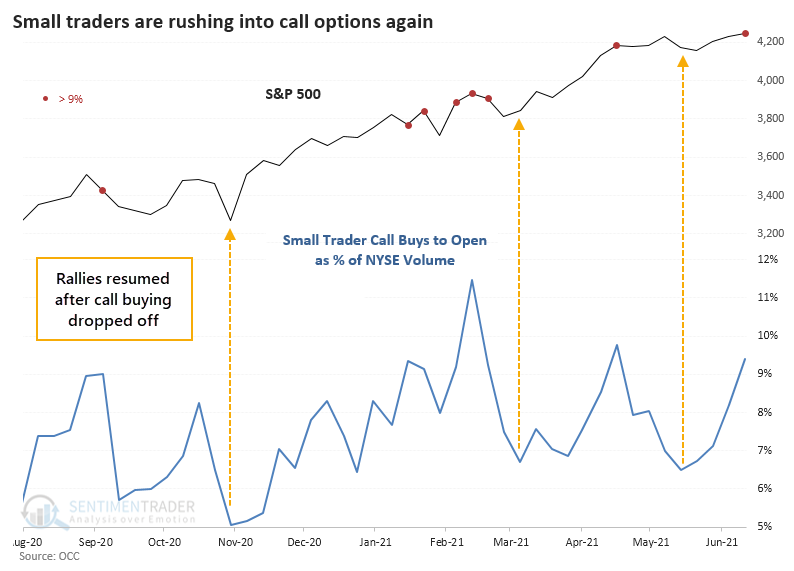

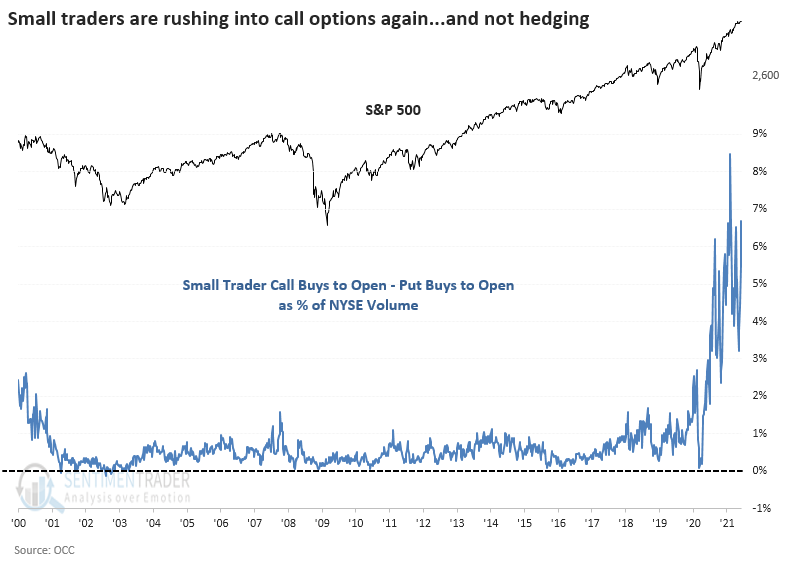

This call buying accounted for over 9% of all NYSE volume, below the peak of around 11% in February. The other times it got this high, the S&P chopped around for a while. Clearly, the uptrend was not interrupted for long, but rallies didn't resume in earnest until speculative call volume dropped to 7% or less of NYSE volume.

