Speculative Options Volume Ramps Up Yet Again

In January, traders reached a peak in speculation in the options market, unlike markets had ever witnessed before.

They're back for more.

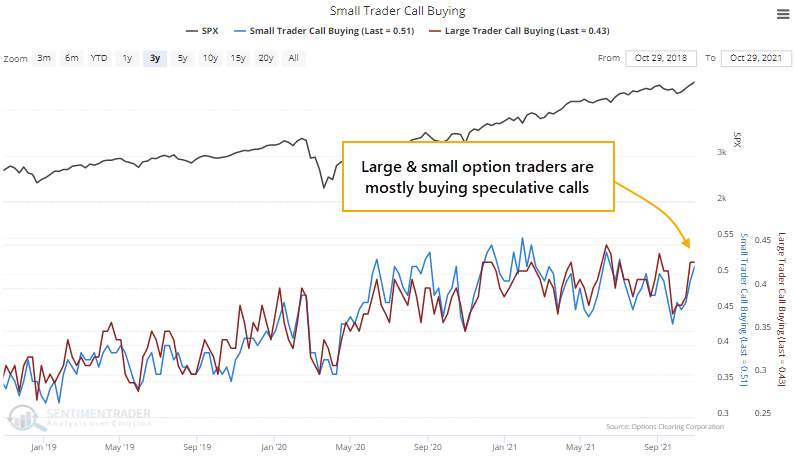

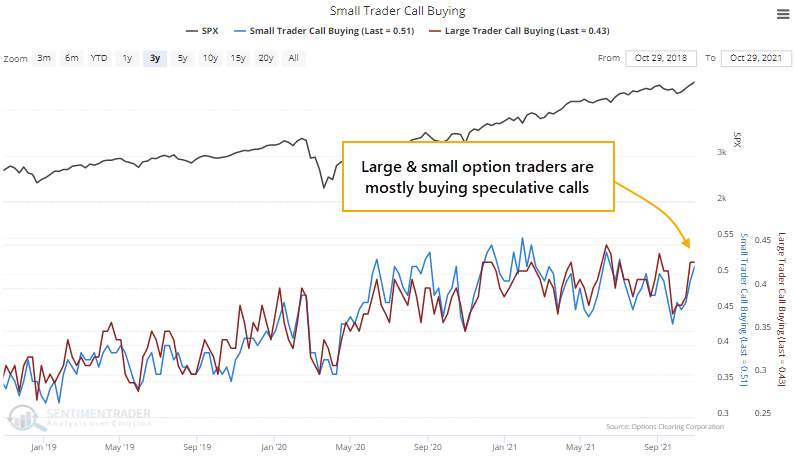

Last week, the smallest traders spent 51% of their volume on buying call options to open. The largest traders tend to be more conservative, but even they focused 43% of their volume on call buying. Both are in the top 2% of all weeks since the year 2000.

