Staples' positive trends reach a record vs Nasdaq stocks

Key points:

- There is a record spread between stocks in uptrends in Consumer Staples versus those traded on the Nasdaq exchange

- When the spread reached its highest level in a year, it did NOT suggest trouble for the broader market

- Historically, the Nasdaq Composite tended to quickly rebound versus the Staples sector

Staples soaring while Nasdaq wilts

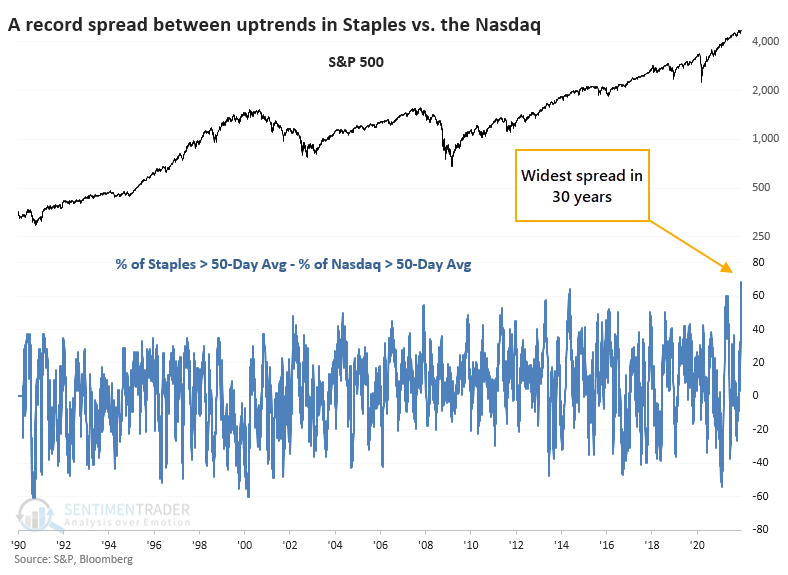

We've already seen that internal trends have been powerful in defensive sectors like Consumer Staples but curiously weak in higher-beta areas like the Nasdaq 100. It's even more fragile in the broader measures that look at the entire Nasdaq exchange.

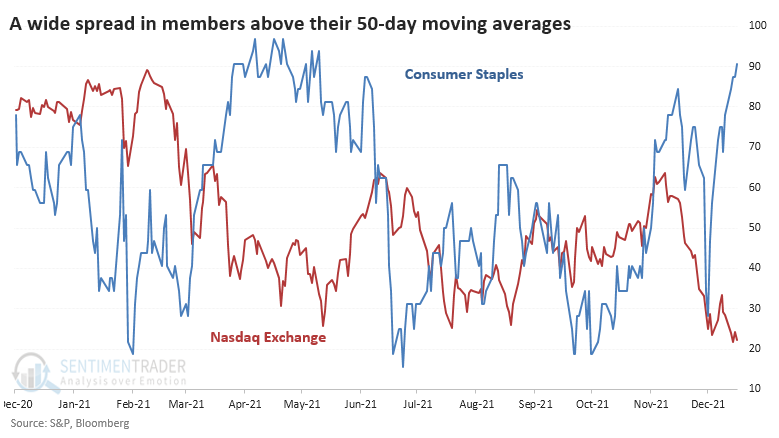

The percentage of Staples stocks trading above their 50-day moving averages reached 90% last week, while fewer than 25% of stocks on the Nasdaq managed to hold their medium-term trends.

That's the widest spread in trends between the two groups in at least 30 years.