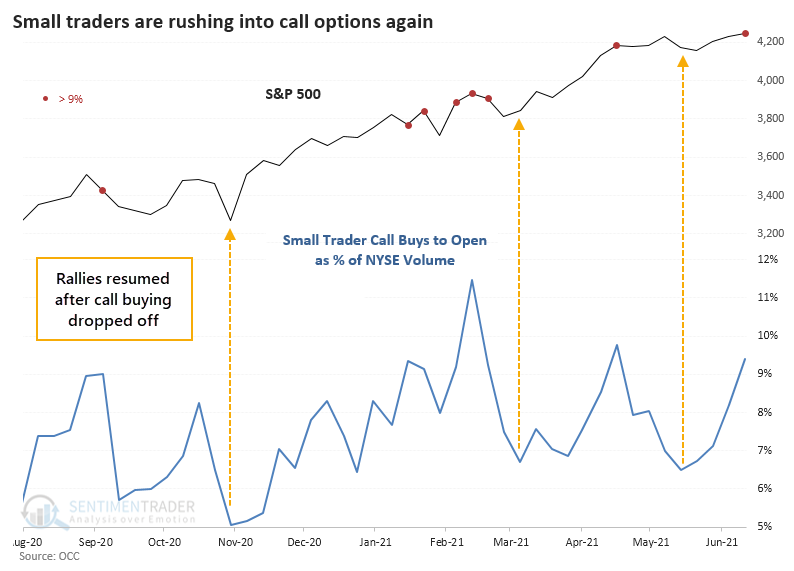

Note that this is raw volume and does not account for the fact that options control 100 shares or dealers on the other side are being forced to buy shares to hedge their exposure. Also, it's helpful to gain some perspective by zooming out and looking at this activity relative to the past two decades.