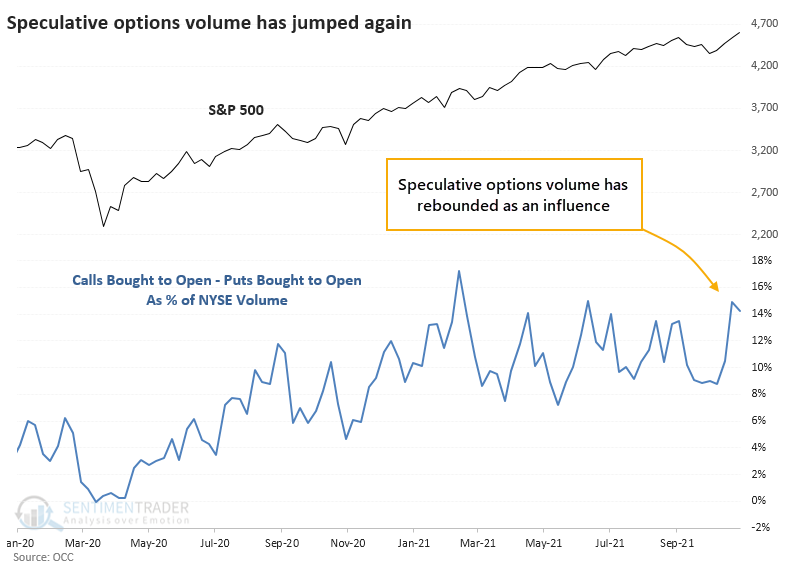

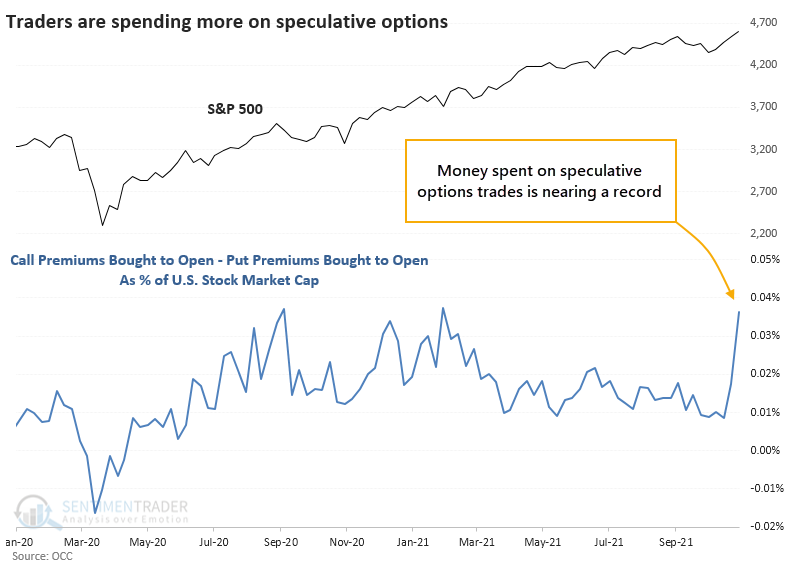

NET SPECULATIVE VOLUME NEARS RECORDS

If we look at all trader sizes, in all options and ETFs traded in the U.S., net speculative volume (call buying to open minus put buying to open) accounted for more than 14% of NYSE volume. This is not accounting for the fact that options control the right to 100 shares; it's just raw volume.

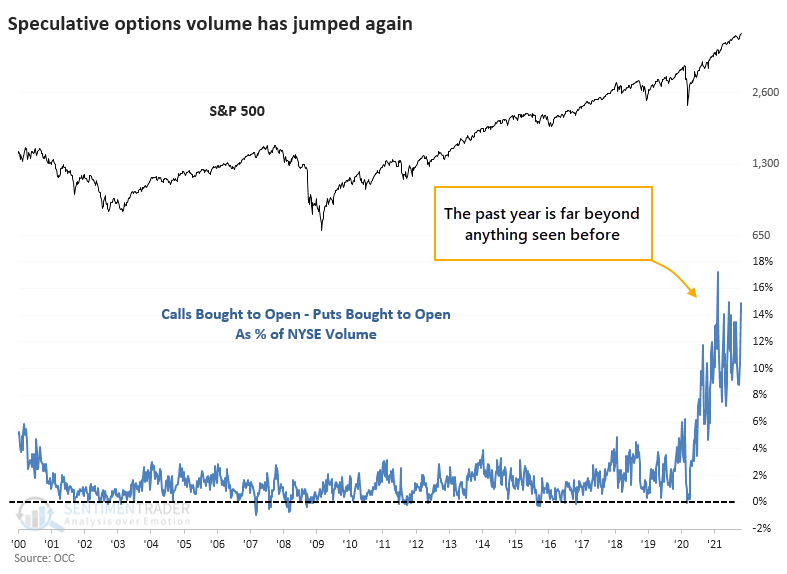

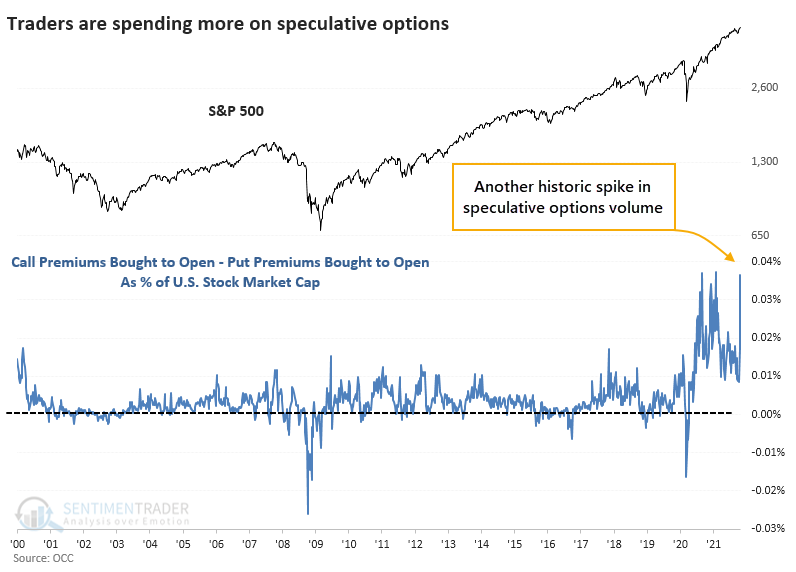

To see what a historical anomaly the past year has been, here's the entire history.