Not a consistent sign of persistent risk-aversion

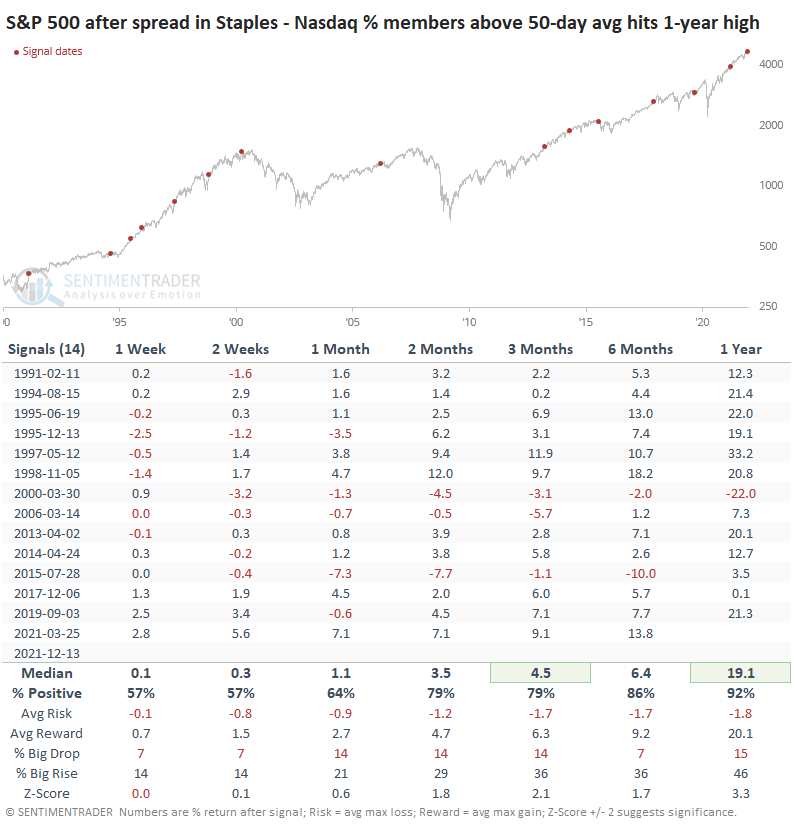

It wasn't very successful if we took this as a warning sign for the broader market. The table below shows every time when the spread between trends in these two groups hit its highest level in at least a year. We only include signals when the S&P 500 was within 5% of a multi-year high at the time.

While the S&P's shorter-term returns were nothing special, its performance was well above random over the next 3-12 months. Over the next year, it showed a positive return 12 out of 13 times (and has a high probability of going 13 for 14). But that loser in 2000 was a major one as it effectively marked the peak of the bubble.

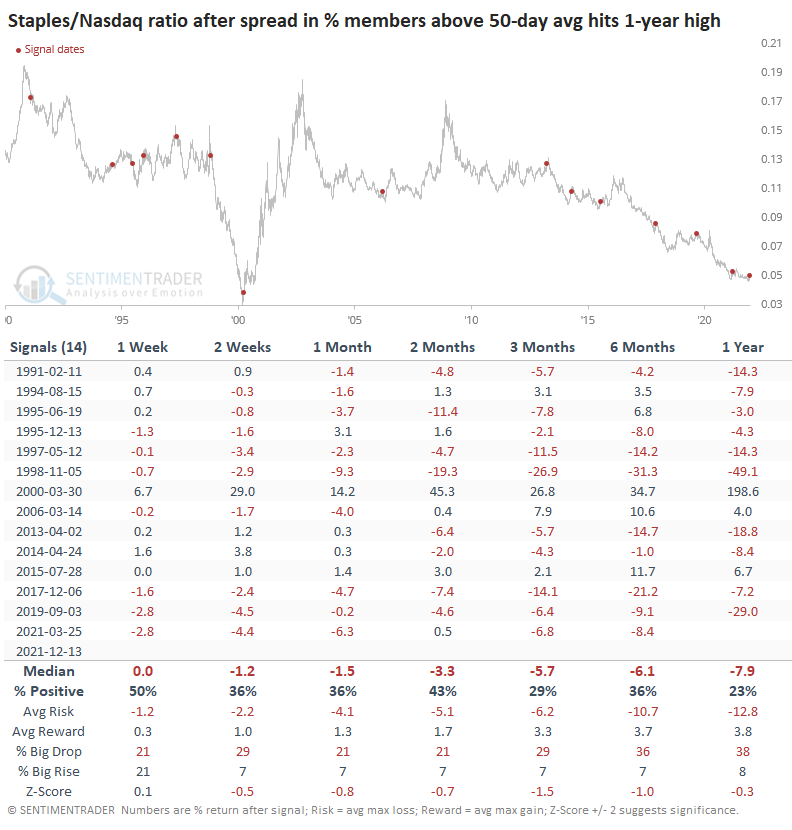

While it's tempting to conclude that this kind of behavior signals a change in fortunes between the two groups, it didn't work out that way most of the time. Staples showed a consistent tendency to underperform the Nasdaq Composite in the months ahead.

There were three significant exceptions to this. In 2000, Staples continued to outperform the Nasdaq across every time frame. Same for 2015. In 2006, Staples took a quick relative dive, then rebounded strongly.

What the research tells us...

There is a historic spread between stocks enjoying medium-term uptrends in Consumer Staples versus those traded on the Nasdaq exchange. This shows a temporary bout of risk-off behavior among investors, but historically it's been rare to see this persist for much longer. It has not consistently indicated that a major change in trend has occurred, but if Staples continue to outperform in the weeks ahead, that probability will increase.