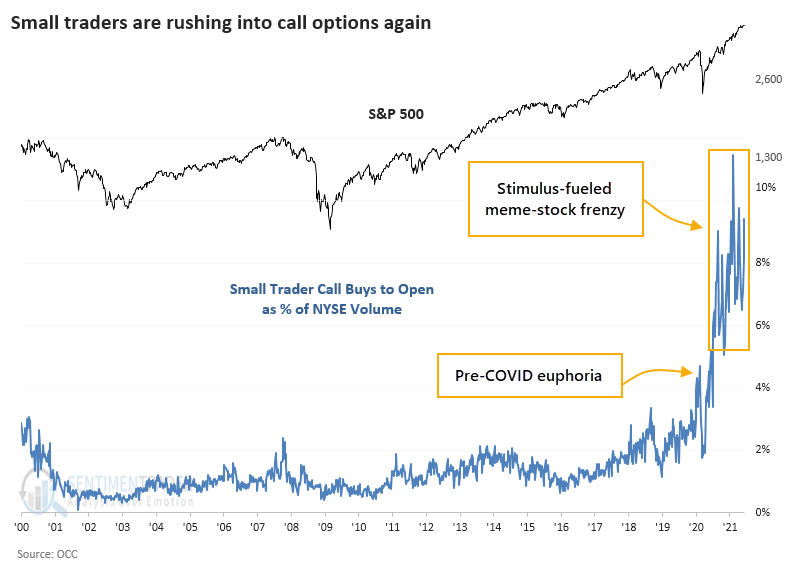

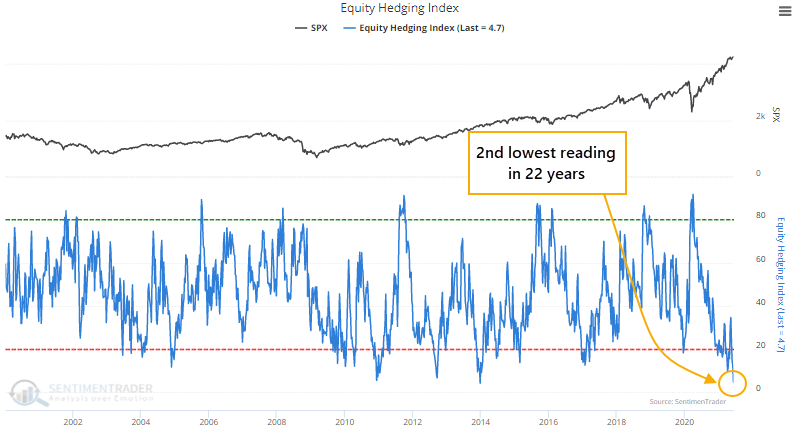

NO HEDGING WANTED

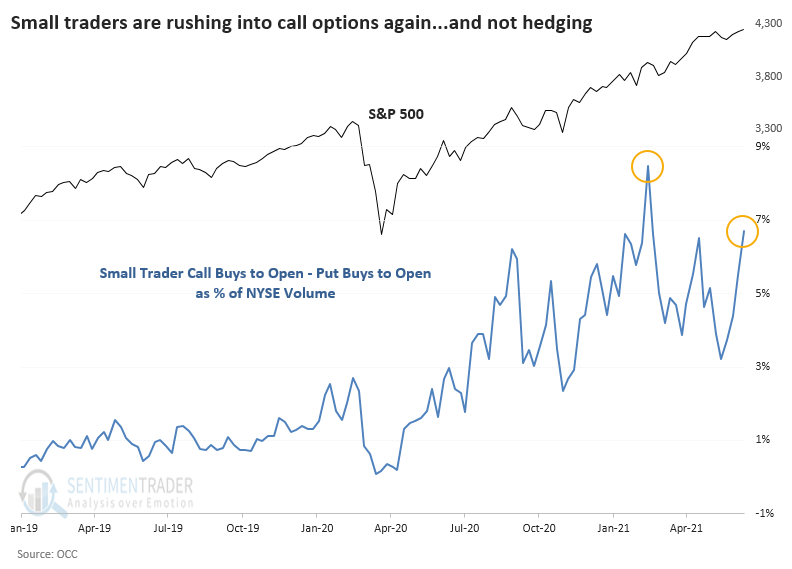

It's not like these traders are hedging by buying some puts, either. When we look at small traders' call buying volume and subtract their put buying to get a net figure of speculative behavior, it's even more egregious. The only week in 22 years that exceeds last week's activity was the week ending February 12 of this year.

Again, some perspective. This is pretty much the same story as the other zoomed-out chart but even more extreme.

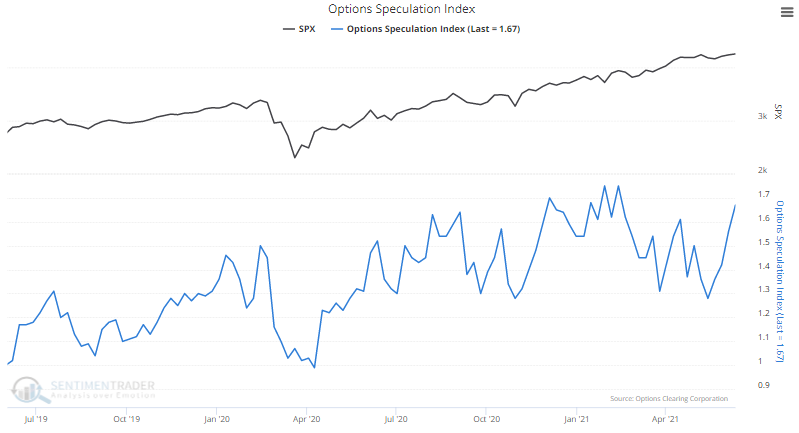

Across all traders and all options volume, there was 67% more volume in trades that profit on a bullish move in stocks and ETFs than volume that profits on a market decline. That pushed the Options Speculation Index close to its record high.

RETAIL RULES THE ROOST

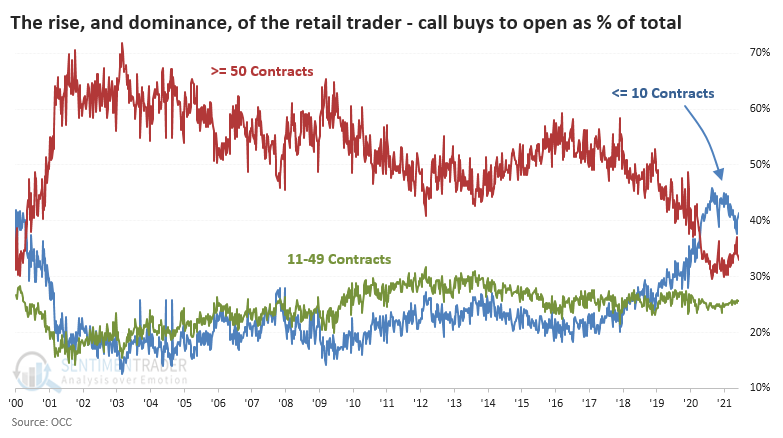

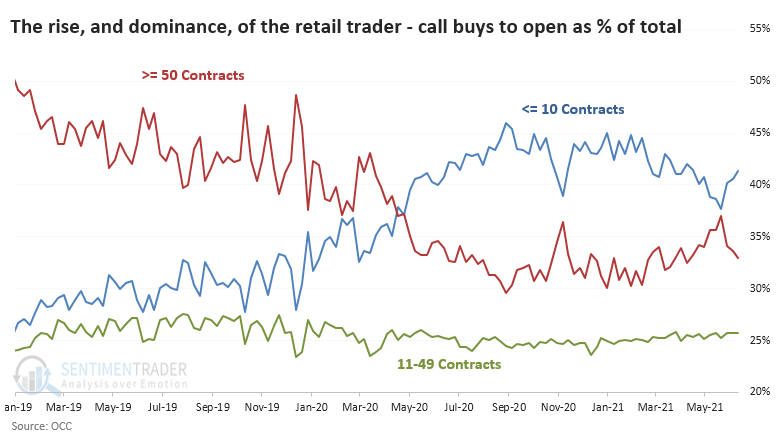

The fact that the Options Speculative Index is close to its high indicates that the rise in speculative trading is not solely due to the smallest of traders. But it primarily is, as we've shown before. Unlike any other period in 20 years, the smallest traders are the dominant factor in speculative options trading, accounting for 40% - 50% of all call buys to open.