When we look at the premiums spent on these options, it gets even more extreme. This is real money being spent. While it accounts for a tiny fraction of the value of U.S. stocks, the knock-on effects from dealer hedging can magnify its influence.

The historical chart shows just how much that last week stands out.

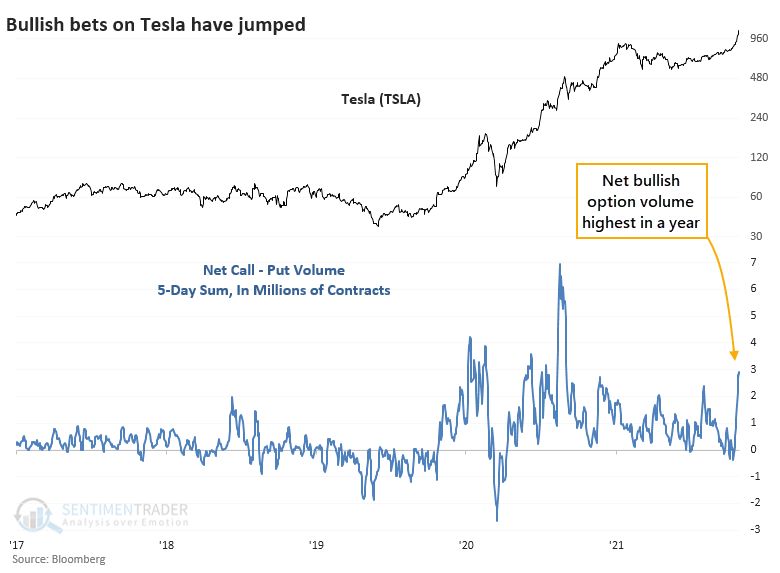

IT'S NOT JUST TESLA

I can already hear the excuses. "But, but, but it's just Tesla!" Well...

- No, it's not

- It doesn't matter

Last week, there were about 3 million more call options than put options traded on Tesla. That's the most in over a year, but it's well below other extremes in the stock.

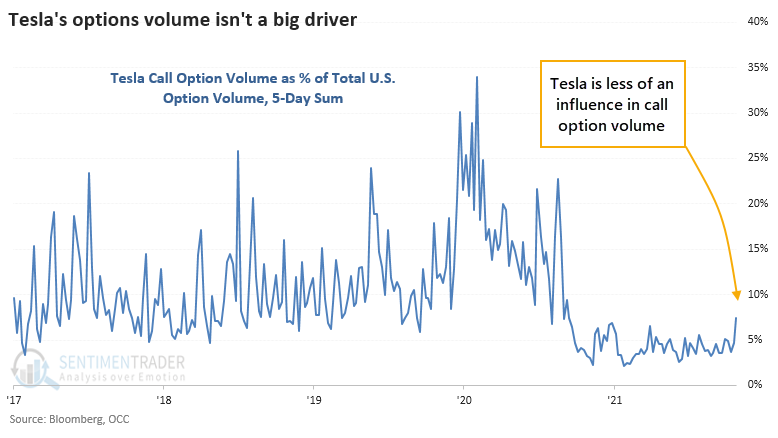

There were about 8,000,000 options traded on Tesla. There were over 100,000,000 call options traded last week across all U.S. exchanges. Tesla's share of overall volume was well below its peak influence over the past five years.

Even if trading in Tesla options was a primary driven of total options volume, that doesn't excuse the speculative nature of the bets.

Buying call options on a company priced at nearly 200x forward earnings estimates, based in part on the personality of the world's richest man who continually pumps crypto frauds, intentionally provokes regulators, and is overtly fascinated with scatological humor, doesn't seem to be the most prudent investment logic. But hey, it's working, and "retail" traders are banking billions.

When speculative options volume spiked last fall, stocks pulled back for a few weeks. When it happened again in late January - early February of this year, the major indexes didn't suffer too much, but meme stocks tumbled, small-cap stocks went into a coma, and breadth flattened. If we've learned anything from the past 11 months, it's that there are factors that can easily overwhelm sentiment extremes to an extent we haven't seen in over 20 years, if ever. But risk just ticked higher for some higher-risk parts of the stock market.