If we zoom in on this activity, we can see we changed regimes almost exactly one year ago. Mid-market traders of 11-49 contracts held steady at about 25% of call buying volume, while institutional-level traders fell from more than 45% of the market to 30% - 35% as the retail trading force took over.

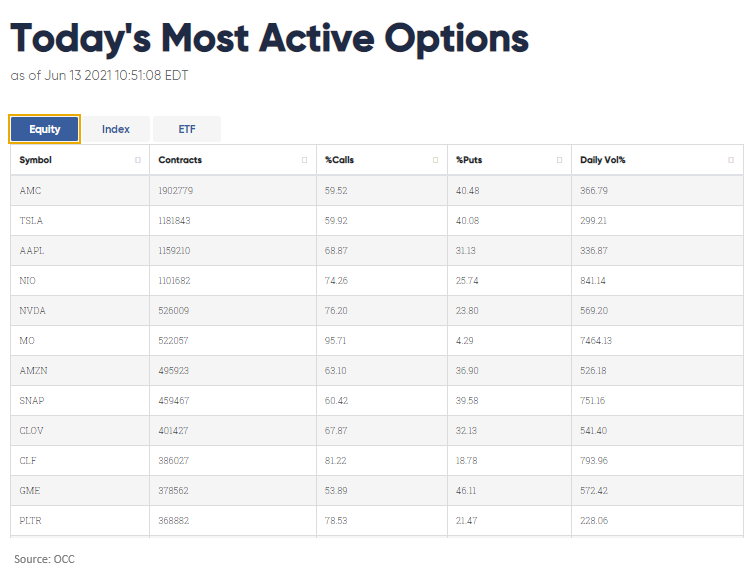

It's not a big shocker to see the usual suspects dominating the most active list. Meme stocks like AMC and CLOV are right up there, along with the go-to's like AAPL and TSLA.

If we sort the table by the stocks with the greatest concentration of call activity at the end of last week, we can get a sense of where this speculative volume has been especially concentrated. These should be among the most vulnerable stocks should there be a shift in sentiment.

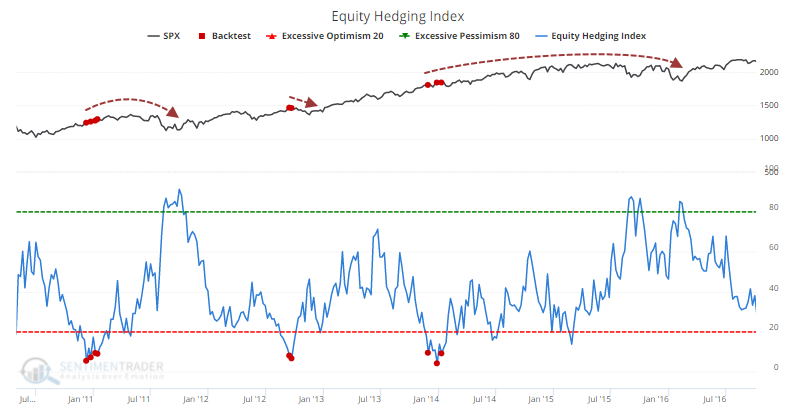

With this drop in hedging activity in options, seemingly little interest in shorting futures, little cash on hand relative to other assets, and similar behavior, the Equity Hedging Index plunged to the 2nd lowest reading on record

Like most sentiment indicators, this tends to be more immediately actionable when there is a spike in hedging activity during times of panic. At the opposite extreme, like now, it has generally resulted in rounding tops as stocks chop higher but ultimately give most or all of those gains back during a subsequent pullback. It can take a long time for this to play out.

There are some major caution signs regarding valuations, some fundamental inputs like inflation readings, and some recent sentiment indicators like the above. There are also some rare and probably minor internal breadth warnings. And yet, most of the trend and risk warning signals have not triggered, and it would be relatively rare (but not unprecedented) to see a large and sustained decline without those. As the general warning signs pile up, we'll be placing ever-more attention on hints of internal deterioration and signs of increasing risk-off behaviors.